By RoboForex Analytical Department

The commodity market is currently being impacted by various factors, causing Brent crude oil prices to decline. Currently, the price of a barrel of Brent is hovering around $72.35, reflecting a loss of approximately 4% within a 24-hour period.

Bearish sentiment in the oil market has been bolstered by Goldman Sachs’ updated price forecast. The investment bank now estimates that the average price per barrel will drop to $86.00, down from the previous forecast of $95.00 at the end of last year. Similarly, the outlook for WTI has worsened, with expectations declining from $89.00 to $81.00 per barrel.

Goldman Sachs analysts had previously held a more optimistic view on oil prices.

Furthermore, the pressure on commodity prices is being exerted by market anticipation of interest rate decisions by the Federal Reserve (Fed) and the European Central Bank (ECB). Both central banks are scheduled to hold their meetings later this week, on Wednesday and Thursday respectively.

Technical Analysis

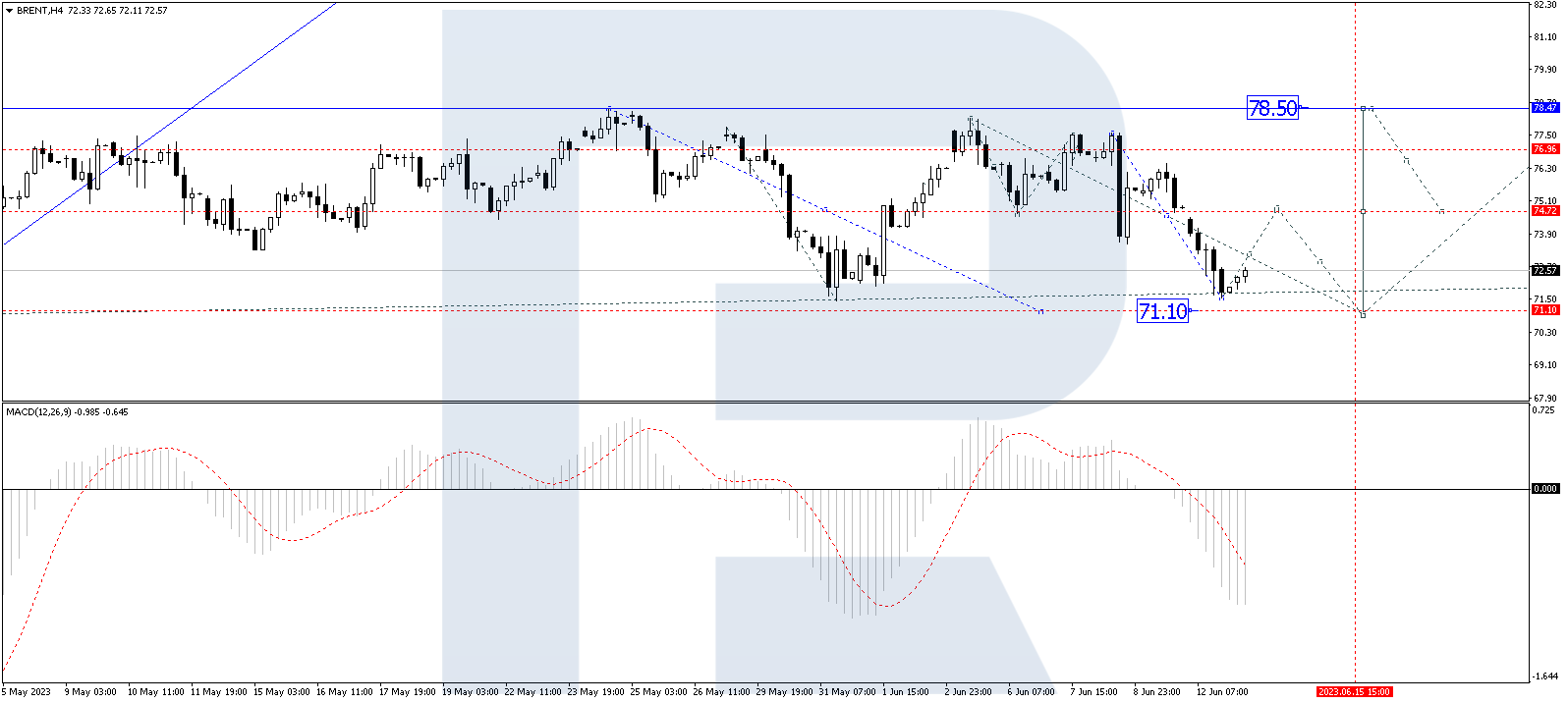

On the H4 timeframe, Brent crude oil is currently forming a wide consolidation range, centered around 74.55. However, the market has extended this range downwards to 71.55, indicating a potential for further correction. Today, we expect to see a potential upward movement towards 74.55, which will be tested from below. Following this, a downward trend towards 71.10 and subsequent upward movement towards 78.50 cannot be ruled out. This is the initial target. Technically, this scenario is supported by the MACD indicator, as its signal line is currently below zero and preparing to exit the histogram area, suggesting potential price growth.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

