The breakdown in the US stock markets early on Monday, October 26, was more about investor expectations and a transitioning away from risk ahead of the US Elections than any other factor. No new stimulus deal being reached in addition to a surge in US COVID-19 cases recently suggests another contraction in the US economy may not be too far away. Additionally, as news bombs seem to be nearly an hourly event, investors and traders are suddenly much more uncertain of the outcome of the US elections which are nearly 7 days away.

KEY FACTORS DRIVING ANOTHER RETEST OF RECENT SUPPORT

There are three key factors putting downward pressure on equities today:

- Risk off: Risk capital is being pulled away from high-flying sectors in an attempt to eliminate excessive drawdowns as a result of extreme volatility throughout the election event.

- COVID-19 Cases Surge: Heading into the early Fall season, COVID-19 cases in the US are starting to rise again. This sets up the expectation that travel, consumer spending and all levels of consumer activity may take another hit just before the holiday season.

- Changing Expectations: As the election nears, skilled traders are suddenly realizing their expectations may not be as “solid” as many thought 30 days ago. This requires an immediate change in planning/structure.

These new environmental aspects related to the capital markets suggest that a “repricing event” is likely to continue before the November 3 election day. The repricing event will likely attempt to test lower support levels in the markets – possibly attempting to reach recent Major Support levels. My team and I outline the support levels on the 240 Minute and Daily S&P 500 E-Mini Futures (ES) charts. Read on to learn more.

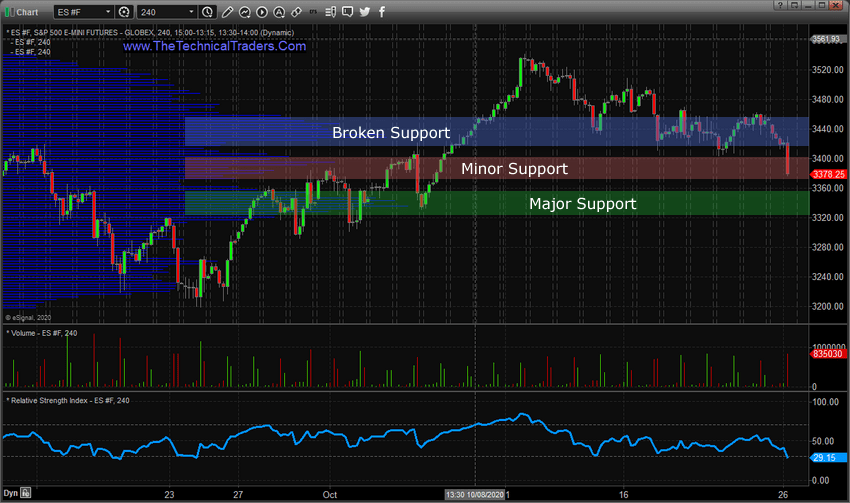

240-MINUTE ES SUPPORT LEVEL

The first chart below is the 240 minute ES chart. It highlights three key support levels. The Broken Support level is the most recent support level that was acting as a floor for price – until today. Minor support exists just below that level between $3370~$3400. Below that, we find Major support near $3325~$3355.

Our research team believes the current price breakdown, or repricing of risk, is an impulse price trend that will end fairly quickly. Of course, we could find other support levels below these current levels, but we believe the current downside price trend is simply an impulse price trend related to the three components listed above. We believe the Major support level will act as a strong price floor over the next 5+ days and potentially set up a substantial price bottom/base near the election day.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

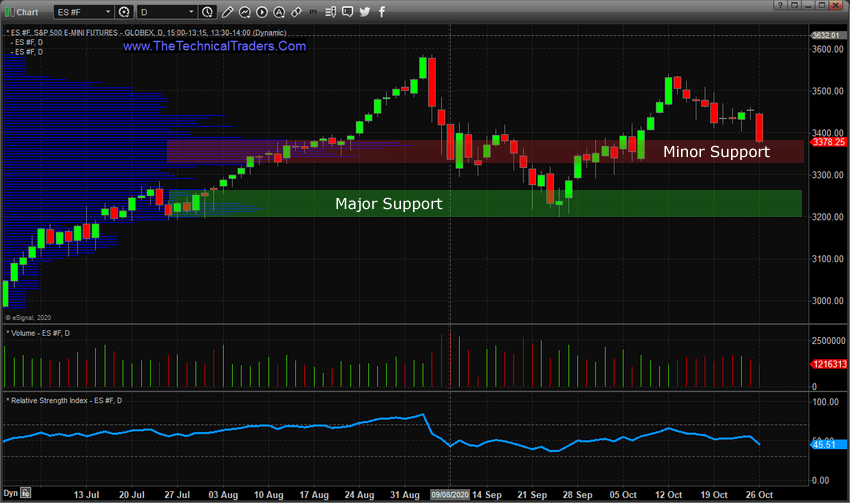

DAILY ES SUPPORT LEVEL

This Daily ES chart shows similar support levels, yet the Major Support level adjusted a bit lower – targeting levels near $3200~$3270. The Minor support level on this Daily chart is aligned with the Minor support level on the 240 minute chart – which suggests this Minor support level may provide a reasonable price floor in the immediate future. Otherwise, the deeper Major support level is likely to prompt a price bottom/base.

We believe traders and investors have already priced into the markets suitable expectations related to information available to them before these new COVID and other data points became available. Now, as there is an immediacy related to adjusting positions and allocation level because of these new concerns, traders are “repricing” perceived risks and that results in what we call an “impulse price move”. Structurally, not much has changed from the past few weeks in terms of economic data/expectations. Traders are simply pulling risk away from the markets in an attempt to prepare for unknowns ahead of the November elections.

This means that capital will be primed and ready to redeploy into the markets once the dust settles. As far as we are concerned, it means more opportunities for great trends and triggers will setup shortly. We expect traders and investors to deploy their capital into suitable sectors/trends as soon as they are capable of discharging the risk concerns that are perceived right now. That could come as early as November 5th or so if the election results are known by then.

I have been through a few bull/bear market cycles in stocks and commodities. I have a good pulse on the market and timing key turning points for investing and short-term swing traders. If you want to learn how to become a better trader and investor, visit TheTechnicalTraders.com to learn how we can help you make money with our research and trading signals. Don’t miss all the incredible trends and trade setups coming up!

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com

NOTICE AND DISCLAIMER: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only and is not intended to be acted upon. Please see your financial advisor before making any trading or investment decisions. Read our FULL DISCLAIMER here.

- Trump signals de-escalation in the Middle East; China’s trade surplus hits a new record Mar 10, 2026

- EUR/USD in Turbulence: Market Questions When Conflict Over Iran Will End Mar 10, 2026

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026