By Orbex

Gold

It’s been a disappointing week for gold bulls. Following some strength midweek, gold flows have since reversed and are now back to around flat on the week, as of writing.

The main driver for gold prices this week has been the movement in the US dollar.

The greenback has been under firm pressure over much of the week as uncertainty ahead of the US elections, as well as hopes of a fresh stimulus package, have weighed on sentiment.

However, a rebound on Thursday interrupted the bullish move in gold. In the near term, there is plenty of scope for gold prices to continue to appreciate.

With uncertainty likely to rise as we head closer to the election, as well as the prospect of a Biden win, the outlook for the dollar has plenty of downside risks built-in.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Alongside this, the rising fears around the growing second wave of COVID mean that gold is likely to retain plenty of safe-haven demand.

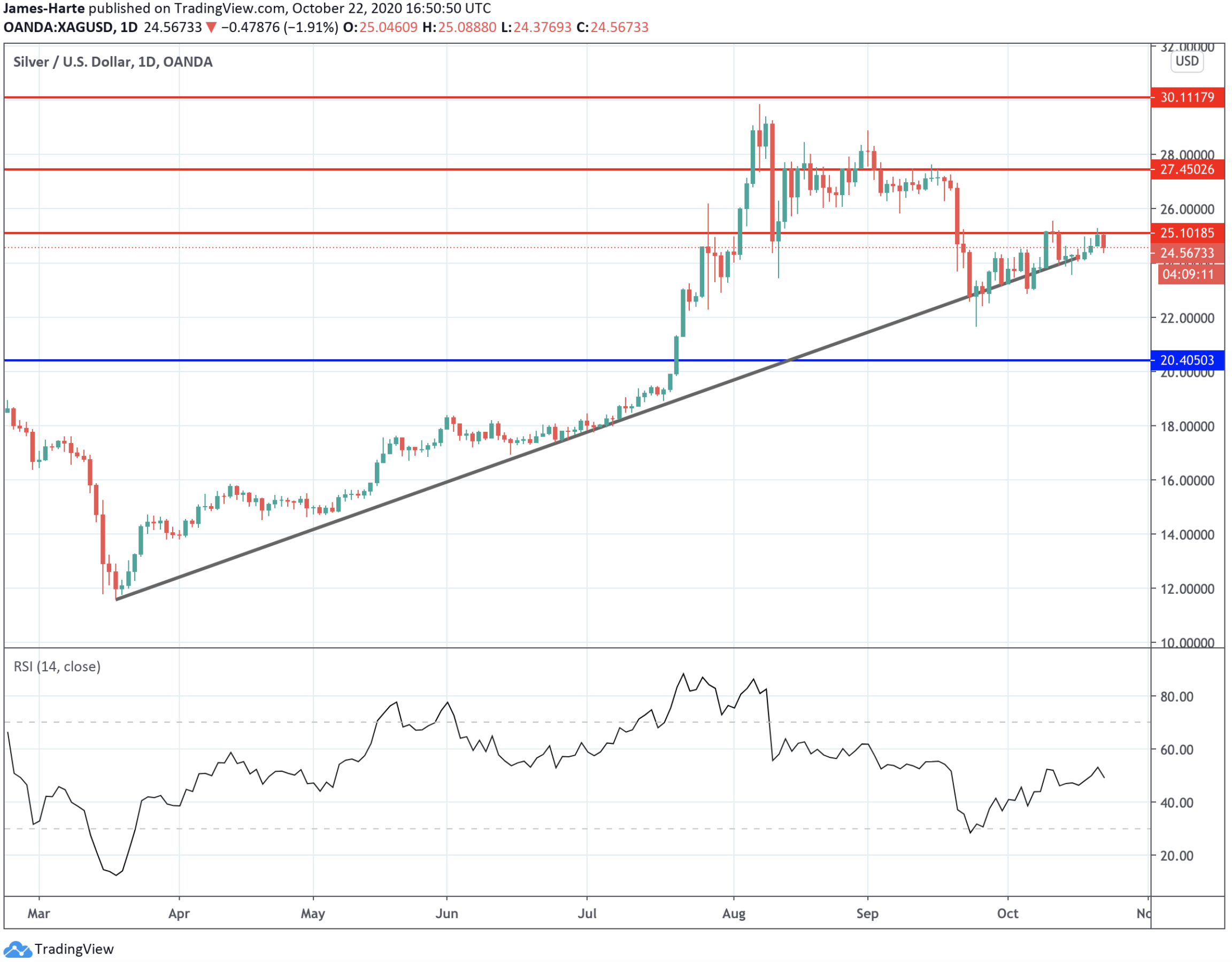

Gold Capped By Resistance

For now, gold prices remain capped by the 1919.92 level resistance. While this level holds as resistance, a further correction towards the 1826.71 level could still materialize.

