By Lukman Otunuga, Research Analyst, ForexTime

The Stimulus drama in Congress is starting to feel like an annoying TV series that nobody really likes but keeps viewers hooked regardless.

As markets entered the week on a positive note on Monday amid renewed optimism over US policymakers reaching an agreement before Election day, it just felt too good to be true. These suspicions were confirmed later in the week as Democrats and Republicans remained trapped in a stimulus limbo despite all the talk and deadlines!

Moving away from US politics, the Pound was practically shivering as fears intensified over a no-deal Brexit. However, comments from EU’s chief negotiator Barnier mid-week saying that an agreement with the UK was within reach injected the Pound with a renewed sense of confidence.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sterling has appreciated against every single G10 currency this week and at one point jumped over 250 pips versus the Dollar. With respect within reach, Sterling may extend gains in the week ahead.

Looking at earnings, Netflix shares fell mid-week after the company’s earnings missed analyst estimates and global net subscriber additions were below forecasts. However, revenues exceeded expectations by hitting $6.44 billion vs $6.38 billion projection. Tesla recorded a fifth quarter in a row of profit, making $8.7 billion in revenue in the three months to September, as deliveries rose 54%!

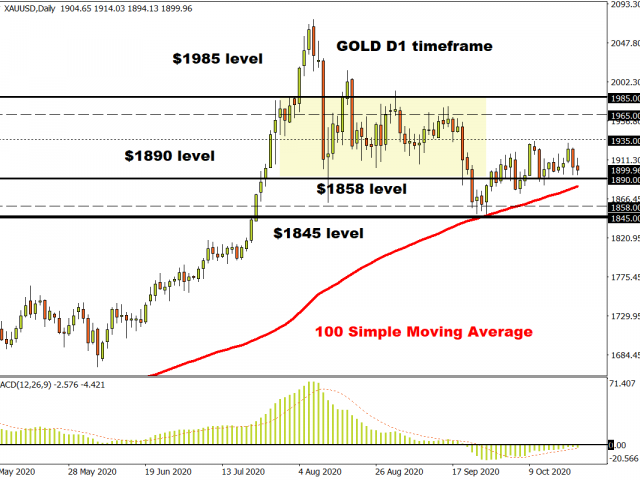

Taking a quick peek at the commodity space, Gold remains in the same old choppy range on the daily charts as investors remain on the side-lines ahead of the November 3rd U.S election.

Over the past three weeks, the metal has found comfort within a $50 range thanks to a variety of themes ranging from a softer Dollar, rising coronavirus cases across the globe, pre-election jitters and uncertainty over the US stimulus package.

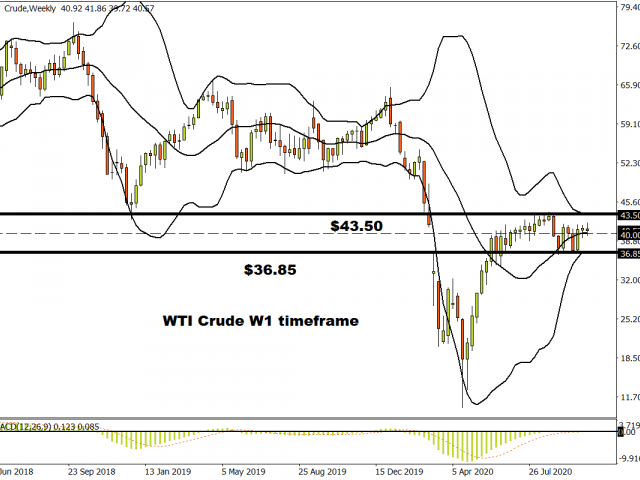

Over the past few months, WTI Oil has been stuck around the sticky $40 level.

There is growing suspicion that the commodity may be waiting until after the November 3rd U.S election to make a move either up or down. Until then, the commodity is likely to be driven by price action and attracted to technical levels.

With the November 3rd U.S election around the corner, there could be more action across financial markets as presidential candidates Trump and Biden drive home their message to voters.

On top of this, the ongoing stimulus drama in Congress may swing the risk pendulum between extremes as investors ponder on the likelihood of a deal before election day!

For a deeper discussion on the week ahead and key market theme, sign up to the upcoming week ahead webinar on Monday 26th October at 1 pm London time!

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026