By Lukman Otunuga, Research Analyst, ForexTime

– 2020 was shaped by unprecedented events, heightened levels of uncertainty and periods of extreme volatility.

The growing list of themes influencing sentiment triggered shocking movements across currency, commodity, and stock markets. It is safe to say that the year will be remembered as one where the coronavirus pandemic and other major themes placed investors on an emotional roller-coaster ride.

In the FX space, many currencies were unable to handle the ever-shifting themes but some successfully exploited the chaos to appreciate higher.

All hail king of the losers…

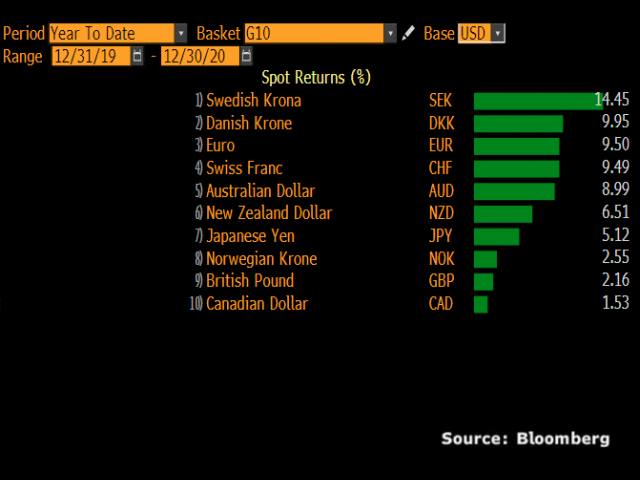

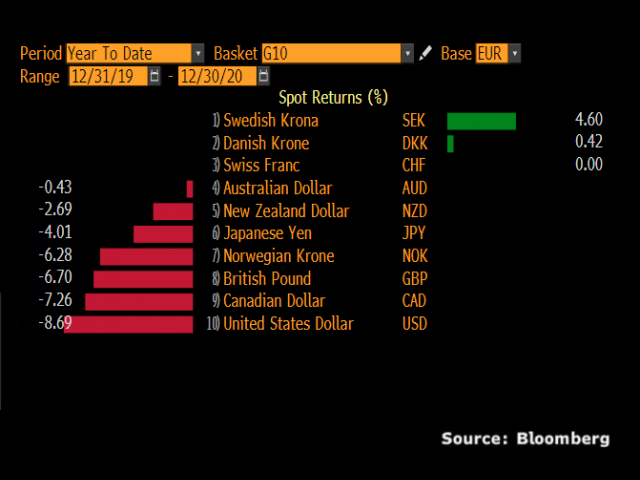

Guess what…the Dollar has depreciated against every single G10 and most Asian currencies since the start of the year.

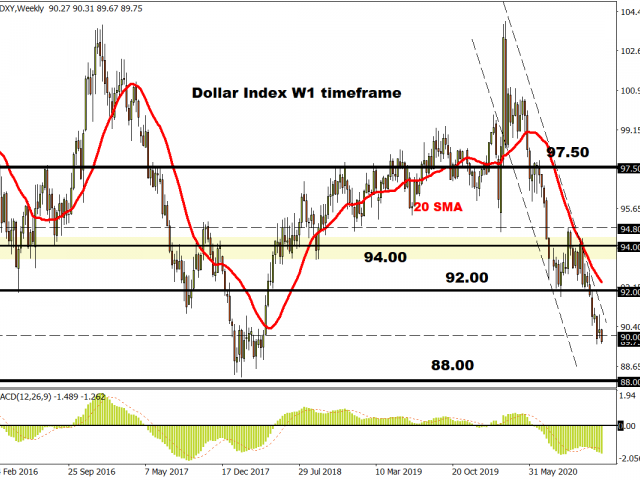

It has been a tragic story for the Greenback in 2020, as low-interest rates, U.S. stimulus, prospects of rising inflation, and improving market mood near the end of the year dragged the currency into the abyss. Looking at the technicals, the Dollar Index (DXY) is down over 7% year-to-date and may extend losses in the new year thanks to vaccine-related optimism.

