By Orbex

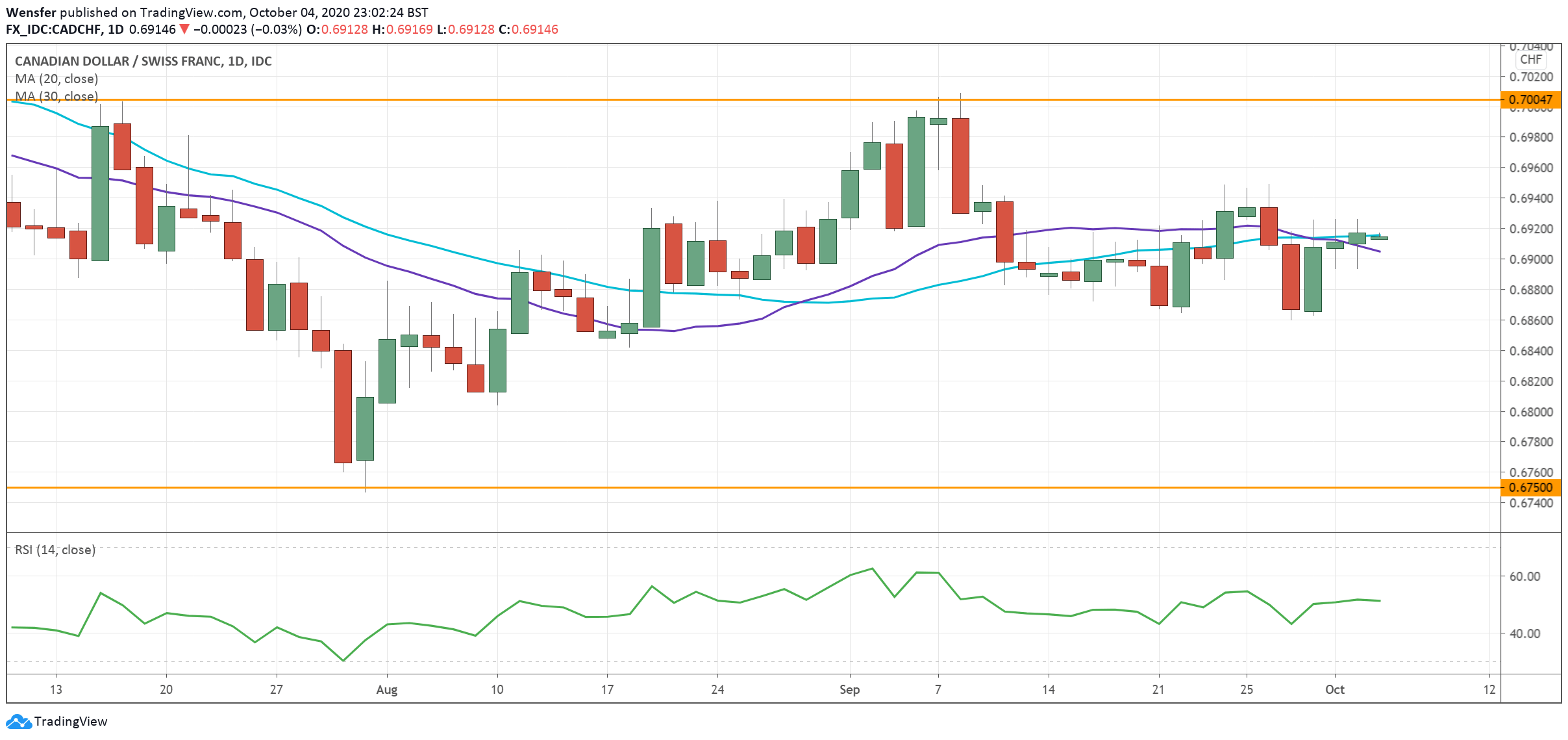

EURGBP Retreats on Signs of Brexit Progress

The pound sterling could be the mover and shaker after Brexit headlines kicked off volatility at the end of last week. EU officials have confirmed that both sides are in talks of ‘next steps’, a sign of progress that has put investors in a cautiously optimistic mood.

One is seldom accustomed to a smooth ride when it comes to trading the Brexit-sensitive pound. Volatility is likely to remain high considering the fact that London has yet to drop the contentious internal market bill.

