By Orbex

Crude prices have been higher again this week with the market bolstered by the broad pickup in risk appetite.

Risk assets, including oil and other commodities, have been higher in response to further vaccine news.

Inventories Rise

Indeed, crude prices have been higher this week despite the latest report from the Energy Information Administration.

The EIA reported that in the week ending November 13th, US crude inventories rose by 0.8 million barrels. However, this was far less than the 1.7 million-barrel increase the market was looking for.

The result only takes inventory levels back up to 489.5 million barrels. At this level, inventories are just 6% above their five-year seasonal average.

Free Reports:

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Gasoline Stocks Rise, Distillate Stocks Fall

Gasoline inventories were also higher over the week, rising by 2.6 million barrels. This takes the total stockpile amount to 4% above their five-year seasonal average.

Meanwhile, distillate stockpiles were fell over the week by 5.2 million barrels. They are now just 11% above their five-year seasonal average.

Imports Lower

Elsewhere, the report noted that US crude oil imports averaged 5.3 million barrels per day over the last week. This marked a reduction of 245k barrels on the prior week.

Looking back over the last four weeks, crude oil imports have averaged 5.4 million barrels per day, around 12% less on the same four-week period last year.

Gasoline Production Drops

Refinery runs were rose by 395k barrels per day on the prior week to average 13.8 million barrels per day.

Refineries were back up to 77.4% of their total operating capacity whole gasoline production was lower, averaging 9.1 million barrels per day.

Demand Recovering

In terms of measuring demand, the total products supplied number averaged 19.4 million barrels per day over the last four weeks, down around 9.1% on the same four-week period a year prior.

Gasoline products supplied averaged 8.5 million barrels, down 9.5% on the same period a year prior.

Distillate products supplied were seen averaging 4.1 million barrels per day over the last four weeks, down 6.5% on the same period a year prior.

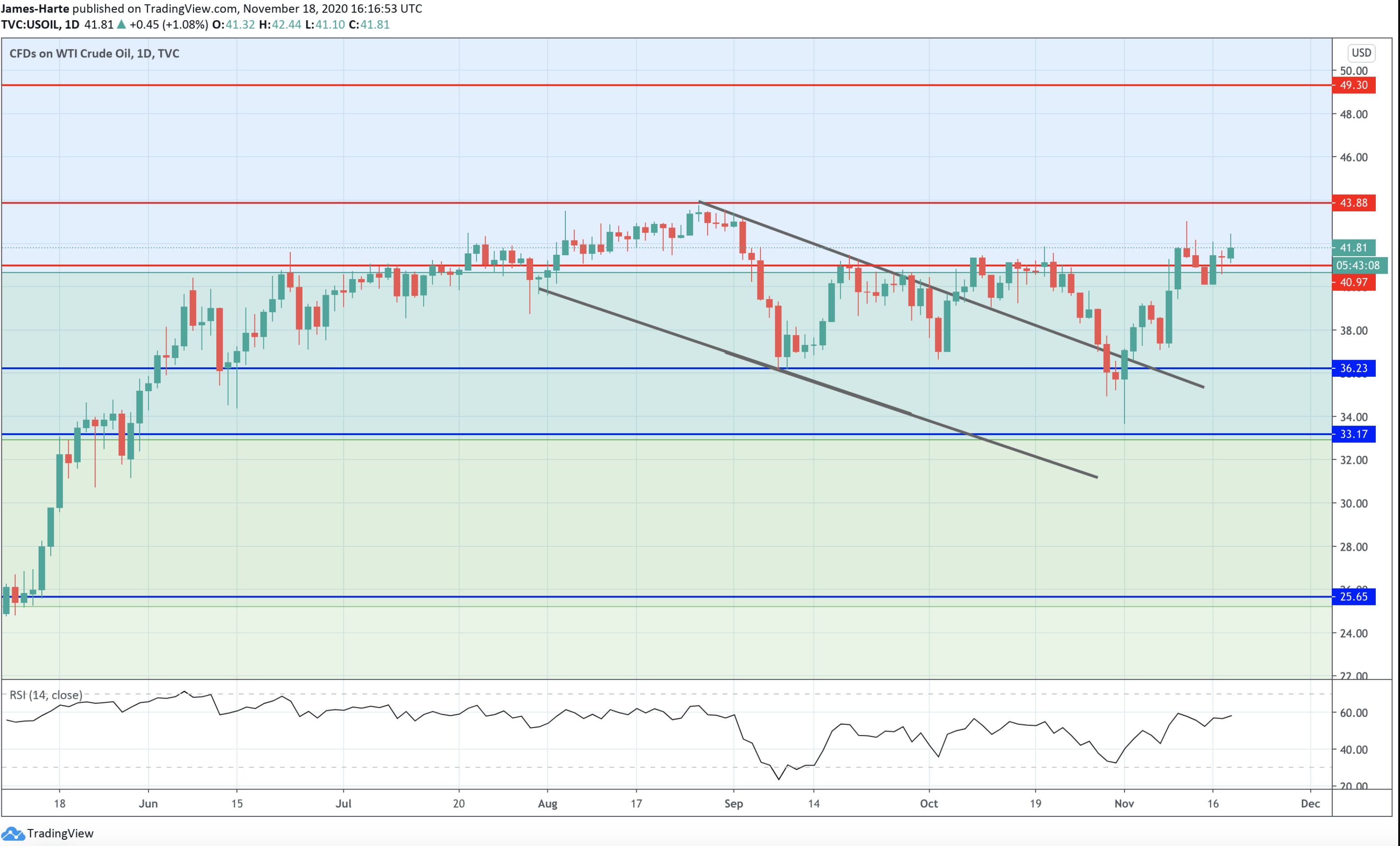

Crude Holding Above Key Resistance Level

Following the rally off the 33.17 level support at the start of the month, oil prices have now broken back above the 40.97 level.

While above here, the focus is on further upside with the 43.88 level the next upside zone to note. To the downside, any correction below the 40.97 level will turn the focus back to the 36.23 level support and the retest of the broken channel.

By Orbex

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026