– After nearly three weeks of sideways/downward price action in Gold and Silver, our researchers believe both metals have already set up another breakout/rally attempt after breaching downward resistance (shown as the downward sloping CYAN line). This could be another huge opportunity for precious metals traders as the next move higher should prompt a rally above recent highs. That means a target price level in Gold above $2100 and a target price level in Silver above $30.50.

ARE METALS POISED TO RALLY TO NEW HIGHS SOON?

The deep price retracements recently in both Gold and Silver have come from news events. First, the EU Banking Report that destroyed the market on September 21. Then, just recently, the news that President Trump contracted COVID-19. The resilience in both Gold and Silver near these recent lows suggests demand for metals is still skyrocketing – otherwise, we believe much deeper price lows would have been reached.

If our previous research is correct, this current basing/bottoming pattern could be the beginning of an explosive upside “appreciation” phase in precious metals.

Please take a minute to read the following past research post from our team.

September 27, 2020: GOLD AND SILVER FOLLOW UP & FUTURE PREDICTIONS FOR 2020 & 2021 – PART I

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

September 28, 2020: GOLD AND SILVER FOLLOW UP & FUTURE PREDICTIONS FOR 2020 & 2021 – PART II

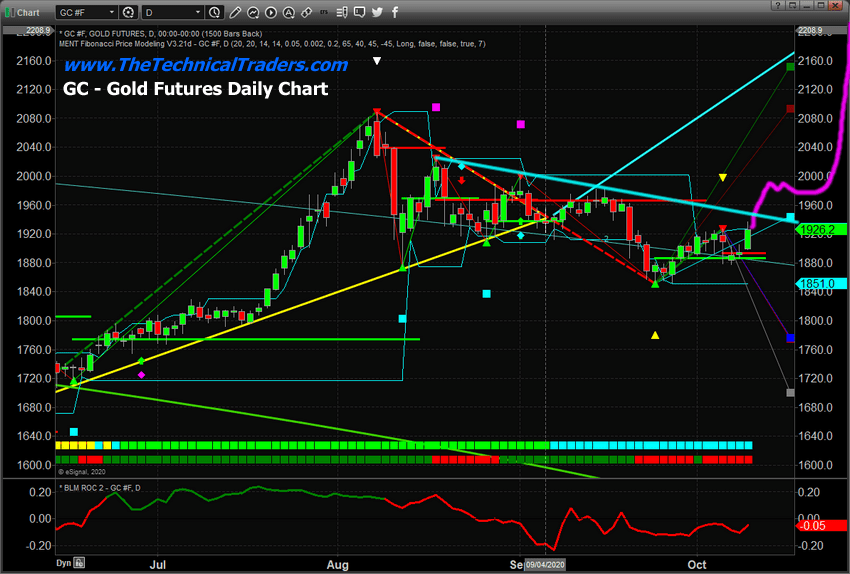

GOLD DAILY CHART

We expect Gold to rally to levels near 1995, then stall a bit before breaking clear of the $2085 level and pushing well above the $2150 as a new rally phase begins. At this point, we believe the upside move to break the CYAN resistance channel is key to starting this upside price recovery.

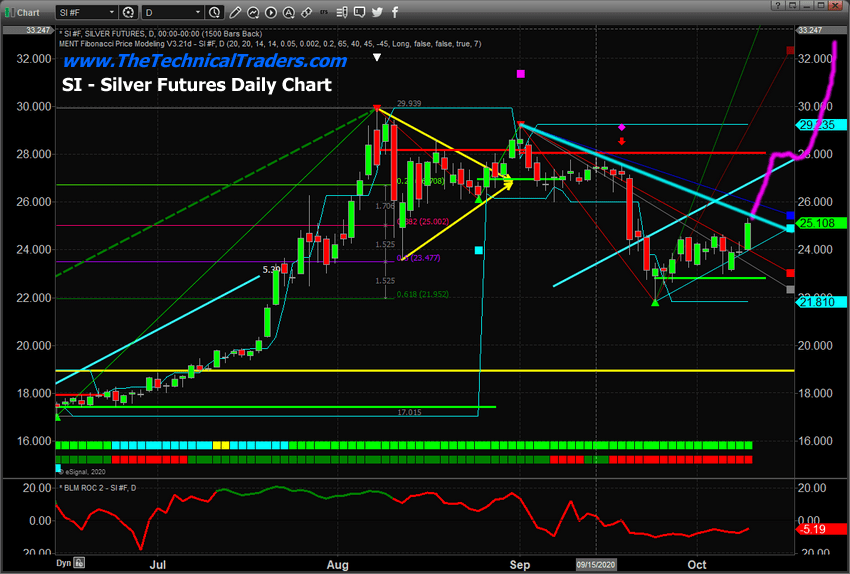

SILVER DAILY CHART

The setup in Silver is very similar and, in many ways, a bit clearer on the chart. The CYAN downward sloping price channel is very clear.

Price is very close to breaking above this channel. We believe the next move in Silver is a rally to levels near $28, then stalling briefly before the next “appreciation” phase begins pushing Silver above $31.50.

Remember, what we are calling the “appreciation phase” is really a much longer-term price appreciation cycle in metals that should begin within the next six months and may last 2+ years.

Be sure to sign up for our free market trend analysis and signals

now so you don’t miss our next special report!

When we are reviewing Daily charts, as we are in this article, we are talking about an appreciation phase that may last 7 to 15 days – not two years. Please take a look at the research articles we’ve linked near the top of this article to learn about the broader market phases that are setting up.

Still, the result is that we believe Gold and Silver are ready to start moving much higher at this point – we need to see those CYAN levels broken first.

Metals have been, and continue to be, incredible opportunities for skilled technical traders. Repeating cycles and patterns allows skilled traders to pick from multiple triggers.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is an incredible year for traders and investors. Don’t miss all the incredible trends and trade setups.

If you want to learn how to become a better metals trader, visit TheTechnicalTraders.com to learn how we can help you make money with our swing and investing signals.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026