Positive news could push the euro below 0.9 and towards 0.8880. The lack of it, however, would mean that the pair could rise back to challenge 0.9210.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

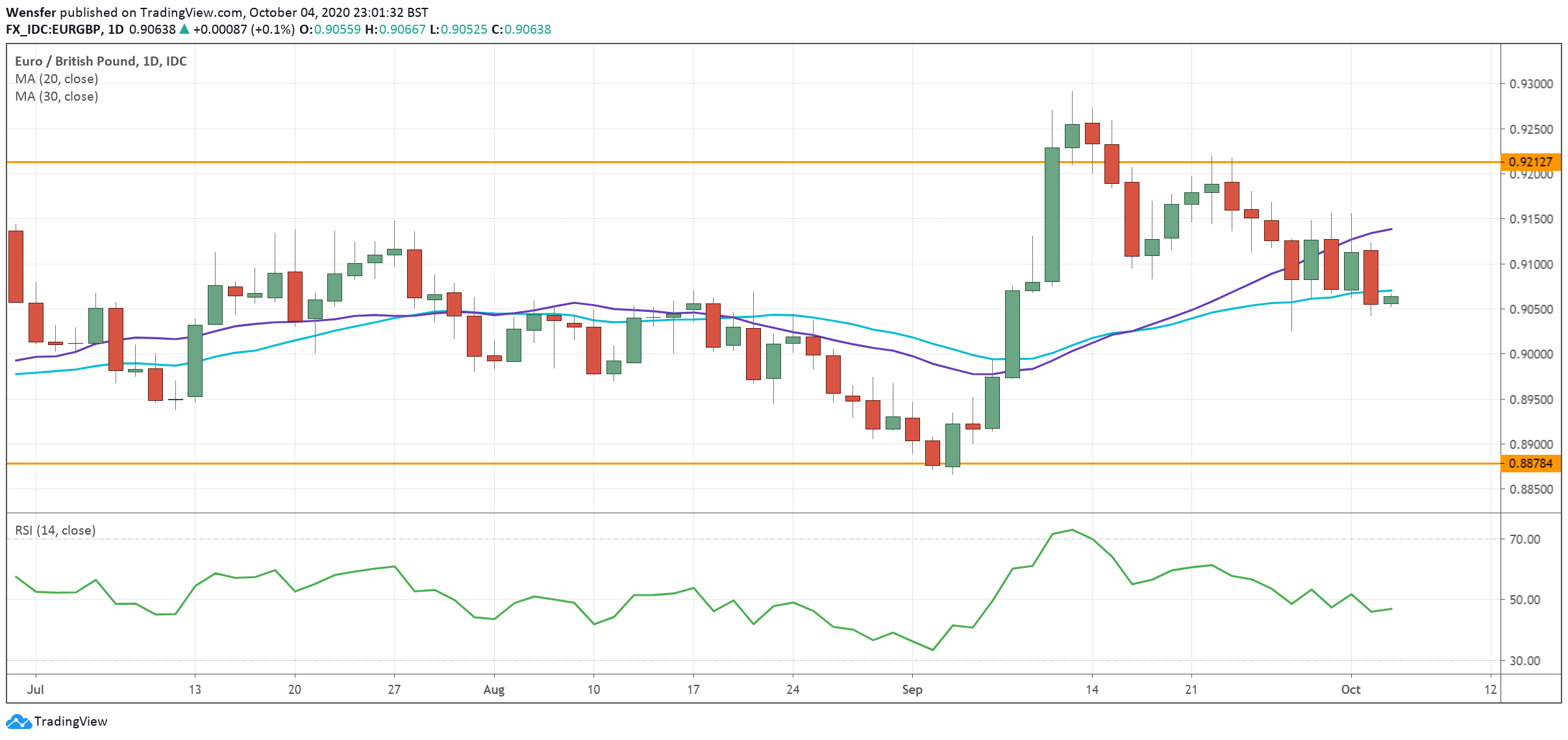

USDCHF Struggles After Lackluster Jobs Data

The US dollar has started a timid rebound from February 2015’s low as investors took some bets off riskier assets.

Uncertainty around the upcoming fiscal stimulus has given the greenback some respite. Whether it will be $1.6 or $2.2 trillion as proposed by Democrats and Republicans respectively, the major concern is if the check could be written before the election. Friday’s job numbers fell short of expectations and that may instill a sense of urgency among policymakers.

The pair’s rally would be sustainable as long as it stays above 0.9050. Further up, strong selling interests could be lying around 0.9450.

