By Lukman Otunuga, Research Analyst, ForexTime

Anyone else feeling that this will be a week to remember for the British Pound?

As Boris Johnson’s October 15th Brexit deadline looms, fears remain elevated over a messy divorce between the United Kingdom and the European Union by the end of 2020. Earlier today we covered the fundamentals influencing the Pound, now its time for us to take a deep dive into the technicals.

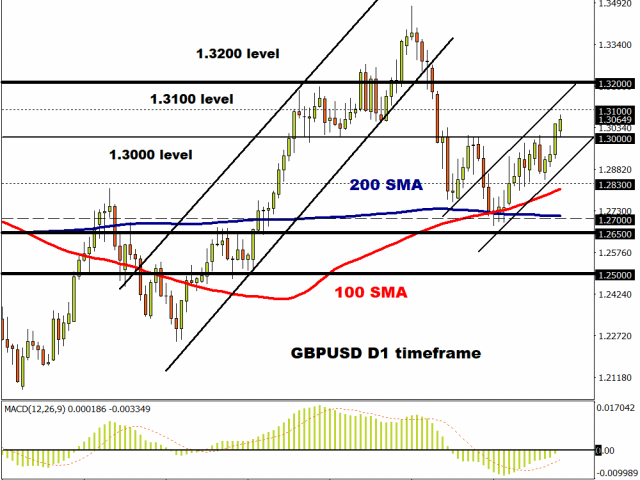

It is safe to say that since July 2016 (one month after the historic referendum), the GBPUSD has resided within a very wide range with support around 1.2100 and resistance around 1.3140. There was a period during early 2018 were prices sprinted through this resistance to punch above 1.4100 before later tumbling back below 1.3140 as Brexit drama intensified.

Looking at the monthly timeframe, 1.2850 has acted as a dynamic level over the past few years, constantly switching between support and resistance. Should this level act as support this month, the GBPUSD could push higher towards 1.3140 which is roughly 350 pips away from current prices.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Zooming straight into the daily, the GBPUSD is bullish. There has been consistently higher highs and higher lows while prices are trading above the 100 & 200 Simple Moving Average. If prices can keep above 1.3000, the next key levels of interest rate may be found around 1.31000 and just below 1.3200. Alternatively, a decline towards 1.3000 could open the doors back toward 1.2830 and 1.2700.

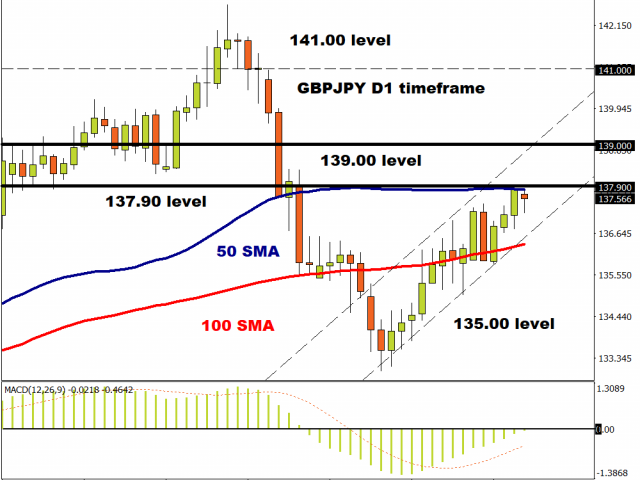

Given the significance of the EU Summit taking place on October 15th, there could be some spice and action on the GBPJPY. If uncertainty boosts appetite for the safe-haven Yen, this could cap the GBPJPY ascent below 137.90. However, a solid breakout above this support may open the doors wide open towards 139.00. Prices are already above the 100 SMA while the MACD is in the process of crossing to the upside.

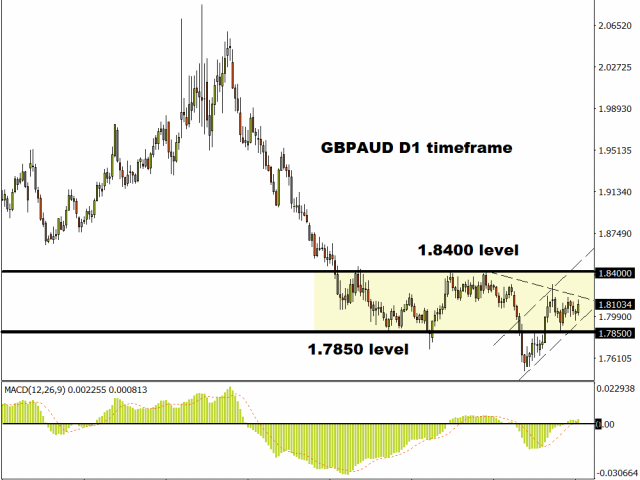

Did someone say breakout? Well, it may be slightly early for that on the GBPAUD but support can be found at 1.7850 and resistance at 1.8400. Where the GBPAUD concludes this week will be influenced by what happens on Thursday. A solid daily close above 1.8100 may signal a move higher over the next few days.

Lastly, let us not forget about the EURGBP. Prices are trading around 0.9040 as of writing. A breakdown below 0.9020 could trigger a decline towards 0.8875. Should 0.9020 prove to be reliable support, a rebound back to 0.9150 could be on the cards.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026