By Han Tan Market Analyst, ForexTime

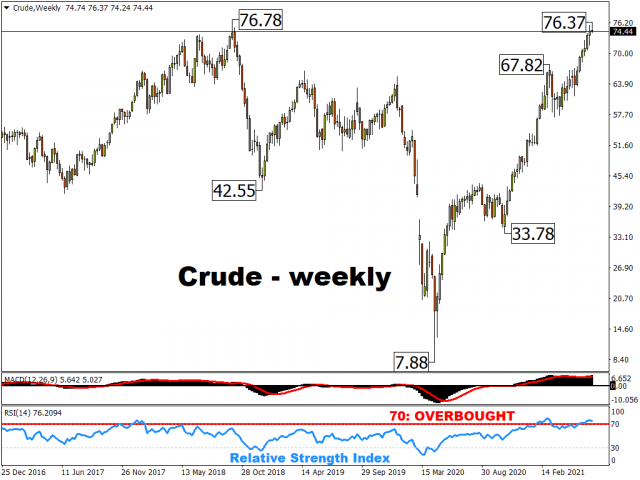

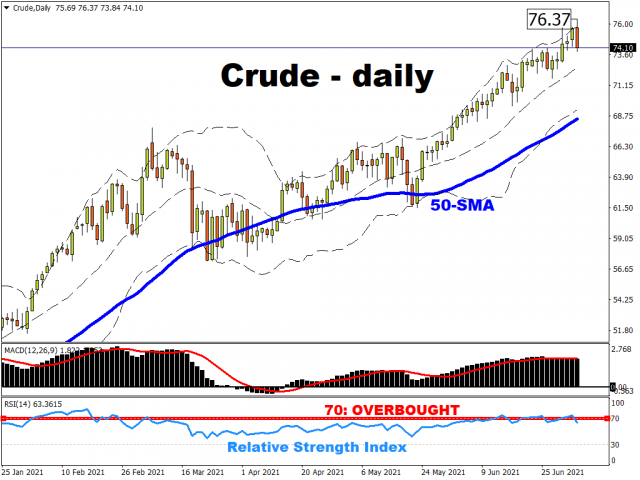

Earlier today, crude oil came to within 0.53% of the October 2018 high of $76.78, before pulling away. Considering that oil prices had broken into overbought territory, perhaps this pullback was down to technical forces as crude now trades back within its Bollinger band.

Still, crude oil bulls are likely to keep an eye on that $76.78 mark; surpassing it would see the highest crude prices since November 2014!

Why are oil prices climbing?

Markets are reacting to the prospects of a world that’s further deprived of oil that it craves for, thanks to a deadlock within OPEC+. As economics dictate, the equilibrium price pushes higher when demand exceeds supply.

Granted these charts pertain to the US benchmark for oil prices. Yet, with US shale producers showing restraint, it is the OPEC+ drama that harbours the much greater potential to sway the oil complex.

To recap, OPEC+ had been slated to make a decision on 1 July about its August output levels. Markets had been expecting a hike of around 500k bpd for next month.

Yet, three rounds of talks have come to naught, leaving global markets now in limbo.

What’s this OPEC+ dispute about?

At the heart of the disagreement is the baseline which serves as the foundation for calculating how many barrels per day (bpd) of oil each OPEC+ member can pump out. The United Arab Emirates wants a higher baseline (they want to pump out more) so that its production capacity is not left dormant. Note that the UAE is the 4th largest producer within OPEC+ and has left about one-third of their output idle.

After all, global markets are tightening and the demand recovery worldwide has seen inventory levels moderating back to the long-term average. In other words, as more factories come online and people take car trips and flights about their summer holidays, all that economic activity requires more oil; and the UAE is eager to supply it.

Until the broader group can agree to raise its baseline, the UAE would not agree to the existing proposal: raise OPEC+ production by 400k bpd from August onwards and extend the output hike agreement through the end of 2022. In the UAE’s view, these are separate items and should be treated differently.

The likes of Saudi Arabia and Russia, heavyweights within the alliance, are opposed to any baseline revision for fear that this could open the floodgates and prompt other OPEC+ members into also demanding for higher baselines, thus disrupting their existing supply plans.

To be fair, this coalition of 23 oil-producing nations have successfully steered markets out of the depths of the pandemic, with crude oil having surged by about 870% since the depths of April 2020. And since the strategy has worked wonders since the pandemic, there is hesitancy to disrupt this formula that has proven successful thus far.

WTI futures have soared by about 55% on a year-to-date basis, even after taking into account today’s declines.

Although, as stated in our previous Trade of the Week, there are major risks to consider, such as a threat of a US-Iran nuclear deal restoring more of Iran oil supplies, and the spread of the delta variant potentially scuppering the optimism surrounding the global economic recovery.

So, what’s next?

OPEC+ has not scheduled a date for the next round of official talks, although it’s very probable that behind-the-scenes negotiations are underway. Still, several potential scenarios could play out:

- Calmer heads prevail despite the recent drama, and all that sabre-rattling of late fades away to a truce and concessions are made. Indeed, Iraq’s oil minister has stated his hopes for the next meeting to happen within the next 10 days. An OPEC+ output hike deal is agreed to (400k bpd?), keeping a lid on oil prices in sub-$80 territory.

- No output hike deal by August means that OPEC+ will keep pumping out at current levels. Taken at face value, as long as the global economy keeps recovering, that could make for tightening conditions which ensure an upward bias for oil prices (think $80/bbl and possibly beyond).

- However, the crucial component to the scenario above is the compliance levels of OPEC+ members. Should the unity within the alliance start to fray, some might feel less compelled to stick to the quotas and begin to send more oil than allowed to their customers worldwide. This could limit the upside for oil benchmarks.

- Looking further out, we might even see a redux of the 2020 price war! Back then, also due to OPEC+ infighting, there was a race to the bottom for oil prices as each OPEC+ members flooded the markets with their oil to jostle for market share. At a time when the pandemic caused demand destruction, the futures contracts for WTI crude even fell into negative territory! While oil prices have seen a remarkable comeback since, if this ongoing deadlock persists until April 2022 when the current agreement expires, we could see oil prices plummet once more.

Note that the UAE had in December floated the idea of leaving the OPEC alliance.

While it’s still too early to think that the current impasse would escalate to such drastic actions, oil traders and investors would do well to keep monitoring the latest developments surrounding this latest OPEC+ saga.

CATCH UP on all things OPEC+ via the ‘Markets Extra’ Podcast

(28 June) OPEC+ Preview: Could a cautious cartel pave the way for $100 Brent?

(25 Feb) What do OPEC+ and “Guardians of the Galaxy” have in common?

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com