By Han Tan, Market Analyst, ForexTime

The long-awaited talks to end all (Brexit) talks failed to provide a breakthrough after last night’s high-level dinner meeting between PM Johnson and European Commission President von der Leyen. ‘Very large gaps remain between the two sides’ and a final Sunday deadline has been set for a ‘firm decision’ on any potential deal.

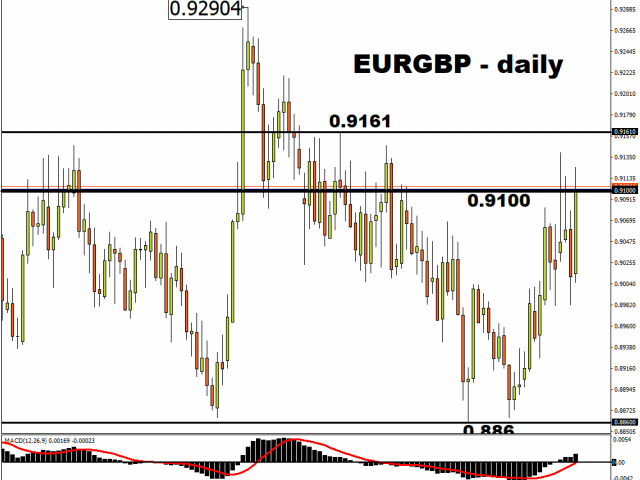

Sterling has tumbled 0.7% with EUR/GBP pushing above 0.91 earlier in the session.

The UK’s currency has been buffeted by political developments over the past few days as traders try and work out if even a ‘lite’ deal can be agreed. The optimists hope that the two sides negotiation teams can still get to this point and that the new deadline might be extended if the UK and EU are close to agreement. But hopes are certainly fading as this would need to be ready to verify by the EU Council before the end of the month. Betting markets now have no-deal chances at 53%.

At least agreement is largely expected at the EU Summit with approval of the EU budget and recovery fund, after Poland and Hungary agreed a compromise with Germany. As for the ECB meeting shortly, President Lagarde has already pre-committed to easing which will likely be seen with more bond buying and an extension of bank loans. This probably won’t be enough to push EUR/USD lower and outweigh the bearish USD forces currently in play.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

EURGBP pushes north

The trade weighted EUR is close to its four-month average which is important to note for the ECB watchers who may be disappointed by any lack of jawboning by the ECB today. But Brexit is driving EURGBP higher and prices are now trading above the 50% retracement level from the March highs and lows earlier this year.

If the pair can hold above 0.91, then bullish momentum can push prices towards 0.9161 which is the next major Fib level.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- IEA deploys strategic reserves to halt soaring oil prices Mar 11, 2026

- GBP/USD Managed to Rise, but Pressure Factors Remain in Place Mar 11, 2026

- Trump signals de-escalation in the Middle East; China’s trade surplus hits a new record Mar 10, 2026

- EUR/USD in Turbulence: Market Questions When Conflict Over Iran Will End Mar 10, 2026

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026