Article By RoboForex.com

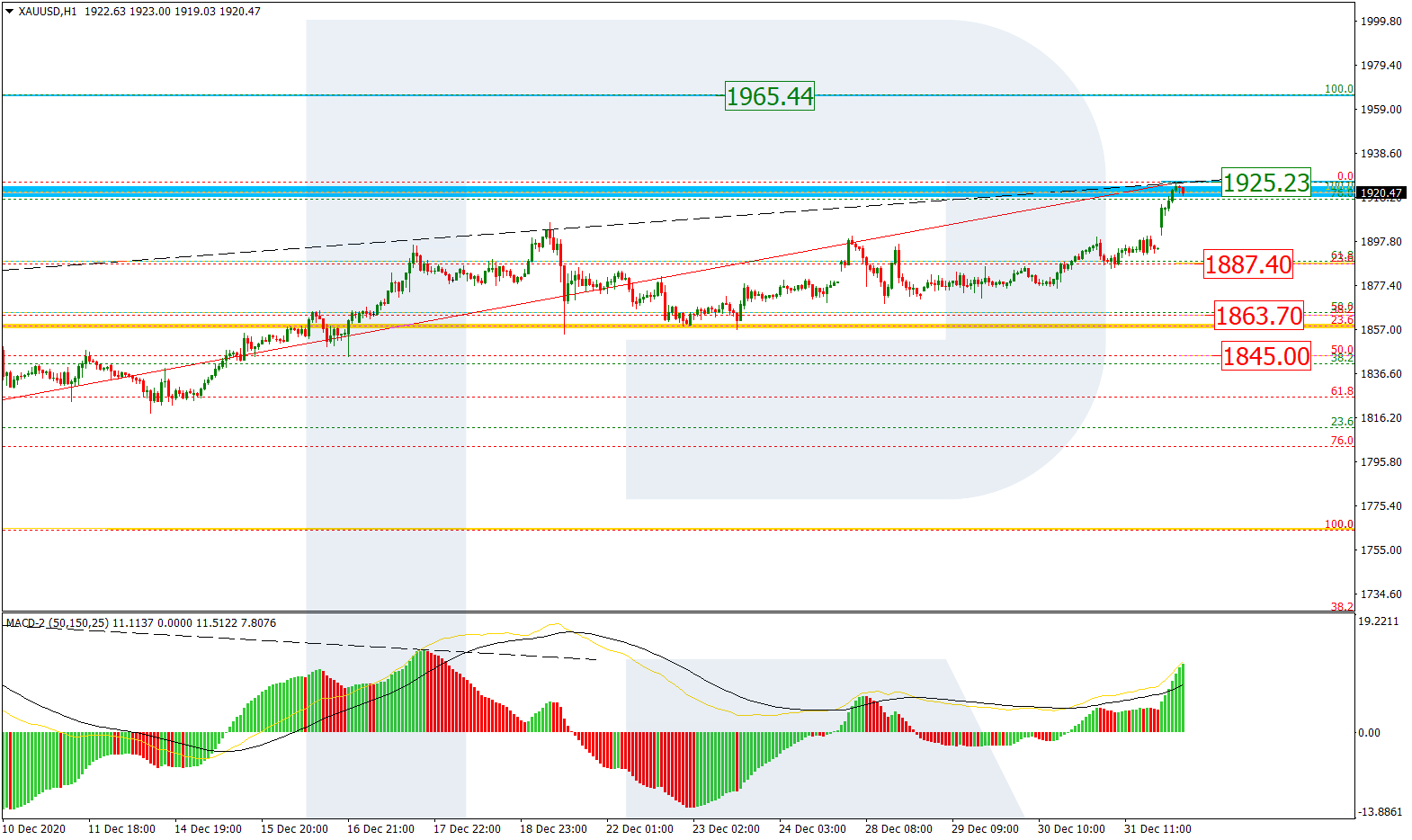

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, after a correctional movement in the form of a Triangle pattern and several tests of the high, XAUUSD has formed a quick rising impulse to break it. As a result, the mid-term uptrend has reached 50.0% fibo and may later continue towards 61.8% and 76.0% fibo at 1956.50 and 2000.00 respectively. However, one shouldn’t disregard a divergence on MACD, which may hint at further mid-term decline towards the key support – the low at 1764.36.

The H1 chart shows that the pair has reached 76.0% fibo. Considering a divergence on MACD, the asset may fall towards 23.6%, 38.2%, and 50.0% fibo at 1887.40, 1863.70, and 1845.00 respectively. However, a breakout of the local high at 1925.23 will result in further trend to the upside.

