Author: Dmitriy Gurkovskiy, Chief Analyst at RoboForex

On Monday, October 5th, the major currency pair is gaining in weight and moving at 1.1731.

The market is slowly restoring to its balanced state: the Trumps are sick but not as serious as market players thought, the speed at which COVID-19 is spreading around the world is high but everyone got used to it, and the statistics on the US labor market turned out to be more neutral than expected.

The Unemployment Rate in the USA went down to 7.9% in September after being 8.4% in the previous month, which is better than the expected reading of 8.2%. The Average Hourly Earnings added only 0.1% m/m after expanding by 0.3% m/m the month before, while the Non-Farm Payroll showed 661K and that’s much worse than expected. However, it’s quite clear that the sector is not elastic and can’t expand and create new jobs on a regular basis.

On the other hand, it is apparent that the risks are reducing, thus allowing the major currency pair to get back to more or less strong levels.

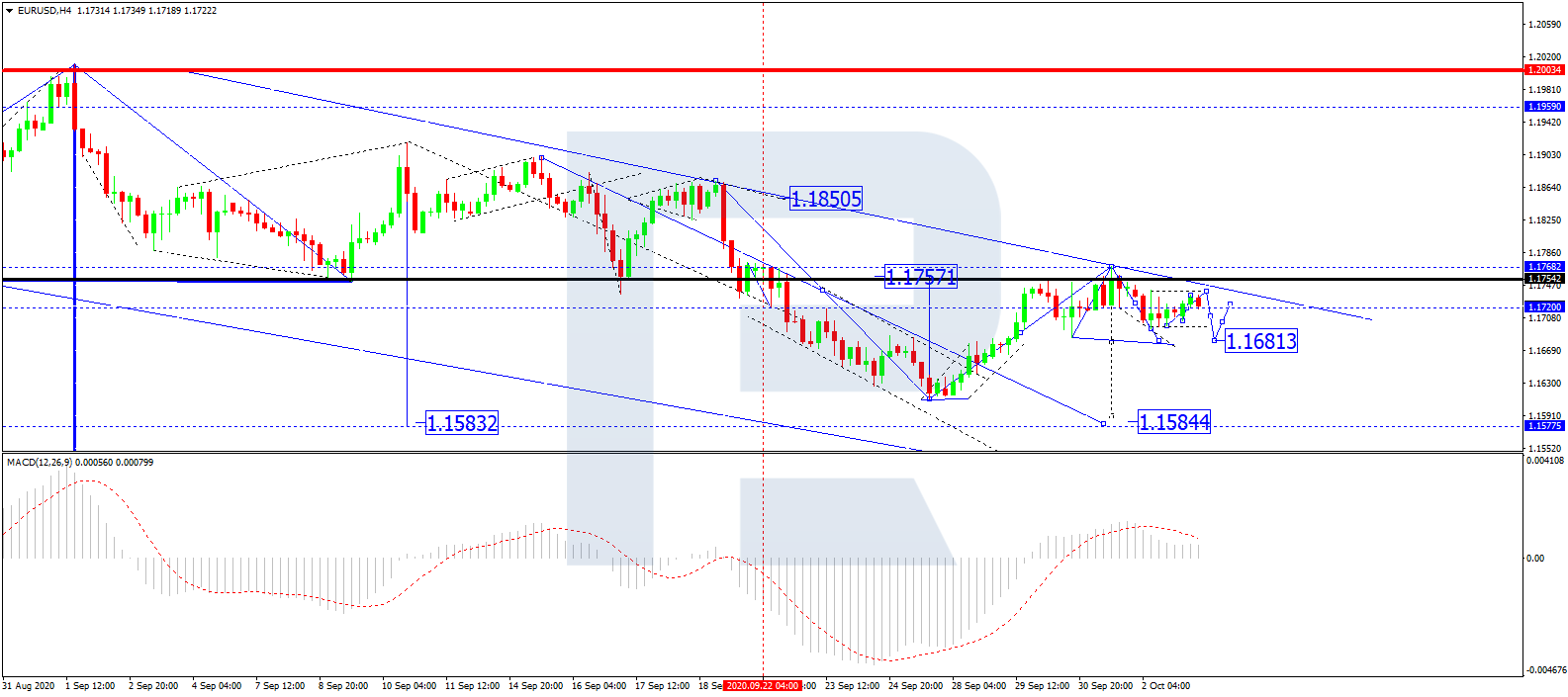

In the H4 chart, EUR/USD has completed the ascending wave at 1.1768; right now, it is consolidating around 1.1720. Possibly, the pair may break the range to the downside to reach 1.1680 and then form one more ascending structure to test 1.1720 from below. After that, the instrument may fall to return to 1.1680 and then start a new correction towards 1.1720, which may be followed by another decline to break 1.1680. Later, the market may continue trading inside the downtrend with the target at 1.1584. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is no longer moving inside the histogram area. Later, the line is expected to fall towards 0 and break it. If it happens, the asset may boost its decline on the price chart.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

