By Lukman Otunuga, Research Analyst, ForexTime

The afternoon after the night before (slight adjustment to the well-known phrase!) is proving bad for US (tech) stocks and good for yields and the dollar.

My colleagues have covered last night’s FOMC meeting in fine detail and it seems that communication challenge we highlighted yesterday was and is still very much alive.

The Fed is desperately trying to walk a fine line between acknowledging better economic growth while maintaining their view that they will leave short-term interest rates close to zero for the next two years.

Chair Powell risks losing credibility with the market as he dismisses inflation as transitory, but any acknowledgment of inflation risks gives credence to the market’s belief that the Fed will be forced to raise rates before 2023. And we guess that’s why he’s paid the big bucks!

Tech getting a bruising

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Yields are surging higher, now touching 1.75% in the 10-year US Treasury bond and a level not seen since January 2020, on expectations of higher inflation.

This means the rotation to value stocks from high-growth equities and especially rate-sensitive tech shares is kicking on. Investors are effectively repricing the value of their shares based on change in interest rate expectations and telling the Fed they are behind the eight ball/curve. By contrast, the Russell 2000 index of small and medium sized US businesses is rising while European bourses like the FTSE100 and German Dax indices are holding their gains, supported by strong banks, energy and industrials which are all trending higher in this environment.

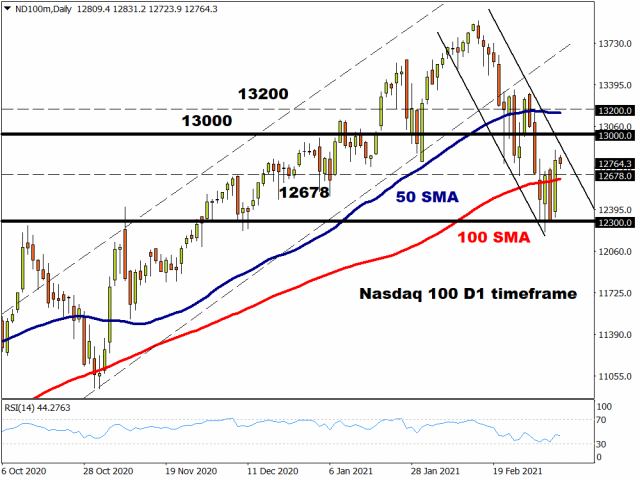

The Nasdaq was looking good for more upside above 13,200 but the 50-day moving average has capped prices and we are now below 13,000.

The 100-day moving average around 12,678 looks to be first support with the February low at 12,660 just below.

Sterling setback on BoE

The Bank of England met earlier today and left all their rates and policies unchanged as expected. The MPC signalled it remains relaxed about the rising (gilt) yields and would “not intend to tighten monetary policy” until there was clear evidence of a job market recovery and the 2% inflation target could be achieved “sustainably”.

This statement echoes much more closely the Fed, than say the ECB last week, especially in their bond buying which is kept largely unchanged.

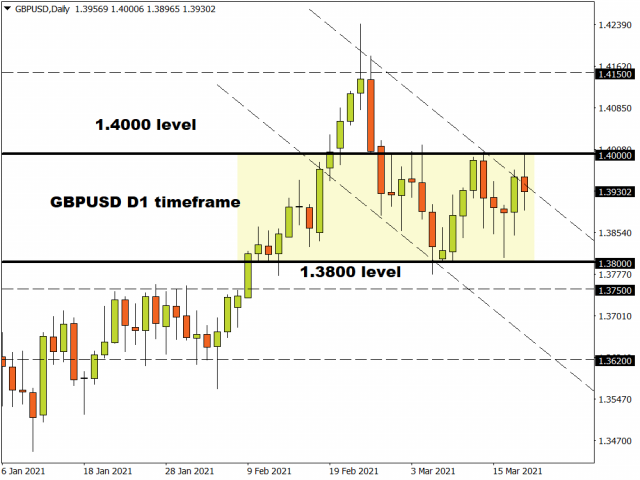

The unexpected delay of vaccines for April is probably only a small setback as the pace should accelerate once more in May. This news might also be impacting sterling which is down on the day, but is still holding in the long-term bull channel from the September lows of last year. Overhead resistance at 1.40 is troubling the bulls but the medium-term picture for the UK and its faster vaccination program should still keep a decent bid in GBP going forward.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026