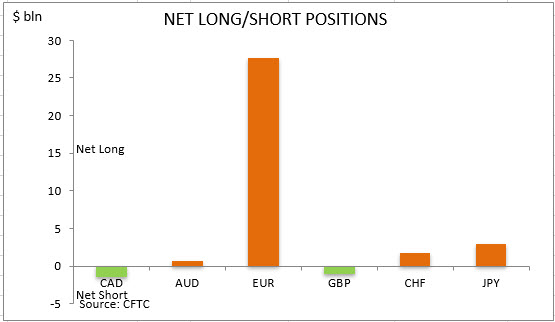

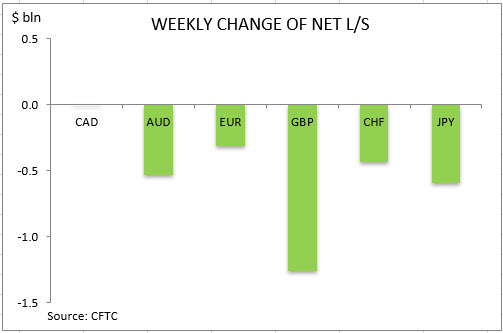

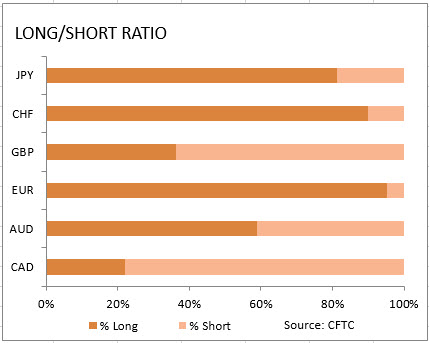

US dollar bearish bets decrease resumed with total net shorts falling to $30.47 billion from $33.60 billion against the major currencies during the one week period, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to September 29 and released on Friday October 2. The decrease in net short dollar bets was the result of mainly British Pound net long bets turning into net shorts, as well as decline in bullish bets on Australian dollar, yen and euro as Markit flash eurozone services PMI dropped to 47.6 from 51.9 in September while manufacturing purchasing managers index’s rose to 53.7 from 51.7. Dollar bearish bets declined despite the Labor Department report above expected 870 thousand Americans filed for first-time jobless benefits and Federal Reserve Fed chair Powell told interest rates would remain low until at least 2024 and “there is a long way to go” for recovery from the economic downturn. At the same time Census Bureau reported orders for durable goods rose 0.4% on month in August, the fourth straight gain, when 1.1% increase was expected. And Markit’s composite purchasing managers index flash reading declined to 54.4 in September from 54.6 in the prior month, signaling a slower pace of growth.

CFTC Sentiment vs Exchange Rate

| September 29 2020 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bearish | positive | -1415 | 4 |

| AUD | bullish | positive | 637 | -534 |

| EUR | bullish | positive | 27606 | -316 |

| GBP | bullish | positive | -1024 | -1260 |

| CHF | bullish | positive | 1731 | -433 |

| JPY | bullish | nuetral | 2933 | -591 |

| Total | 30467 |

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Note: This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.

Market Analysis provided by IFCMarkets.com

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026