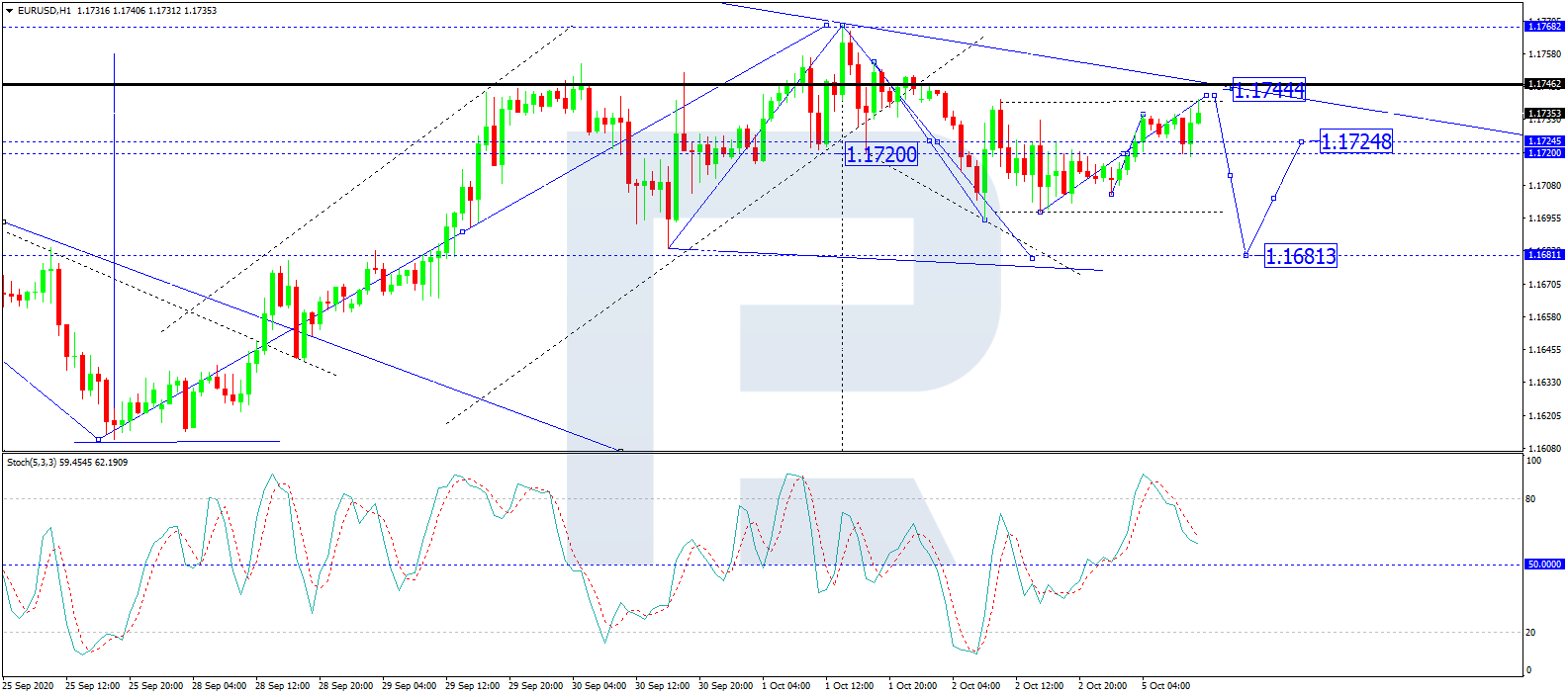

As we can see in the H1 chart, after completing two descending impulses towards 1.1695, EUR/USD is correcting to reach 1.1744. After that, the instrument may continue trading downwards with the first target at 1.1680. From the technical point of view, this scenario is confirmed by Stochastic Oscillator: after breaking 80 to the downside, its signal line is moving downwards steadily. Later, it may continue falling to reach and break 50. After the line break 50, the asset may boost its decline on the price chart.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026