By Lukman Otunuga Research Analyst, ForexTime

US stocks have opened modestly in the red today, while European bourses have been faring worse this morning reflecting the divergent views for the region’s economies based on their progress in the vaccine rollout. The market is also having to consider vaccine diplomacy that is currently pervading the rising number of infections in Europe. The EU’s threat to curb vaccine exports may not be followed through this time around but it definitely remains a drag on euro sentiment.

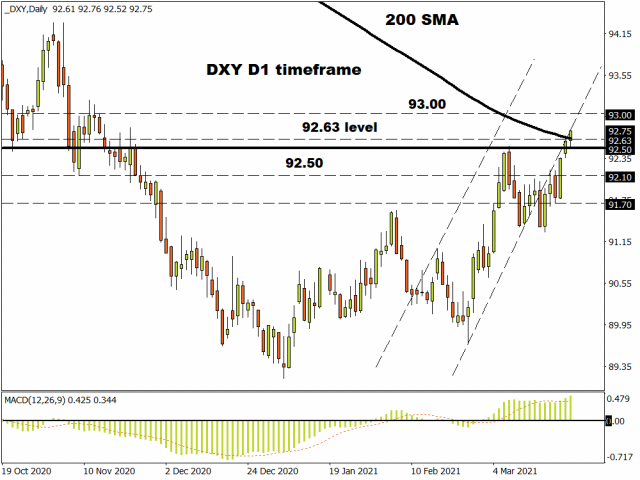

Dollar technical level in focus

This environment is helping the dollar for sure, as the greenback makes its way past the widely watched 200-day moving average (92.63) on the DXY. With US yields supportive of dollar sentiment so far this year, any fall back in those yields is likely needed to curb the USD’s attractiveness. The final estimate of Q4 GDP ticked up two tenths to 4.3% while the weekly jobs numbers from across the pond were also positive, although we saw a similar decline in the initial jobless claims four weeks ago.

If the bulls can hold above the 200-day moving average, then they will take aim at 93.00 as the next level above which could then see momentum indicators become a little stretched.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Equity and fixed income rebalancing

It’s quarter-end soon (where did those few months go!?) which means many pension funds have to rebalance their portfolios due to the massive selloff in bonds over the past quarter. Essentially, fund managers have to top up their holdings of fixed income which means selling down part of their equity holdings. This is also magnified by the solid performance of stocks over the last few months. Estimates as to the quantities to be bought range between $80 billion to over $140 billion and the peak of rebalancing is generally around the 25th of the month ie today!

However impactful this is, we see that the S&P 500 is sitting on its 50-day moving average which has acted as decent support over the last several months.

Bearish momentum has picked up recently so if that moving average fails to work its magic again, the 3,800 marker beckons.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- The US stocks are back to selling off. The US raised tariffs on China to 145% Apr 11, 2025

- EUR/USD Hits Three-Year High as the US Dollar Suffers Heavy Losses Apr 11, 2025

- Markets rallied sharply on the back of a 90-day tariff postponement. China became an exception with tariffs of 125% Apr 10, 2025

- Pound Rallies Sharply Weak Dollar Boosts GBP, but BoE Rate Outlook May Complicate Future Gains Apr 10, 2025

- Tariffs on US imports come into effect today. The RBNZ expectedly lowered the rate by 0.25% Apr 9, 2025

- Volatility in financial markets is insane. Oil fell to $60.7 per barrel Apr 8, 2025

- Japanese Yen Recovers Some Losses as Investors Seek Safe-Haven Assets Apr 8, 2025

- The sell-off in risk assets intensified as tariffs took effect Apr 7, 2025

- COT Metals Charts: Speculator Bets led lower by Gold, Copper & Silver Apr 5, 2025

- COT Bonds Charts: Speculator Bets led by SOFR 1-Month & US Treasury Bonds Apr 5, 2025