By Han Tan Market Analyst, ForexTime

The mighty dollar is sinking again this morning as numerous factors gang up on the world’s most heavily traded currency.

We’ve talked about seasonal trends previously with DXY peaking more or less bang on cue towards the end of March. Positioning is interesting and relevant as the latest futures report tells us that USD short covering has lost momentum. The decline in US bond yields has also fully justified selling in the greenback with Fed policy makers happy to stress that rate hikes are some way off, though the recent uptick in yields does warrant some attention.

In the short-term at least, the majors are approaching some serious technical levels with:

It seems a lot of dollar positive news is firmly embedded in the buck while traders are only seeing upside in euro negative news for example.

As we move into the second half of the year, we may well finally see what many Wall Street analysts were predicting at the start of the year, with the DXY falling nearer to 89.00 as a synchronised global recovery takes shape.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Stock market calm upset

US stocks slipped off their record highs and European markets are currently mixed and modestly in the red. Tech led the selling with the Nasdaq down nearly 1% as eyes turn to some significant US companies who report this week like Intel and American Airlines, while we covered Netflix earlier today.

Interestingly, the VIX picked up off its lows yesterday as the S&P500 traded around 16% above its 200-day moving average, a level that has spurred a selloff on numerous occasions in the last eight months.

The calm in stocks is also seen in the Dow which has gone more than 30 days without a loss of 1%, the longest streak since just before the pandemic.

UK jobs jolt

Important UK labour figures were released earlier this morning with the unemployment rate surprisingly dipping to 4.9%, despite the winter lockdown. The furlough scheme is certainly proving its worth as a band-aid for the jobs market, but many economists predict the jobless rate will rise to north of 6% when the scheme finally unwinds in September. That much of the employment upheaval is in the consumer services sector makes it hard to predict when these jobs might come back, and this is a key question for many developed economies. The new EU-UK relationship will also be another factor in the equation.

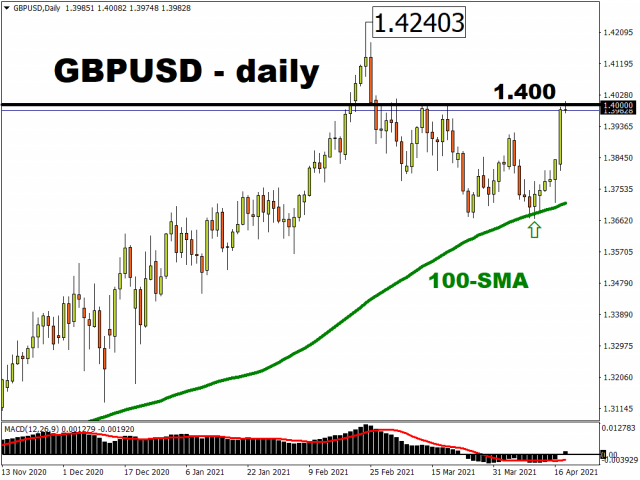

Cable is consolidating its gains and rising for a seventh straight day, enjoying a rising EUR/USD as well as the strong data.

Traders have been waiting for the reopening effect and fast vaccine rollout to kick into GBP, so patience has very much been a virtue!

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026

- USD/JPY to Quickly Return to Growth: Momentum Favours the US Dollar Mar 4, 2026

- European equities plunge amid Persian Gulf military conflict Mar 3, 2026

- Gold Rallies for Fifth Day, With External Risks Mounting Mar 3, 2026

- Iran Crisis: A Dangerous Turning Point Mar 2, 2026