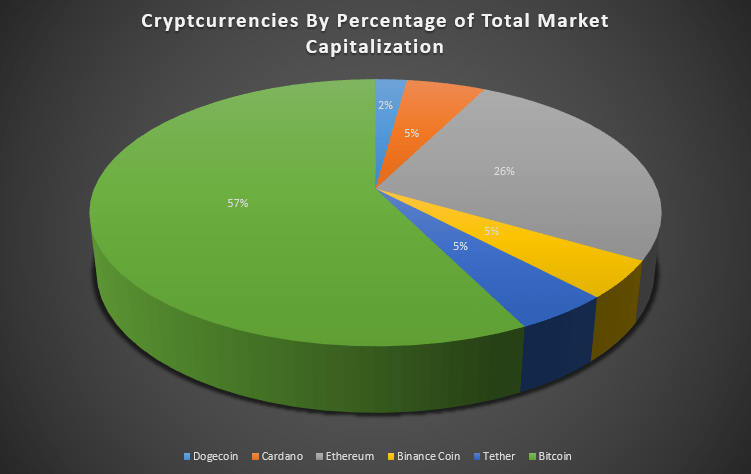

Bitcoin beating the $50,000 mark over the weekend got companies like Amazon, Walmart, Starbucks, and others looking for cryptocurrency leaders to guide their way through the world of digital currencies. Meanwhile, Bitcoin’s recent surge promised an outbreak of growth for other cryptocurrencies too.

New opportunities for Walmart Customers and Crypto Traders

With rising prices for cryptocurrencies, Walmart is looking for a visionary expert in cryptocurrency to help in the development of the company’s digital strategy. Walmart’s interest in crypto followed the massive moves of Fortune 500 companies to expand crypto. To mention one, Amazon posted a similar position just weeks before Walmart. The intention of such job opening is clearly stated, in the announcement – “broad set of payment options for its customers” online and offline. The appropriate candidate will also be responsible for the development of the digital currency strategy and product roadmap

Later a fake press release was spread, stating Walmart will accept Litecoin as a result of collaboration between two companies. Walmart refused these statements, saying they will look into this fake news. Litecoin on their side confirmed in a recent tweet that they have nor have a connection nor they possess information about the origin of such statements. Nonetheless, the scam resulted in a successful pump, surging litecoin 25%. Everybody knows what is spread trading, but this basic market manipulation by scammers allowed traders to gain major profit from the difference between Bid and Ask prices of litecoin. Walmart’s efforts to break into the cryptocurrency world is also motivated by the need to defeat its retail competitors outside the US, mainly in the Chinese market, where eCommerce platforms are taking over traditional stores, and payments with crypto are the new normal.

How Will Blockchain Technology Change Walmart’s Chinese Presence?

Despite its presence in China since 1996, Walmart first decided to put the Chinese food market on a blockchain back in 2016 after the release of concerns over food poisoning in China and across countries of import of Chinese food. The purchasing power of the Chinese middle class was growing along with the demand for pork, making China the largest pork-eating country in the world in 2012.

To ensure the quality of the meat for the growing demand, Walmart China introduced a blockchain traceability platform to track the product from farm to stores in China and abroad, covering all stages of the supply chain by simply scanning the QR code. Originally, the technology has tested and launched 23 product categories with the expectation to expand by another 100 categories.

Free Reports:

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Sign Up for Our Stock Market Newsletter – Get updated on News, Charts & Rankings of Public Companies when you join our Stocks Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

With the unaided eye, it may seem pork chops and decentralized digital currency have a very vague connection. Initially, Walmart intended to open 30-40 shops in China yearly, however, Walmart has closed over 30 stores in recent years in China, including its 20-year-old store in Guangzhou. Pressured by its strongest Chinese retail counterparts Alibaba and J.D. com, in 2016 Walmart has sold the Walmart China eCommerce platform to JD.com to satisfy customer needs and put the company in a more competitive position.

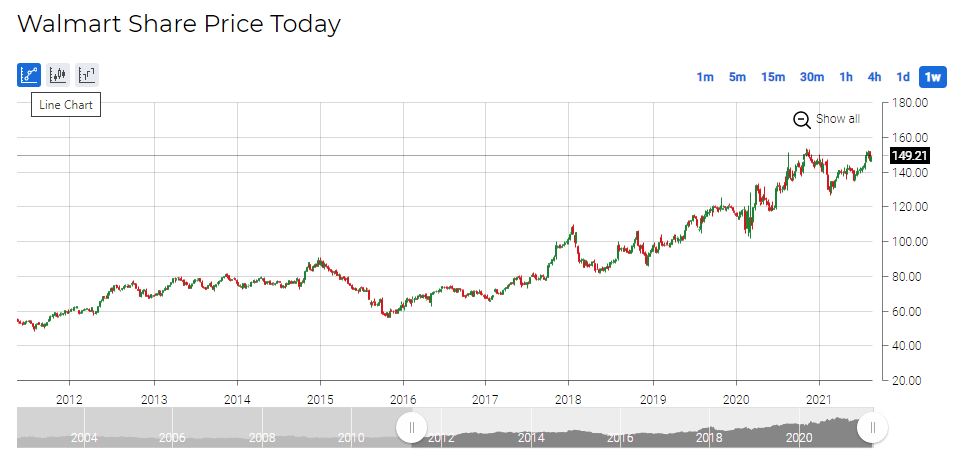

People are simply no longer willing to go back to traditional brick-and-mortar shopping. Cryptocurrencies are moving forward, reshaping finance and other industries, including supply chains. The biggest hazard on the way of large-scale digitization is the recent calls of Chinese State Council and Vice Premier Liu He for the crackdown on bitcoin mining and trading behavior, which caused Bitcoin price falls. According to Liu He, tighter crypto regulation is needed to protect the financial system. These calls followed the U.S. Treasury Department’s statement that it will require reporting on crypto transfers of more than $10,000, just as with cash. As part of the efforts to centralize cryptocurrency, the central bank of China was the first to develop its own yuan-backed digital currency. After these announcements were made, about $1 trillion was wiped off the market value of global Chinese shares, as well as some fund managers dumped their holdings in Chinese stocks. In 2020 Walmart stock price made a record-breaking growth along with other retail giants. Investors are worried that in the short-term the growth won’t be as it was before.

The Bigger Picture of Blockchain in the Retail Industry

Many currency traders switch to crypto trading in recent years. Investors that jumped to crypto trading note that among other reasons, the main reason why people choose to invest in crypto assets is that they are easy to invest in and have the potential to make a huge amount of profit in a short period of time. Of course, they also accept that with great possibilities come high risks. With retail giants like Amazon and Walmart accepting the validity of cryptocurrencies and make them available for their customers, the blockchain industry reaches a tipping point. And while companies, investors, and traders make cryptocurrencies the new normal, lawmakers debate on legal regulations. The capitalization of people’s interest in crypto will bring Walmart and other companies closer to their ambitions in finance and fintech.

Article by IFCMarkets.com

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026