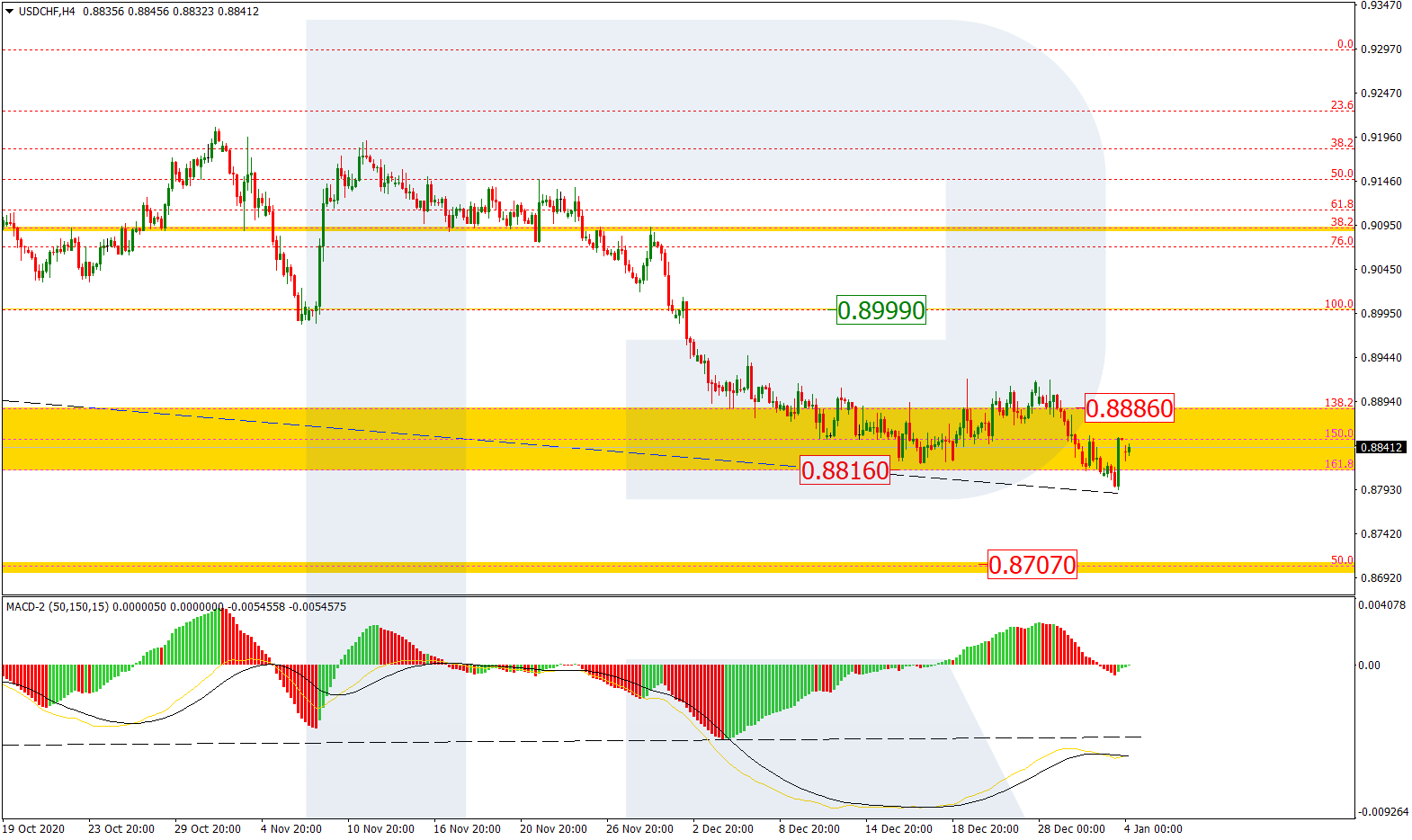

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, after updating the low and attempting to leave the post-correctional extension area between 138.2% and 161.8% fibo at 0.8886 and 0.8816 respectively, USDCHF has skyrocketed and this movement to the upside may be considered as the start of a new mid-term correction. The correctional target remains at the resistance at 0.8999.

The H1 chart shows a more detailed structure of the correction after a convergence on MACD. The asset is approaching 23.6% fibo at 0.8864 and, after breaking it, may continue moving towards 38.2%, 50.0%, and 61.8% fibo at 0.8908, 0.8943, and 0.8979 respectively. A breakout of the support at 0.8793 will complete this correction.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.