By Orbex

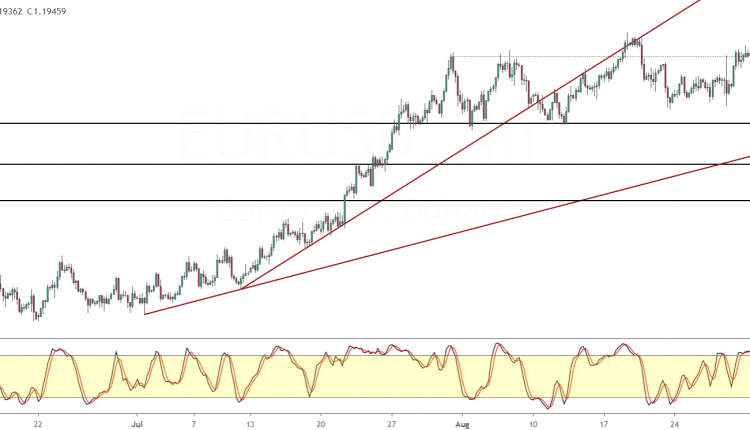

EURUSD Pulls Back After Briefly Rising Above 1.2000

The euro currency posted a fresh high as prices briefly rose above 1.2000 handle. However, just as quickly, the euro pulled back off this level.

Price action is supported to the upside as it tests the 1.1950 level. This marks the previous highs from 18, 19 August.

As long as this level holds, a reversal could see the euro firming up above 1.2000.

Alternately, if the euro loses the 1.1950 handle, then we could expect to see a move lower.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Still, price action will be supported near the lower support area around 1.1800.

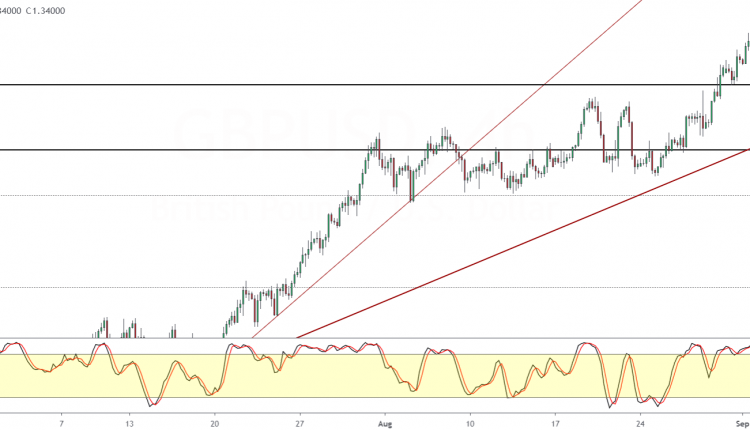

GBPUSD Rises To A New One-Year High

The British pound sterling got a boost from a weaker US dollar as price briefly traded at a new one-year high of 1.3401.

Price action is pulling back lower following this new milestone.

The upside bias remains in place as long as the support level near 1.3300 holds up. But a close below this level could accelerate declines lower.

The next lower support will be near the 1.3122 level.

We could see another leg to the upside if the support level near 1.3300 holds and prices can rebound.

WTI Crude Oil Struggles To Clear 43.50

Oil prices are trading modestly higher but price action still remains below the 43.50 technical resistance.

The downside is also supported as the consolidation in the commodity continues with a slightly bullish bias.

The support level near 42.00 is yet to be tested. The current ranging price action is forming a narrow range between 43.50 and 42.50 regions.

A breakout from either of these levels could see a near term momentum established.

The positioning in the Stochastics oscillator suggests that price action could possibly move lower.

The dynamic support off the trend line should hold for the moment.

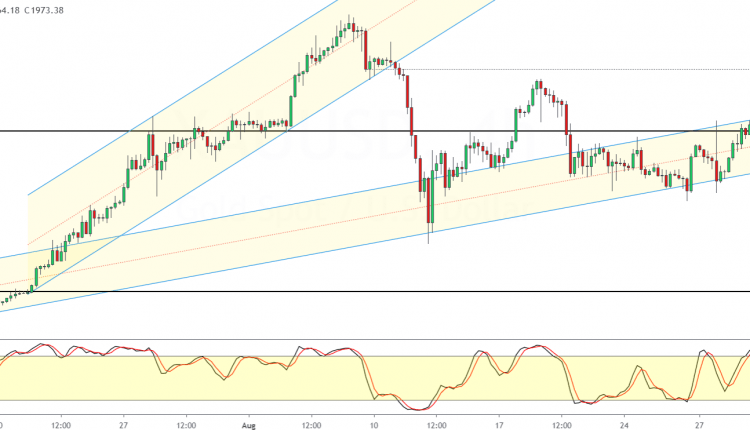

Gold Attempts To Establish Support At 1987

The precious metal made modest gains on Tuesday as prices fell back to the support area near 1987.

As long as this support holds, we could see price action attempting to push higher.

However, note that the lower high could indicate a possible move to the downside. This will make the 1987 support level even more critical.

Below the support, gold prices could start to move lower if they close below the previous swing lows of 1912.

To the upside, price action will need to clear the 2024 level in order to resume the bullish trend.

By Orbex

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026