Article By RoboForex.com

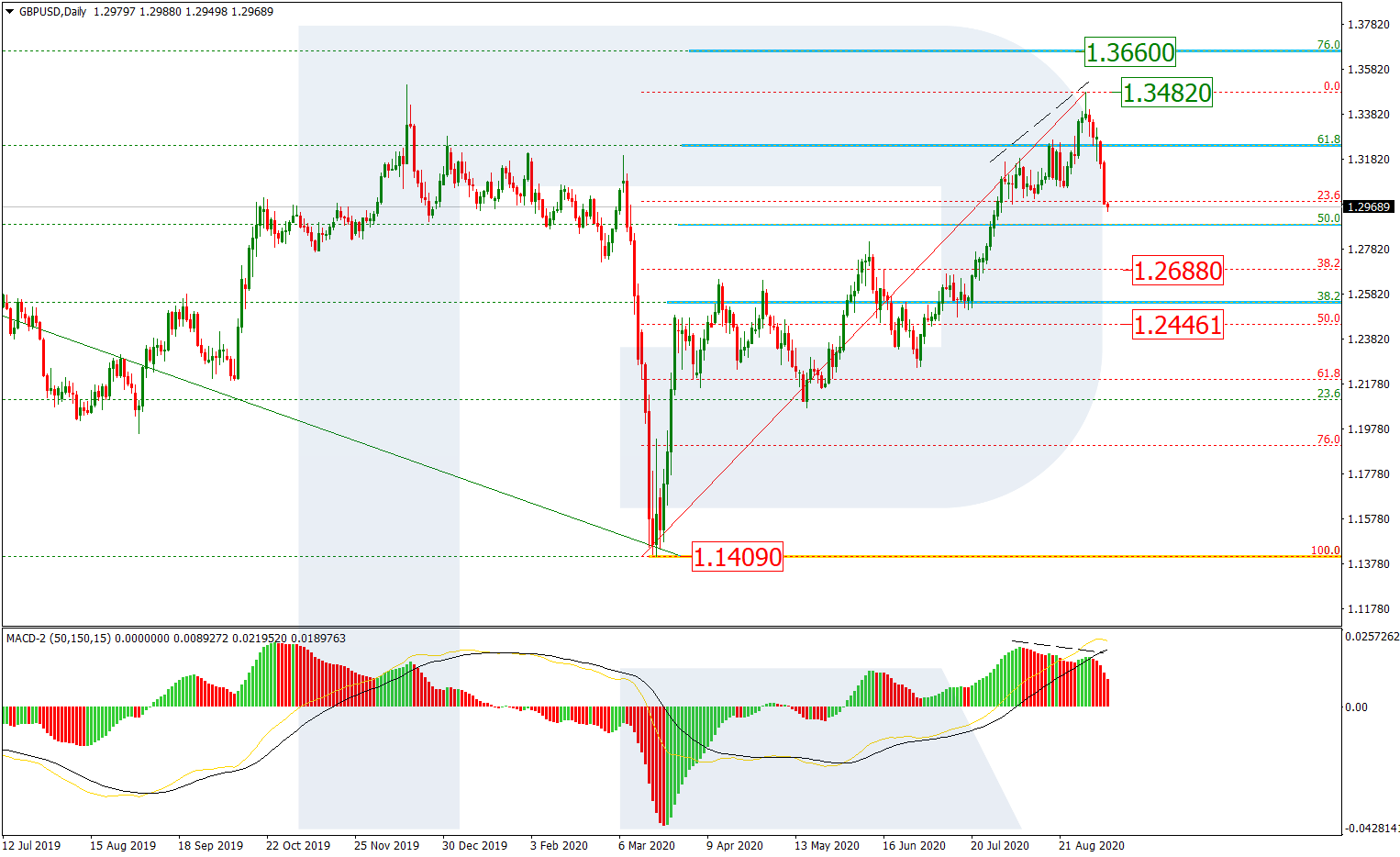

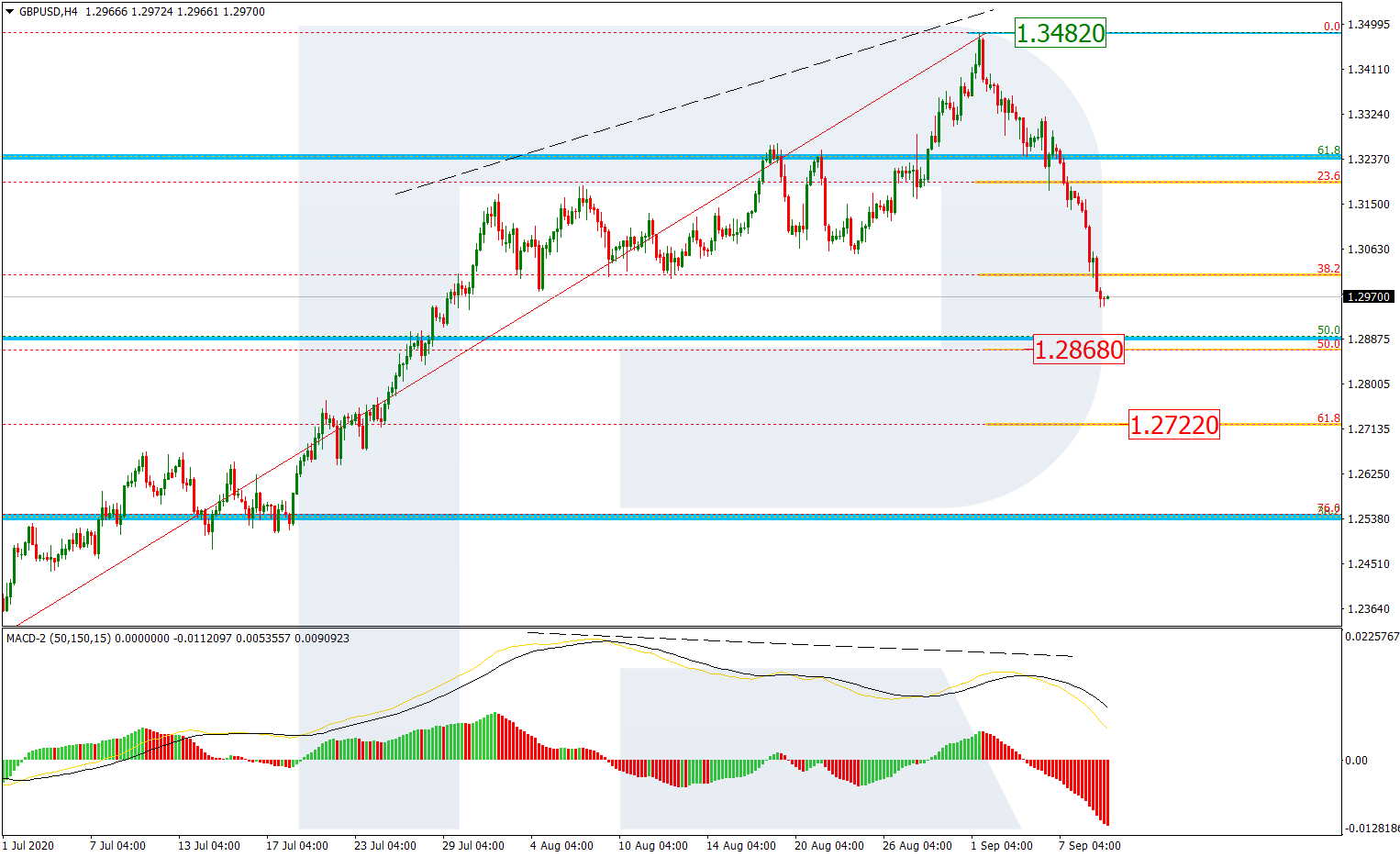

GBPUSD, “Great Britain Pound vs US Dollar”

On D1, the quotations are developing a correctional phase after stepping over the long-term level of 61.8% and a divergence on the MACD. If we look at this movement as a correction of the whole preceding uptrend, then upon reaching 23.6% Fibo, the quotations will head for 38.2% (1.2688) and 50.0% (1.2446). After the pullback, another wave of growth to the current high 1.3482 will start and continue to the long-term level of 76.0% (1.3660).

On H4, there is a decline as a correction of the last wave of growth. By now, the market has dropped below 38.2% Fibo. The next levels of the correctional decline might be 50.0% (1.2868) and 38.2% (1.2722).