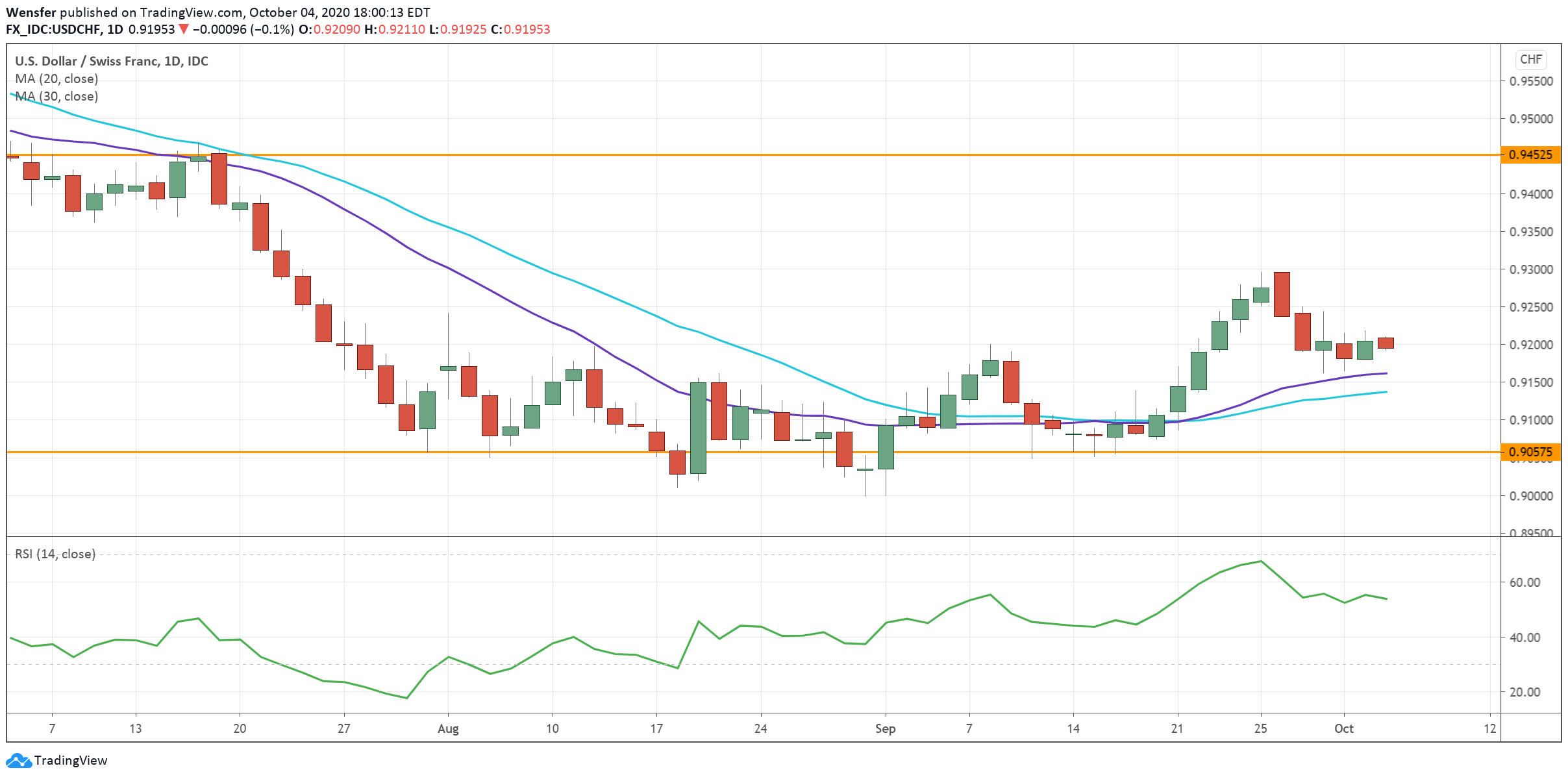

AUDJPY Halts Advance on Potential Rate Cut

Investors buying dips have helped the Australian dollar bounce back from its three month low. Global sentiment has turned upbeat with rallies across equity markets and encouraging Chinese data suggests strength in the economic recovery. All these would be supportive of the risk-sensitive Aussie.

However, the currency might struggle going into Tuesday’s RBA meeting, a major risk event as markets anticipate an interest rate cut. Should the central bank postpone the easing until November, the Aussie could see more buying interests.