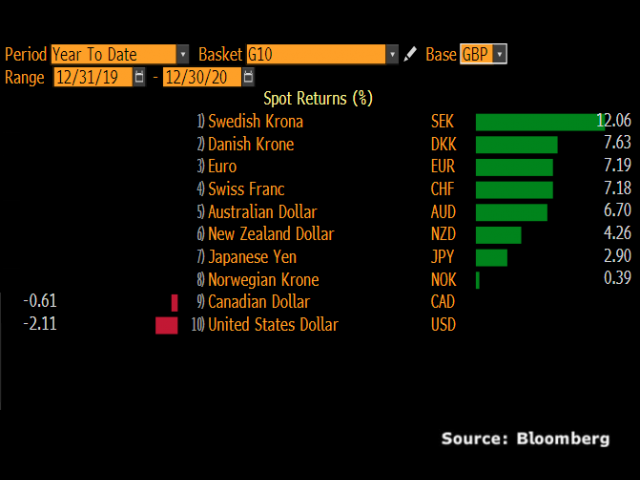

Pound: Sick man of the G10 space

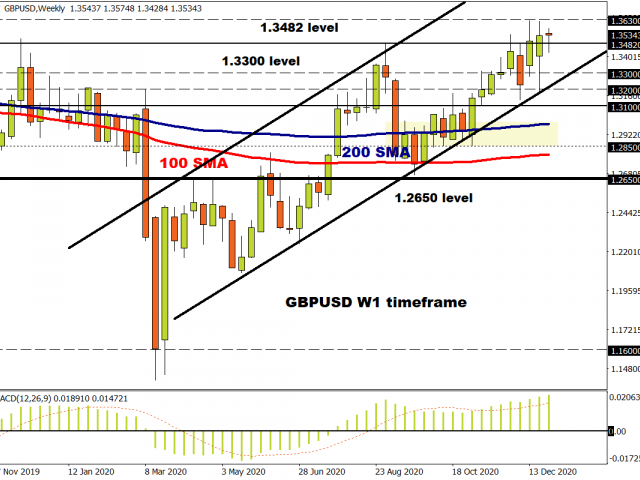

Anyone surprised that the British Pound has weakened against almost every single G10 currency this year?

The UK economy found itself trapped in a fierce battle against COVID-19 and Brexit related uncertainty. Although it became the first country to authorize Pfizer/BioNTech’s Covid-19 vaccine, fears remain elevated over a double-dip recession due to the impact of the new coronavirus variant. In regards to Brexit, the UK and EU were able to reach a breakthrough before Christmas…however many questions remain unanswered over the terms of the agreement.

In a nutshell, the Pound is trouble with fresh weakness expected in 2021.

Euro silently steals the throne

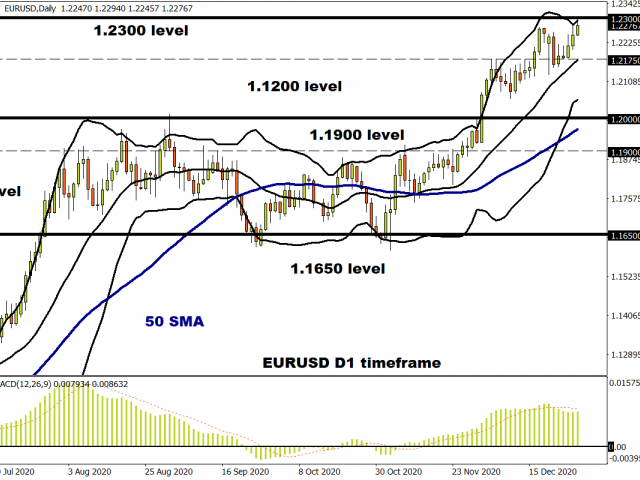

It has not been a bad year for the Euro despite the surging coronavirus cases and domestic risks impacting the Eurozone.

Since the start of 2020, the Euro has climbed more than 8% against the dollar amid growing optimism about global growth prospects. Given how the Dollar is expected to extend losses in 2021, this could push the Euro higher. This could be bad news for the ECB which fears the risk of lower inflation but also bad news for European companies that are heavily dependent on exports outside of the Eurozone.

Looking at the technical picture, the EURUSD is trading towards 1.23 and could test 1.25 in the coming months.

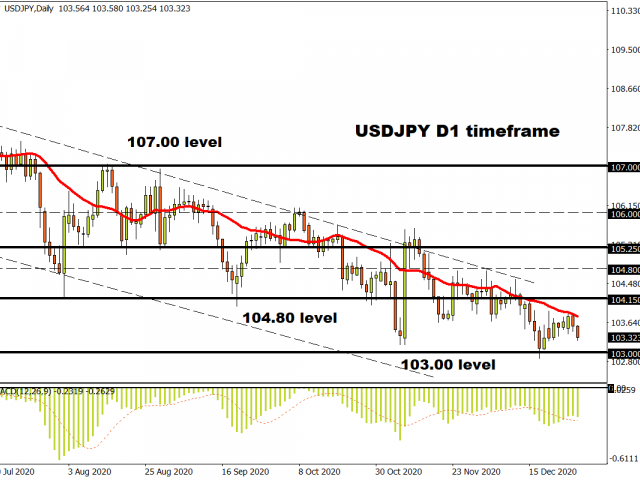

Let us not forget about the Yen

The Yen is on the path to concluding 2020 gaining almost 5% versus the Dollar.

It has been a mixed year for the currency thanks to the conflicting themes influencing global sentiment. Ignoring its performance against the Dollar, the Yen has weakened against most G10 currencies this year mostly due to the improving market mood and risk-on vibes. As investors become increasingly confident over the global outlook amid vaccine hopes, this could drag the Yen lower in 2021.

Focusing back on the USDJPY, prices are likely to trend lower due to a weaker Dollar.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com