By Lukman Otunuga Research Analyst, ForexTime

It has been a while since we have taken a deep dive into the world of the British Pound.

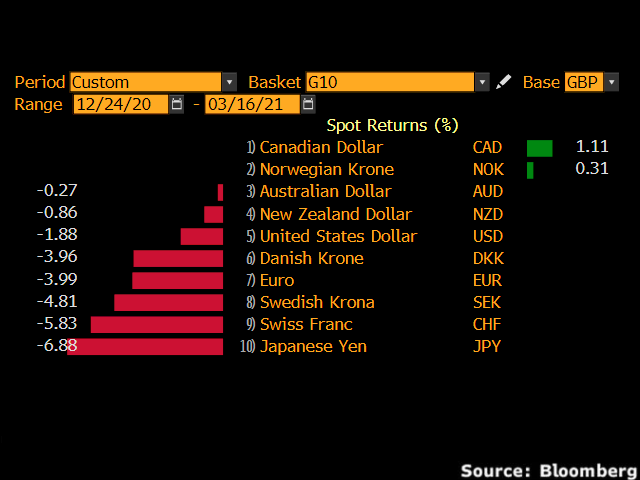

The currency remains in a position of power due to the massive reduction in Brexit-related uncertainty, improving economic outlook, and vaccine rollouts. Sterling is up against almost every single G10 currency since December 24th, 2020 – when the EU and UK reached a post-Brexit deal.

However, things have been shaky for Sterling since the final week of February.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

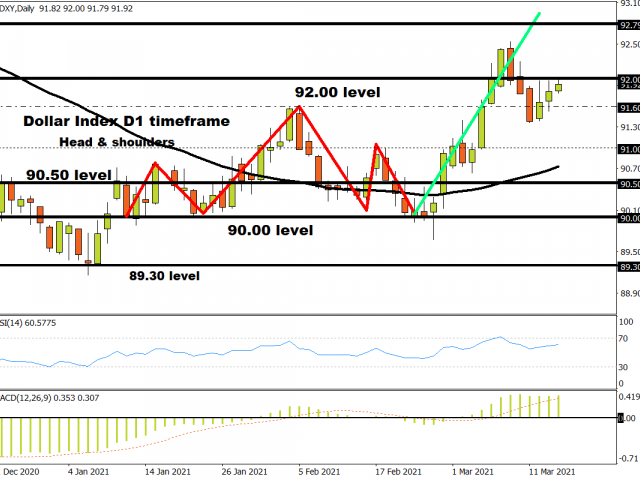

An appreciating Dollar certainly played a role in the Pound’s decline as surging Treasury yields sent investors sprinting towards the world’s reserve currency.

But the fundamentals remain in favour of the Pound. It not only remains heavily supported by growing hopes of recovery but falling Covid-19 cases and optimism over Rishi Sunak’s budget plan. However, the technicals are singing a different tune.

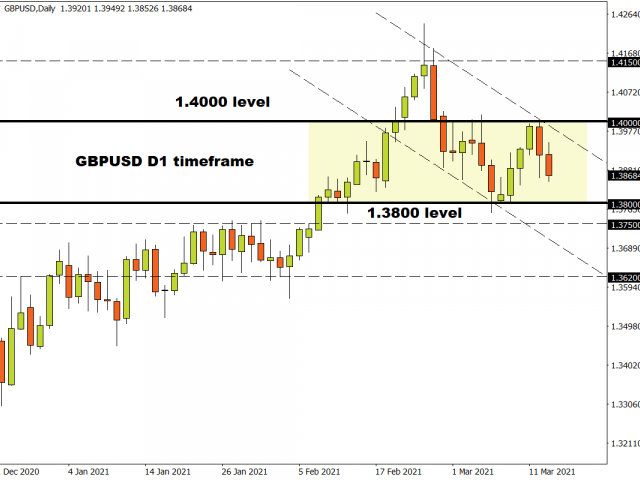

GBPUSD eyes 1.3800

Yesterday, we discussed the possibility of the GBPUSD descending towards the 1.3800 support level with a breakout on the horizon. Prices are trading below the daily 20 Simple Moving Average while the MACD is in the process of crossing to the downside. A solid daily close below 1.3800 may open the doors towards 1.3750 and 1.3620.

