By Han Tan, Market Analyst, ForexTime

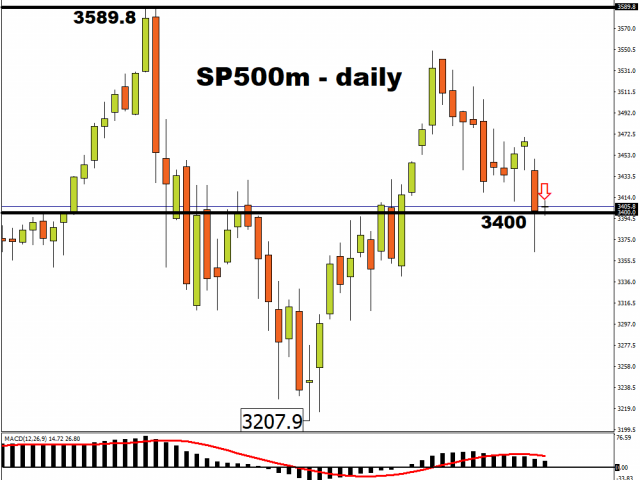

Asian stocks are falling in line with Monday’s selloff in US equities, after the S&P 500 posted a 1.86 percent drop, its biggest one-day decline in over a month. S&P 500 Minis are still smarting from the market’s decision to de-risk as pessimism creeps in over a pre-elections US fiscal stimulus agreement.

Even though China reported a 10.1 percent increase in its September industrial profits, the fourth consecutive month of double-digit on-year gains, leading the world once again in its journey into the post-pandemic era, Asian benchmark indices are still being gripped by the broader risk-off sentiment. The risk aversion nudged Gold higher, keeping it above the psychologically-important $1900 level though still within the tight range it has adhered to of late.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Market’s fears rising

Markets are getting choppier with just a week to go before the US presidential elections. The selloff at the onset of the trading week suggests that investors are facing up to the US political risks that lie just around the bend.

The VIX index, which is widely considered to be Wall Street’s fear gauge, has crossed above the psychologically-important 30 level once more. And the VIX futures contract, which extends into mid-November, rose by 8.86 percent on Monday, indicating expectations for heightened levels of volatility over the coming weeks.

Growing list of concerns

Market participants have to also keep a close watch over Covid-19’s resurgence in major economies, with US infections hitting new records while France reported its biggest spike in hospitalizations since April. The pandemic threatens to wreck the still fledgling recovery in the global economy. Without the veneer of an imminent fiscal support for the US economy, risk assets would likely have a hard time justifying any substantial climbs over the coming days, especially considering the looming political uncertainties.

With volatility comes potential opportunities

Investors who had initially seemed complacent about the above-mentioned downside risks may have to pay the price for their complacency, and brace for potentially more market angst over the coming days. The expected record-high US Q3 GDP due Thursday, with markets forecasting a print of 32 percent, may not be enough to dissuade the bears over the immediate term. Even positive surprises in the ongoing US earnings season may only evoke a fleeting response, with investors likely to focus on the longer-term implications of the US elections and the pandemic.

Still, a shock outcome after November 3rd may present outsized opportunities across broad asset classes, provided investors still have the wherewithal to take advantage of them. However, with market uncertainties running high, perhaps the bias for risk aversion will remain intact over the rest of this week.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026