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

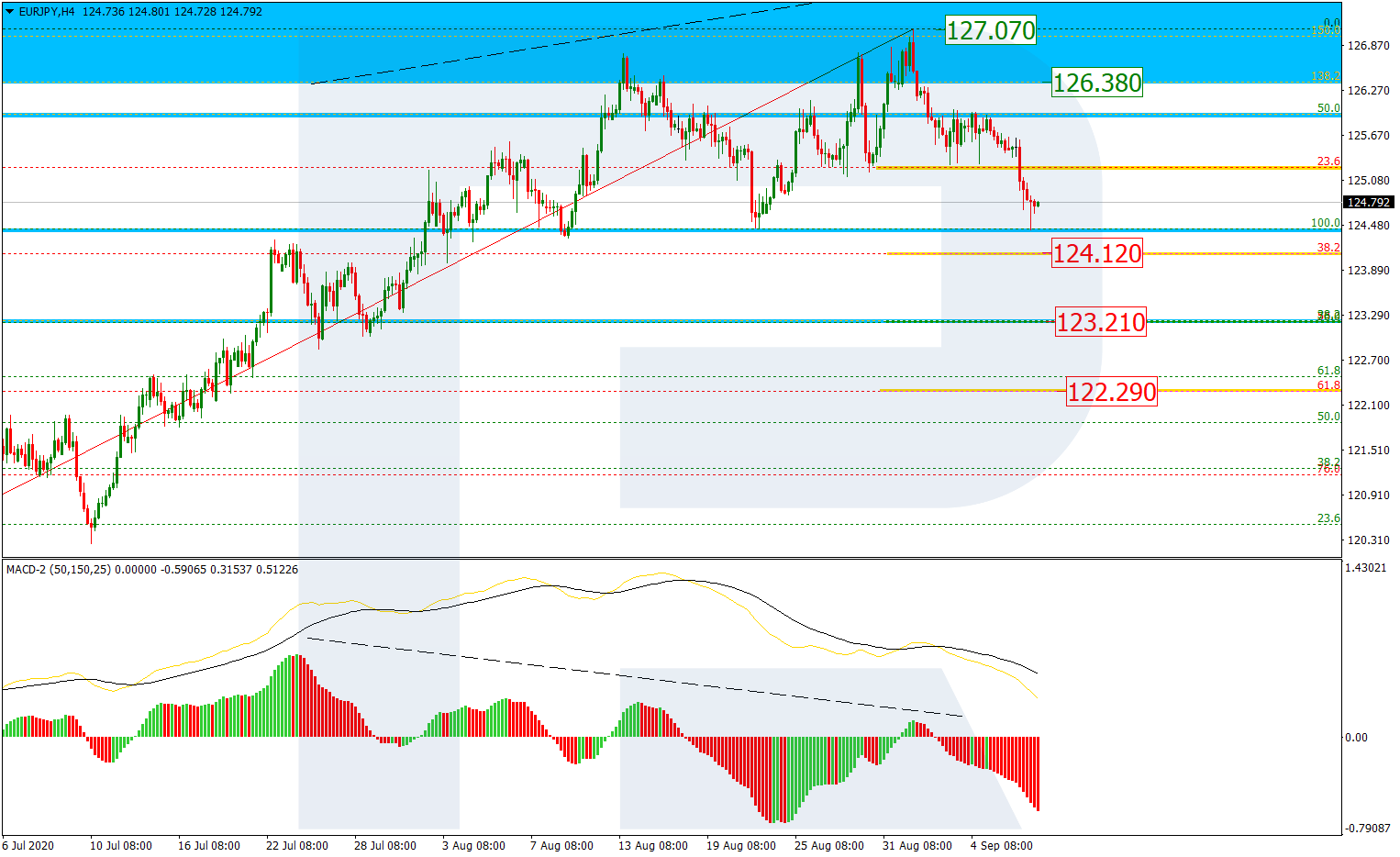

EURJPY, “Euro vs. Japanese Yen”

On H4, a correctional phase begins after the price tested the post-correctional extension range of 138.2-161.8% (126.38-127.59) and a divergence formed on the MACD. The wave of decline is nearing 38.2% (124.12) and may proceed to 50.0% (123.21) and 61.8% (122.29). The resistance is at the high of 127.07.

On H1, we may see the wave of decline to 38.2% (124.12) in more detail. We may also see a convergence on the MACD, which may signal the end of the decline. The reversal of the local trend may let the quotations rise to the post-correctional extension range of 138.2-161.8% (126.38-127.59) again.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

- Trump signals de-escalation in the Middle East; China’s trade surplus hits a new record Mar 10, 2026

- EUR/USD in Turbulence: Market Questions When Conflict Over Iran Will End Mar 10, 2026

- Prices push oil above $100 per barrel Mar 9, 2026

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026