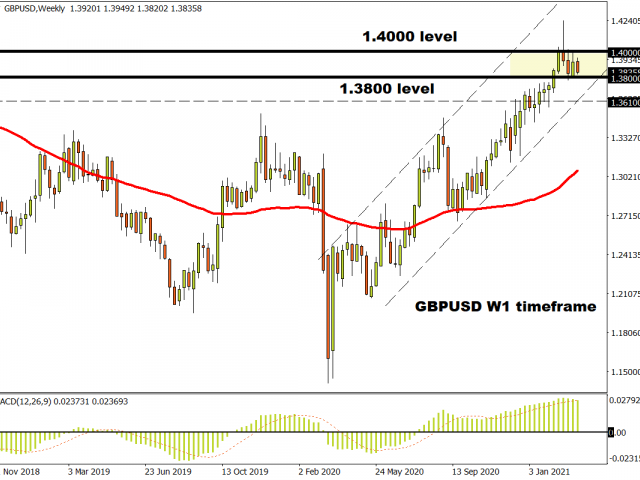

Same story on the weekly

There have been consistently higher highs and higher lows on the weekly timeframe. A technical pullback towards 1.3610 could be on the cards once prices break below 1.3800.

What about the Bank of England meeting?

The Bank of England (BoE) is widely expected to leave monetary policy unchanged on Thursday.

While the European Central Bank (ECB) is concerned over the surge in bond yields, the BoE views it as a sign of optimism that the economy is about to rebound! With interest rates at a record low of 0.1%, much of the focus will be directed towards the BOE’s asset purchase program, which is buying £150 billion of bonds this year. It will be interesting to see if any adjustments are made given the BoE’s views on the surge in bond yields.

Should the central bank express further optimism over the UK economy, this could offer Sterling a boost.

Back to the technicals

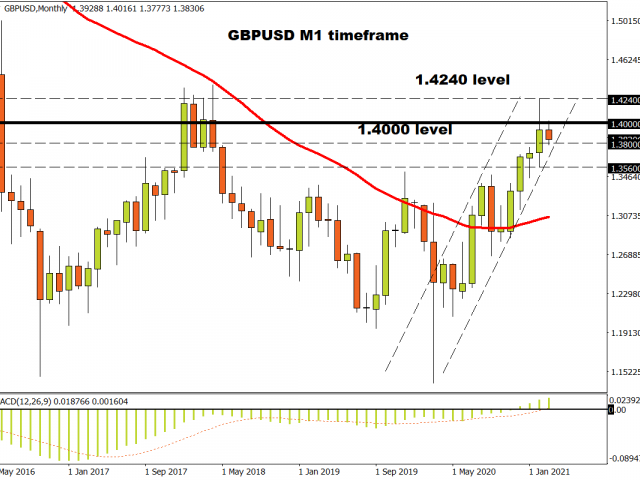

Things are still looking bullish on the monthly timeframe but February’s candlestick looks, suspect. The sharp rejection from the 1.4240 level could be an early signal that the bears are back in the game. It’s all about the 1.3800 support level and whether a monthly close below this key point is achieved. While there have been consistently higher highs and higher lows, a move back below 1.3560 may threaten the uptrend as this is below the most recent higher low.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- IEA deploys strategic reserves to halt soaring oil prices Mar 11, 2026

- GBP/USD Managed to Rise, but Pressure Factors Remain in Place Mar 11, 2026

- Trump signals de-escalation in the Middle East; China’s trade surplus hits a new record Mar 10, 2026

- EUR/USD in Turbulence: Market Questions When Conflict Over Iran Will End Mar 10, 2026

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026