By Lukman Otunuga Research Analyst, ForexTime

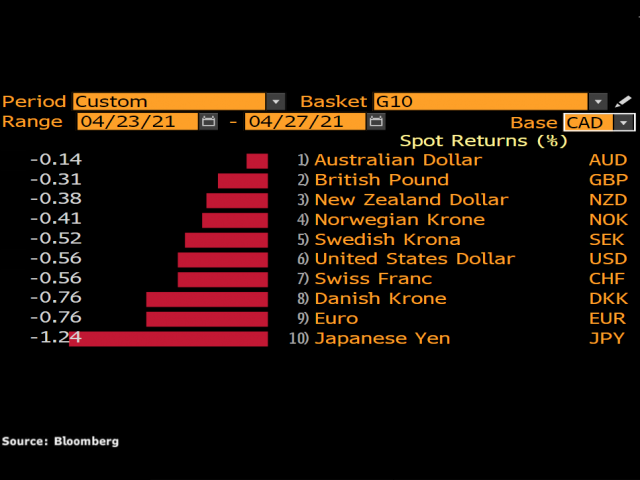

Our currency spotlight shines on the Canadian Dollar, New Zealand Dollar and Australian Dollar.

Since the start of the week, these commodity currencies have appreciated against the Greenback and major peers in the G10 group.

Today, the goal is to uncover potential technical setups for the week ahead and our tool of choice will be technical analysis.

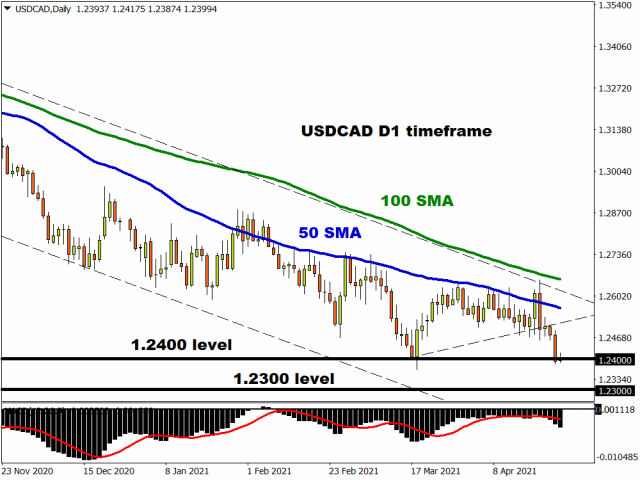

USDCAD screams bearish

It has been a great week for the Canadian Dollar thus far.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Looking at the USDCAD, prices are heavily bearish on the daily charts as there have been consistently lower lows and lower highs. Lagging indicators in the form of the Moving Averages and MACD favour further downside. Given how the USDCAD has secured a daily close marginally below the 1.2400 support, this may signal a decline to levels not seen since early 2018 around 1.2300.

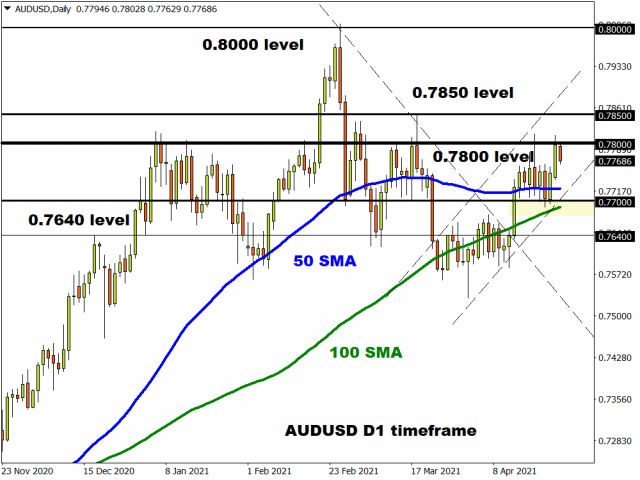

AUD bulls still in the game

Just like the Canadian Dollar, the Australian Dollar has appreciated against most G10 currencies this week.

Talking technicals, the AUDUSD needs to secure a solid daily close above 0.7800 to challenge 0.7850 and potentially higher. Technicals remain in favour of bulls as prices are trading above the 50-day and 100-day Simple Moving Average. Should 0.7700 prove to be reliable support, this could inspire bulls to re-test the 0.7800 resistance in the short term.

Alternatively, sustained weakness below 0.7800 may result in a decline back towards 0.7700 and 0.7640, respectively.

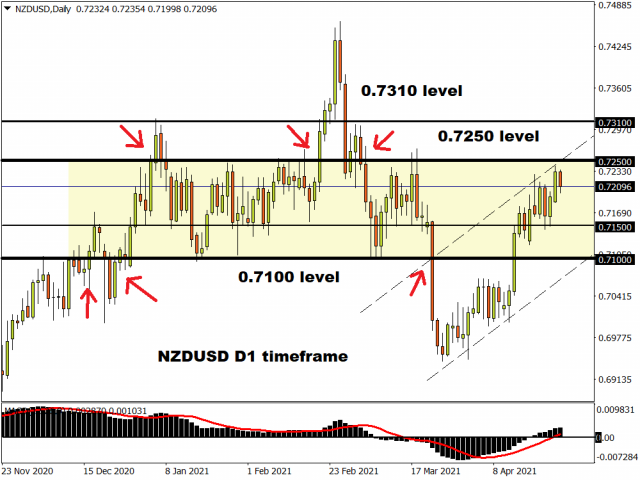

NZDUSD back within a wide range

As the sub-title says, the NZDUSD currently resides within a 150 pip range on the daily charts with support around 0.7100 and resistance at 0.7250. But there have been periods where the currency pair has broken above or below this range as highlighted on the chart.

Given how bulls remain in the driving seat, the NZDUSD has the potential to push higher with 0.7250 acting as the first barrier. A strong daily close above this level may open the doors towards 0.7310.

If 0.7250 proves a tough resistance to crack, prices may decline back towards 0.7150 and 0.7100, respectively.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026