By RoboForex Analytical Department

The price of Brent crude oil is showing positive momentum, stabilizing at approximately $88.57 per barrel as of Monday. The market sentiment is predominantly bullish.

This upward trend is supported by encouraging economic data from both China and the United States. Specifically, China’s business activity outperformed expectations in August, lending some optimism to projections for oil demand. However, it’s worth noting that the strength of the U.S. dollar could act as a moderating factor on crude oil price gains.

In terms of supply, Baker Hughes’ recent statistics reveal that the count of active oil rigs in the U.S. remains stable at 512 units. Meanwhile, Canada saw a minor decline, with one rig going offline, bringing its total to 114 units.

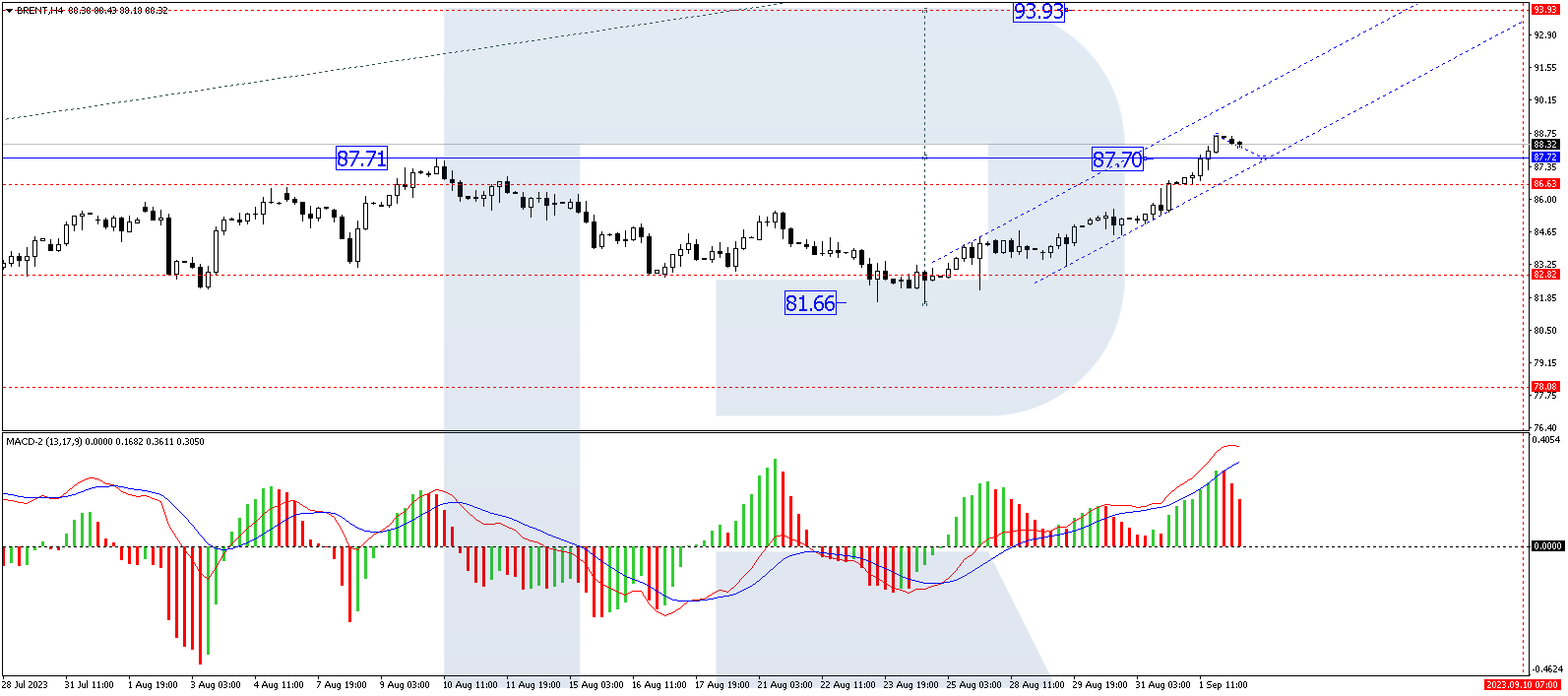

Technical Analysis of Brent Oil

On the 4-hour chart for Brent, the price trajectory suggests robust growth. This upward movement can be interpreted as targeting a level of $93.93. Once this price target is achieved, a price correction to $87.70 is anticipated, potentially accompanied by a retest from above. Subsequently, analysts expect the price to climb to the initial target of $104.00. The Moving Average Convergence Divergence (MACD) indicator corroborates this outlook, with its signal line directed sharply upward, indicating the possibility of reaching new highs.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