77.70 is a key hurdle on the upside while 74.00 is the immediate support level.

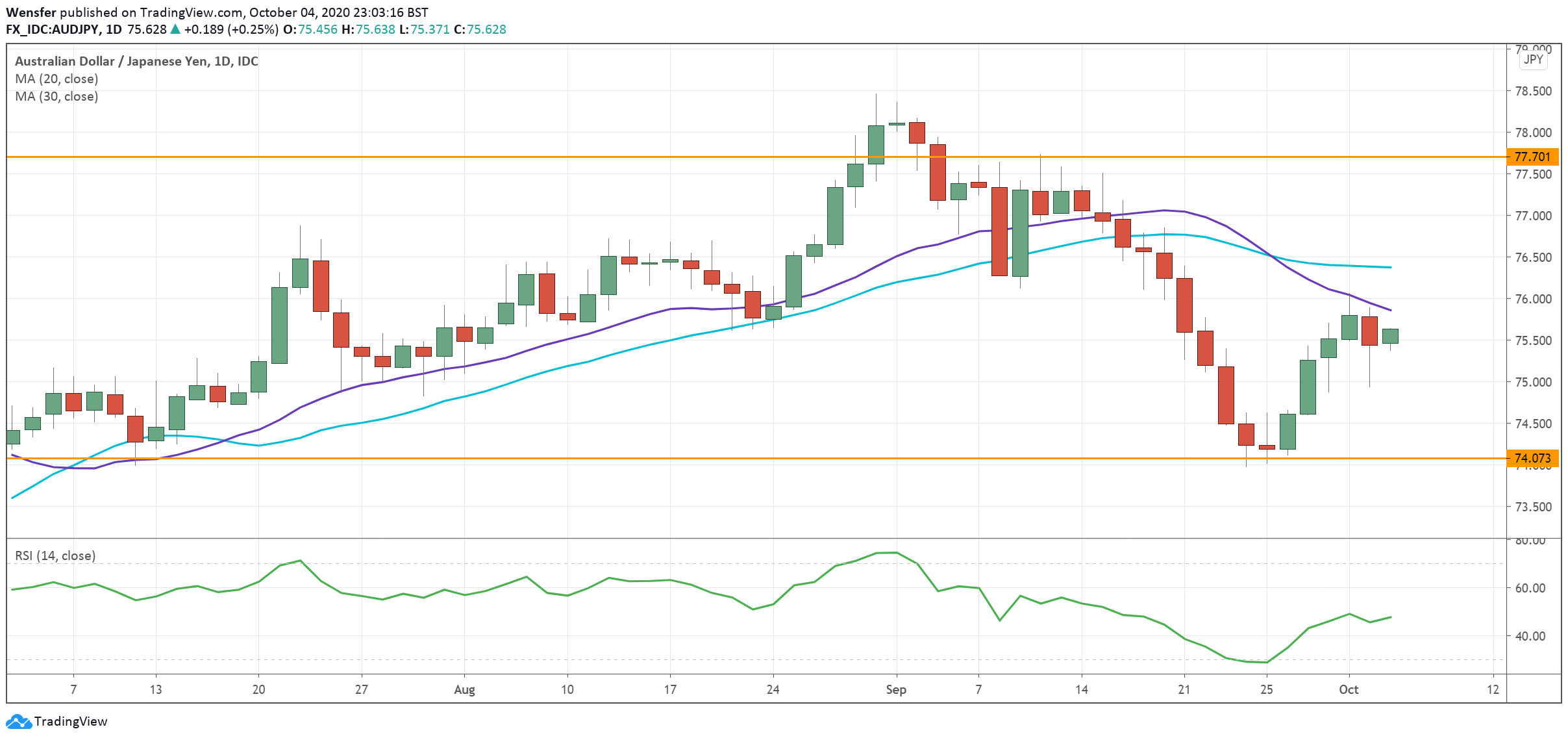

CADCHF in Consolidation as Oil Goes Sideways

Uptick in investor sentiment has yet benefited the Canadian dollar which is stuck in its recent trading range. With oil prices moving sideways, the commodity-related loonie is looking for a strong enough catalyst to commit to a direction. Friday’s jobs data may tilt the balance. A crippled labor market may thwart the pair’s latest rebound.

A positive reading, however, could push the loonie to challenge the psychological level of 0.7000. In the meantime, traders are bound to range-trading opportunities within a 7-month-long consolidation area between 0.66 and 0.72.

By Orbex

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026