By Han Tan, Market Analyst, ForexTime

Equity traders appear willing to have one last dance at the “fiscal stimulus” ball, swaying to any tune that hints at a US fiscal stimulus package being agreed to before the November 3 presidential elections. Going by the latest comments from House Speaker Nancy Pelosi, who’s hopeful that an agreement could be reached, US equities are keeping the faith that the White House and Democrats can agree to a fresh round of fiscal stimulus by the weekend.

After the S&P 500 climbed 0.47 percent on Tuesday, the futures contracts are trying to end a run of six straight days of declines. This price action suggests that major US benchmark indices could see more gains at the Wednesday open.

But just like Cinderella, investors must keep an eye on the clock.

While enjoying themselves at this stop-start “fiscal stimulus” ball, they run the risk of being caught off guard if negotiators decide to abandon talks and walk away empty-handed at the final hour. The magic ends when reality strikes, and market participants could find themselves with losses in-hand, perhaps feeling much like Cinderella who could only console herself with memories of the ball, all while sat on a pumpkin after the magical carriage was no more.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Already, Senate Majority Leader Mitch McConnel has signaled resistance to any deal with a heftier price tag. Democrats are pushing for a headline number of US$2.2 trillion, while the White House has raised their offer to US$1.88 trillion. It remains to be seen whether that gap of US$320 billion can be reconciled over the coming days.

Dollar, Gold also caught up in fiscal stimulus hype

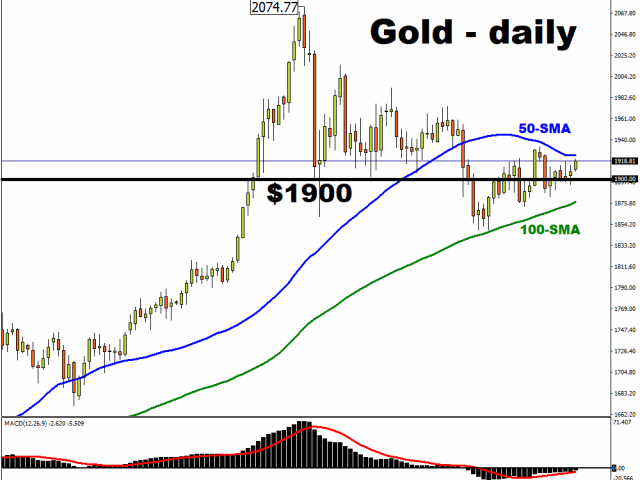

And it’s not just US stocks that are attending this ball. The Dollar index has also swooned by one percent so far this month, moderating below the psychologically important 93.0 level, which in turn has provided a gentle lift for spot Gold, pushing it back towards its 50-day simple moving average (SMA). These price actions suggest that investors are betting that the world’s largest economy is set to receive more incoming government support, which would boost US inflation. Upwards pressures on prices would then erode the Dollar’s purchasing power, while boosting Bullion which is widely considered to be a hedge against inflation.

If a deal cannot be sealed within the next two weeks, at least investors can console themselves that more government financial aid is set to arrive after the elections. It then depends on whether an outright winner can be determined soon after November 3rd, and the winner may then dictate the size and timing of the fiscal stimulus package.

Still, these next few days are crucial for stocks. Only time will tell whether markets have merely believed in a fairy tale of an imminent fiscal stimulus package this whole time, or if dreams really do come true.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026