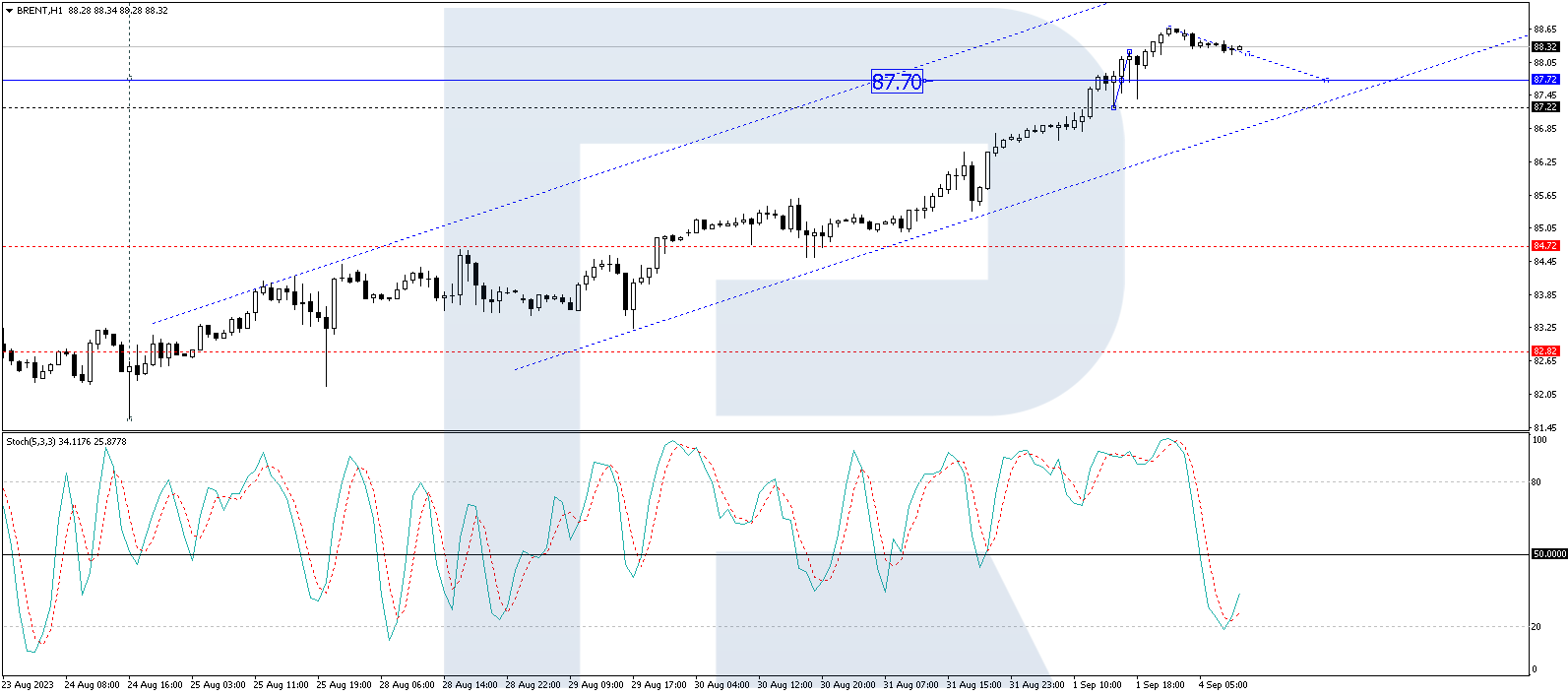

On the 1-hour chart, Brent has already seen a surge to $87.70, and a consolidation pattern has emerged around this price point. A breakout above this level has set the stage for an extension to $90.00, from where the upward trend could potentially continue to $93.93. The Stochastic oscillator lends technical support to this scenario; its signal line has bounced off the 20-point level and is advancing toward 50. Should it surpass this level, further upward movement to 80 is highly likely.

In summary, both short-term and medium-term technical indicators suggest that Brent oil prices are poised for further gains, although external economic factors could introduce some volatility.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026