By Lukman Otunuga, Research Analyst, ForexTime

After the shocking and momentous scenes in Washington yesterday evening, perhaps the two most important things to remember as a trader are that firstly, markets are forward-looking vehicles. They do not focus on the present or past, but on the future. Secondly, markets do have a long history of being unmoved by political violence as rioting and street violence have very little economic effect.

Dollar finds a foothold

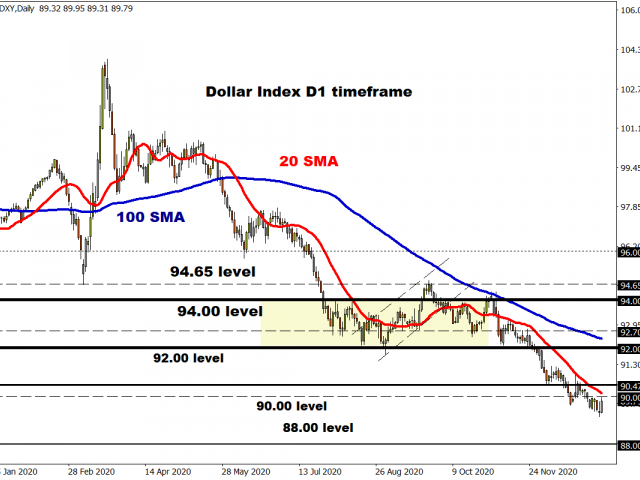

Significantly, Congress ended up certifying the presidential election results which means a Democratic sweep in Washington and the prospect of more stimulus spending. Bond yields are higher again which is giving some welcome relief to the Dollar. Although the broader environment over the medium-term remains unchanged, certainly the bid in the greenback is offering some stablisation with its recent heavy losses.

The demand for USD also tallies with its seasonal characteristics as we often see the buck doing better at the start of the year. DXY will need to clear the end of November low around 90.47 to stand any chance of arresting the long-term downtrend and moving back towards the 92 level.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

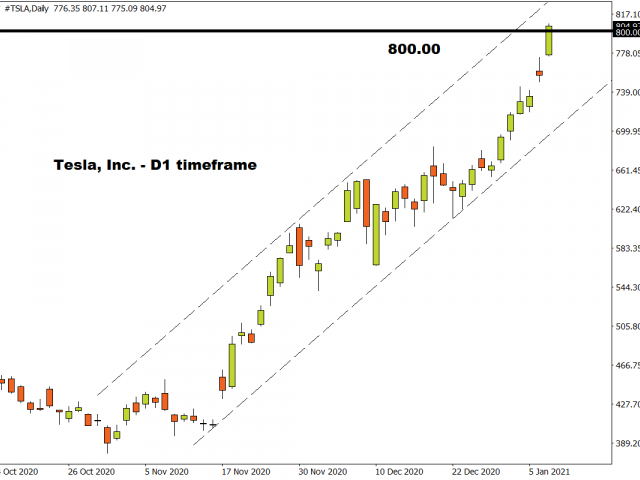

US equities: record highs

As if to reinforce the point about markets oblivious to political violence, stocks are making new highs as the sheer weight of money coming into risk assets driven by the medium-term optimism continues. Equity markets are very much pricing in better corporate earnings due to the expected economic boost from further fiscal measures. The tech-heavy Nasdaq has erased all its losses from yesterday and is peering into record territory as well. Are markets running ahead of themselves? The myriad of headwinds from last year are certainly no more (think Brexit, stimulus, vaccines…) and the central bank punchbowl is still very full, for now at least!

Two assets breaking records fast and catching the eye are Bitcoin and Tesla. The carmaker has now made Elon Musk the richest man in the world, after a 750% rise in the last 12 months. Meanwhile cryptocurrency prices have accelerated higher once again, crossing the stunning level of $1 trillion in total market cap for the first time in history. Bitcoin is approaching $39,000 while Ethereum has also surged higher, breaking back above $1200 for the first time since January 2018.

When certain assets experience such parabolic and explosive moves, technical analysis can be tricky as even the 20.5% correction on Bitcoin witnessed last week now looks like a blip. Given how more action could on the horizon, it may be wise to hold onto your (crypto)hats while driving in your Tesla !

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026