However, while prices hold above this support the focus is still on continued upside in the medium term and a break back above the 1919.92 level turning focus back to higher levels thereafter.

Silver

The silver market has seen broadly the same price action as we have seen in gold this week.

The downside move in the dollar across much of the week has offset the downward impact of the weakness in equities markets.

Typically, silver derives some support from industrial stocks though, given the second wave, industrial stocks have been falling this week.

Traders will now be looking to today’s manufacturing data sets which could offer silver some support if the readings show strength.

Similarly, if the releases undershoot expectations, this could weigh on silver prices further.

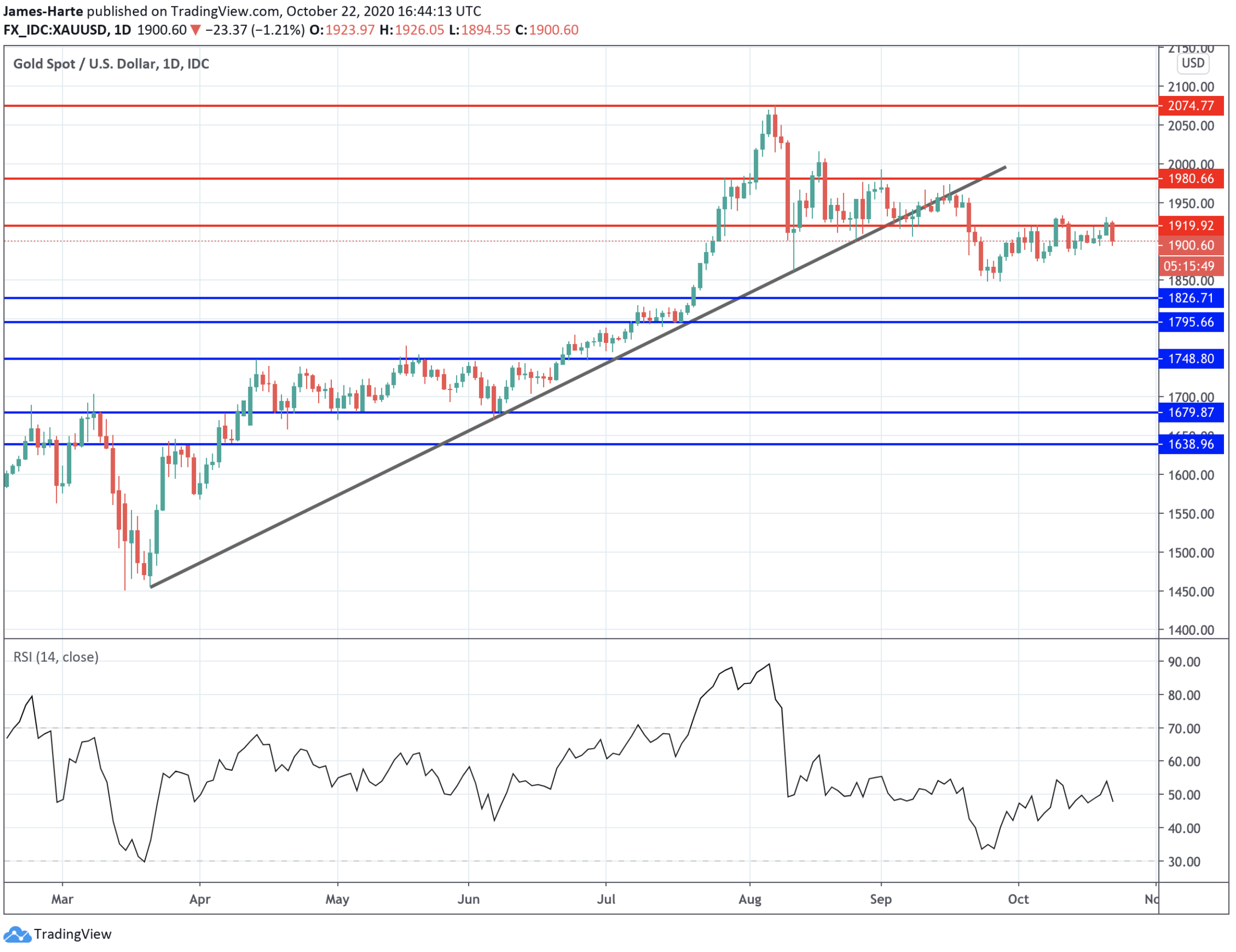

Silver Trapped Between Trend Line & Resistance

Silver prices continue to hug the rising trend line from year to date lows, which continues as support for now. However, the 25.1018 level is still holding as resistance and unless bulls can break back above here soon, a drop down to the 20.4050 level is still a risk.

By Orbex

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026