November 17, 2018 – By CountingPips.com – Receive our weekly COT Reports by Email

Bitcoin Non-Commercial Speculator Positions:

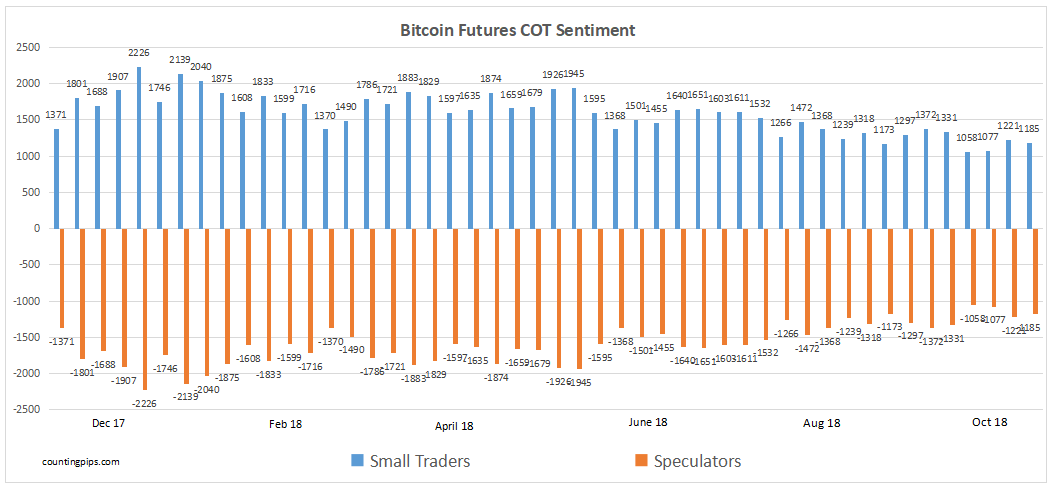

Large cryptocurrency speculators slightly edged their bearish net positions slightly lower in the Bitcoin futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Bitcoin futures, traded by large speculators and hedge funds, totaled a net position of -1,185 contracts in the data reported through Tuesday November 13th. This was a weekly change of 36 net contracts from the previous week which had a total of -1,221 net contracts.

This week’s net position was the result of the gross bullish position gaining by 217 contracts to a weekly total of 1,709 contracts compared to the gross bearish position total of 2,894 contracts which saw a rise by 181 contracts for the week.

Free Reports:

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Download Our Metatrader 4 Indicators – Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The speculative Bitcoin position had seen increasing bearish net positions in the previous two weeks. The spec position continues to remain at the lower end (less bearish) of its range since the beginning of bitcoin futures trading.

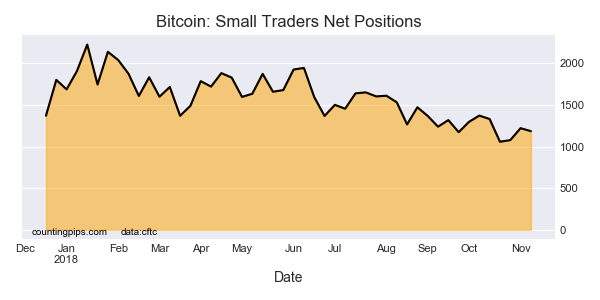

Meanwhile, the small traders position, which is on the opposite side of this market from the speculators, reduced their existing bullish positions this week by an equally offsetting -36 contracts to a current bullish level of 1,185 net contracts.

Meanwhile, the small traders position, which is on the opposite side of this market from the speculators, reduced their existing bullish positions this week by an equally offsetting -36 contracts to a current bullish level of 1,185 net contracts.

Bitcoin Futures COT Data is Speculators vs Small Traders

The Bitcoin futures data is in its forty-eighth week since the start of the cryptocurrency futures data releases on December 19th 2017. The data includes trader classifications of only speculators and small traders and without any commercial traders (typically business hedgers or producers of a commodity).

Speculators started off and have remained on the bearish side since the beginning of the bitcoin data releases while the small traders have continued to be on the bullish side of this cryptocurrency market.

Bitcoin Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Bitcoin Futures (Front Month) closed at approximately $6285 which was a decline of $-130 from the previous close of $6415, according to unofficial market data.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators). Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

Article By CountingPips.com – Receive our weekly COT Reports by Email

- COT Metals Charts: Speculator Bets led by Silver, Gold & Platinum Mar 7, 2026

- COT Bonds Charts: Speculator Bets led by 10-Year Bonds & Fed Funds Mar 7, 2026

- COT Energy Charts: Speculator Bets led by Brent Oil & Heating Oil Mar 7, 2026

- COT Soft Commodities Charts: Speculator Bets led by Corn & Soybean Meal Mar 7, 2026

- Investors run to safe-haven assets amid Middle East escalation Mar 6, 2026

- EUR/USD Under Pressure: Middle East Risks Outweigh All Else Mar 6, 2026

- Bitcoin shows resilience to Middle East events. Oil market stabilizes Mar 5, 2026

- GBP/USD: Market Not Expecting BoE Rate Cut in March Mar 5, 2026

- Brent headed for $100? Mar 4, 2026

- Global stock indices continue sell-off due to Middle East conflict Mar 4, 2026