By Han Tan, Market Analyst, ForexTime

January 2021 is set to end the same way it began: jam-packed with major events.

- Monday, 25 January: The Davos Agenda 2021

- Tuesday, 26 January: IMF releases World Economic Outlook; Microsoft Q4 results

- Wednesday, 27 January: FOMC rate decision; Q4 earnings for Facebook, Apple, Tesla

- Thursday, 28 January: US Q4 GDP

- Friday, 29 January: US December personal income and spending, January consumer sentiment

Investors are set to continue monitoring commentary about the global economic outlook out of Davos and the IMF over the coming days.

Yet, the greater potential to move markets arguably lies in the mid-week events.

F.A.T. performance may buoy markets

Tech heavyweights such as Facebook, Apple, and Tesla are set to report their respective Q4 results after US markets close on Wednesday. Microsoft will be reporting after markets close the day prior (Tuesday, 26 January).

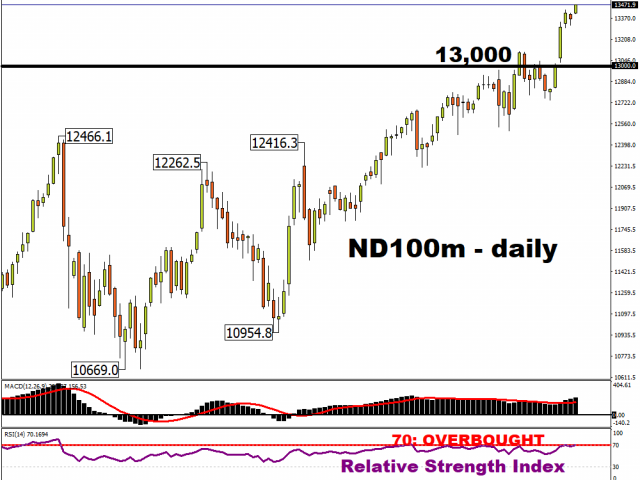

Investors have been loading up on tech stocks in anticipation of a strong performance towards the end of 2020, emboldened by Netflix’s positive surprises during its Q4 earnings announcement last week. Such inflows have pushed the Nasdaq Composite Index higher by more than 5% so far this year. That’s more than double the gains seen in the S&P 500 (2.27%) and almost quadruple the advances in the Dow Jones index (1.28%) for the same year-to-date period.

Perhaps this is the final hurrah for tech stocks before the rotation play resumes in earnest this year.

Then again, never discount the resilience of tech, with Nasdaq futures pointing to further gains during the Asian morning session.

Fed to leave interest rates untouched this week

Also happening mid-week, the Fed is set to announce its latest policy decision.

Although the US central bank is not expected to adjust its policy settings at this meeting, investors are ready to react to the commentary by Fed chair Jerome Powell.

For context, investors have begun pricing in a US economic outperformance in the second half of the year. This is based on the idea that efforts to help the world’s largest economy recover from the pandemic will start to bear fruit then, as the vaccine rollout takes hold and the trillions of Dollars in fiscal and monetary stimulus courses through businesses, households, and economic sectors.

When this scenario unfolds, the Fed would have to eventually taper some of its ongoing support, which amounts to some US$120 billion of monthly bond purchases.

It remains to be seen when this pullback will actually happen, but that isn’t stopping the markets from already trying to pre-empt such a scenario.

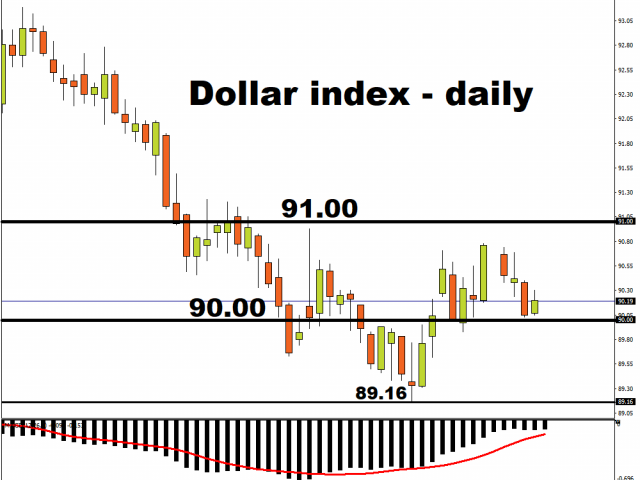

The narrative above has prompted a steepening in the US Treasuries yield curve, with the 10-year yields still around their highest since March. That has offered support for the US Dollar while exerting downward pressure on Gold prices, forcing the precious metal to stay close to its 200-day simple moving average.

Fed may attempt to quell tapering talk some more

Still, Powell may attempt once more to suppress the notion of any Fed tapering over the near-term.

It is imperative that markets also believe his words in order for various assets to produce a noticeable reaction. Otherwise, they might just continue in the same vein.

Investors will also be juxtaposing Powell’s comments with the hard US economic data due in the latter half of the week. Markets are currently expecting a 4.2 percent quarter-on-quarter growth for the US economy in Q4. Personal income levels in the US are expected to have returned to growth last month, although spending likely dipped compared to November.

Still, any green shoots of economic outperformance or positive surprises may hasten any Fed tapering, while potentially prompting the Dollar index to retest the 91 psychological resistance level once more.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com