By Han Tan Market Analyst, ForexTime

The ‘buy the dip’ mindset is still alive and kicking, as seen for tech stocks which had endured a bruising past few sessions.

As highlighted in my note yesterday, the Nasdaq 100 minis indeed found support around the 12,750 region before now using its 50-day simple moving average (SMA) as a platform to push higher. The Nasdaq was initially headed for losses by as much as 3.5% to wipe out its 2021 advance, only for market participants to limit Tuesday’s declines to just 0.22% by the end of the session and restore a year-to-date gain of 2.11%.

True believers in the tech sector had determined that the recent rout had gone on long enough to present a buying opportunity, and so in they went.

The futures contract for the tech-heavy index is edging tepidly higher at the time of writing, suggesting that more tech aficionados are now willing to wade back in.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

This mantra has certainly served tech investors well amid the pandemic, and may prove resilient even when contending with the shifting market dynamics as the world recovers from Covid-19.

Similarly, the futures contracts for the S&P 500 found support at its 50-SMA, with the actual index closing up 0.13% in the latest US session.

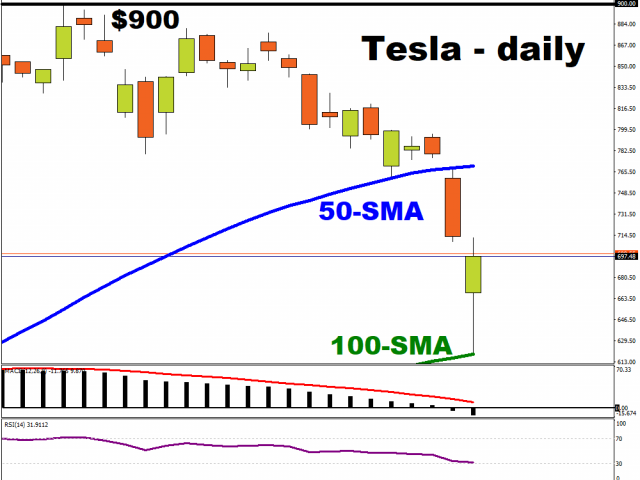

The buy-the-dip action was also seen in Tesla’s stocks.

A month after flirting with the psychologically-important $900 level, the EV-maker’s share prices has broken below its 50-day SMA, only to find stronger support at its 100-day counterpart. Tesla believers then pushed the stock higher above the $700 line in late trading.

What prompted the ‘buy the dip’ action?

Fed Chair Jerome Powell reiterated the US central bank’s continued support for the economy during his testimony before the Senate. He once again conveyed his view that the US economy is still “a long way” from the Fed’s goals, and isn’t anywhere close to pulling back on the $120 billion in monthly asset purchases the central bank currently conducts to ensure financial conditions are supported.

Such commentary prompted Treasury yields to moderate, with 10-year Treasury yields falling by as much as 4 basis points. Powell’s words, combined with the technical indicators at play mentioned earlier, are being attributed for reinvigorating stock prices.

Could Facebook and Amazon be next on tech’s ‘buy the dip’ watch?

Facebook and Amazon have been stuck in a sideways trend after posting their respective record highs over 5 months ago. Looking at their price charts, their respective 200-day SMAs set to be increasingly relied on as an immediate support level, more so in Facebook’s case.

Facebook and Amazon are set to contend with heightened scrutiny from lawmakers around the world, which are exerting strong headwinds on their respective share prices. The pandemic tailwinds that both have enjoyed are set to ease further, as life attempts to return as close to normal as possible as the Covid-19 vaccine reaches more of the global population.

As mentioned in yesterday’s note, while I expect the overall resilience in the tech stocks to hold, they are set to lag other sectors amid the ongoing reflation trade which appears to have more room to run.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Trump signals de-escalation in the Middle East; China’s trade surplus hits a new record Mar 10, 2026

- EUR/USD in Turbulence: Market Questions When Conflict Over Iran Will End Mar 10, 2026

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026