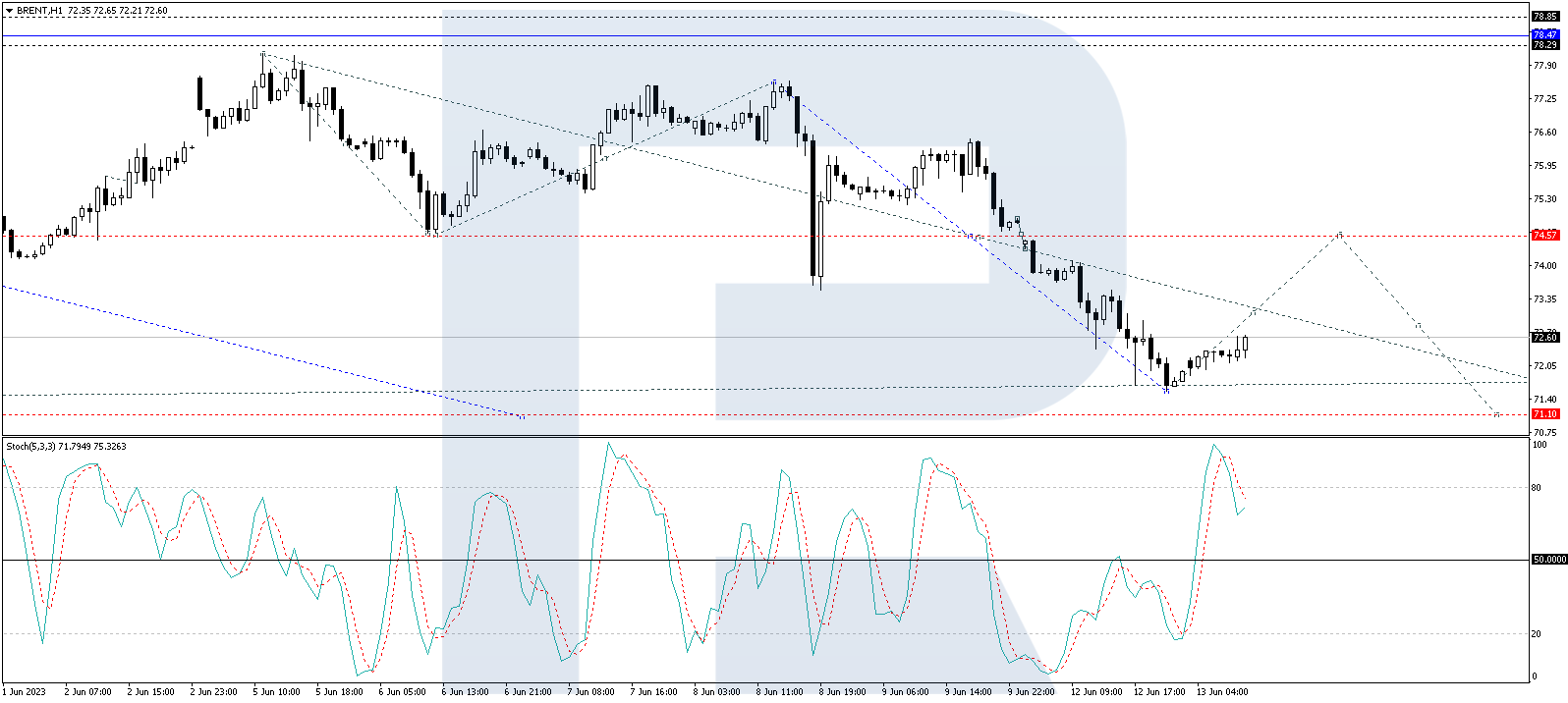

On the H1 timeframe, Brent crude oil is currently following an upward wave structure towards 73.10. Once the price reaches this level, a downward correction towards 72.30 may occur. Subsequently, if the price reaches the 72.30 level, a further rise towards 74.55 is anticipated. Technically, this scenario is confirmed by the Stochastic oscillator, as its signal line continues to decline towards 50. Once it reaches this level, an upward movement towards 80 is expected to begin.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led lower by Gold, Platinum & Silver Apr 13, 2025

- COT Bonds Charts: Speculator Bets led by SOFR-3M, Fed Funds & Ultra Treasury Bonds Apr 13, 2025

- COT Soft Commodities Charts: Speculator Bets led by Soybean Oil & Wheat Apr 13, 2025

- COT Stock Market Charts: Speculator Bets led higher by Nasdaq, Russell & DowJones Apr 13, 2025

- The US stocks are back to selling off. The US raised tariffs on China to 145% Apr 11, 2025

- EUR/USD Hits Three-Year High as the US Dollar Suffers Heavy Losses Apr 11, 2025

- Markets rallied sharply on the back of a 90-day tariff postponement. China became an exception with tariffs of 125% Apr 10, 2025

- Pound Rallies Sharply Weak Dollar Boosts GBP, but BoE Rate Outlook May Complicate Future Gains Apr 10, 2025

- Tariffs on US imports come into effect today. The RBNZ expectedly lowered the rate by 0.25% Apr 9, 2025

- Volatility in financial markets is insane. Oil fell to $60.7 per barrel Apr 8, 2025