The large traders positioning in the futures markets gets most of the attention when it comes to deciphering market signals. This is because we can see who is adding to positions, who is taking away from positions or who may be sitting in an extreme level and what we may think that means. I believe that there is a more fundamental step to be taken before seeing ‘who’ is making moves. When reading the cot reports, we must take into consideration open interest analysis and its relationships to the major traders and to the market prices.

What is Open Interest?

The CFTC definition of open interest states:

The total number of futures contracts long or short in a delivery month or market that has been entered into and not yet liquidated by an offsetting transaction or fulfilled by delivery. Also called open contracts or open commitments.

This means that open Interest (OI) is the amount of contracts that are currently live in the marketplace. The number of sellers (short) is equal to the number of buyers (long). Open Interest increases by 1 contract when a new buyer position and a new seller position enter the market. If a buyer closes out his position, he must do so to a seller and this decreases open interest by 1.

Free Reports:

Why is OI important?

Open Interest is a key component to price trends and a gauge to whether the trends are gaining steam, losing steam or could be ripe for a trend change. High open interest simply means there are many more opinions (long and short) in the market while low open interest is evidence of less enthusiasm about that particular market.

In his book, ‘Volume and Open Interest’, Ken Shaleen describes open interest as the “fuel” to sustain prices trends and when “open interest declines, fuel is being removed and the prevailing price trend is running on borrowed time.”

The higher open interest goes in tandem with the dominant price trend, the farther the current trend will continue. Shaleen refers to this as a “healthy” trend.

How can we use Open Interest in analyzing a market?

From the table above, you can see that there are some general interpretations to be made from the combination of price and open interest. Here is more detailed information on these situations below.

A healthy bull market is when price is rising and open interest is gaining at the same time. Traders are coming into the market to help propel the uptrend further along (More “fuel”).

No market goes in a straight line so there are times along the way when the uptrend cools off. At this time, the dips in price will be accompanied by dips in OI as well. For the healthy uptrend to continue, we would like to see a resumption of price gaining in conjunction with OI rising.

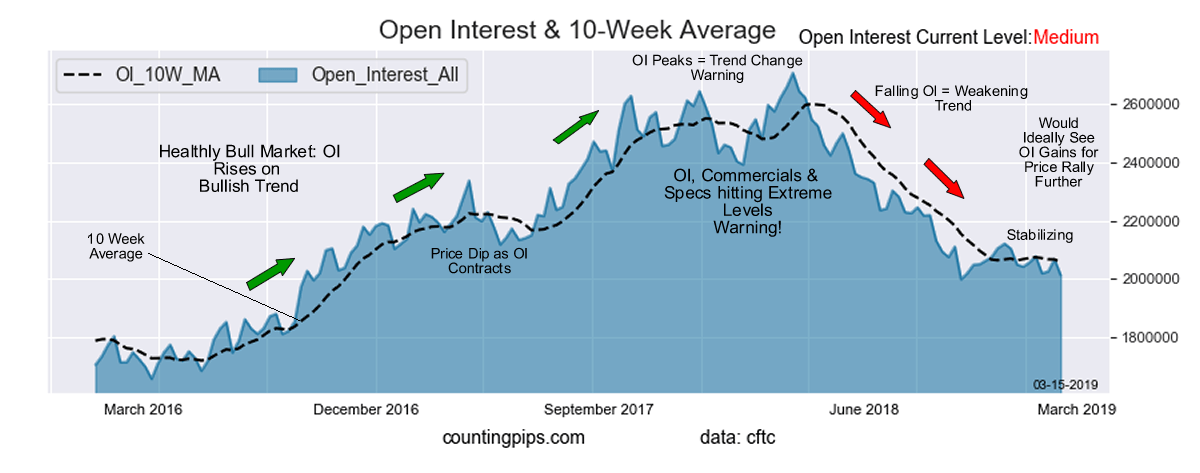

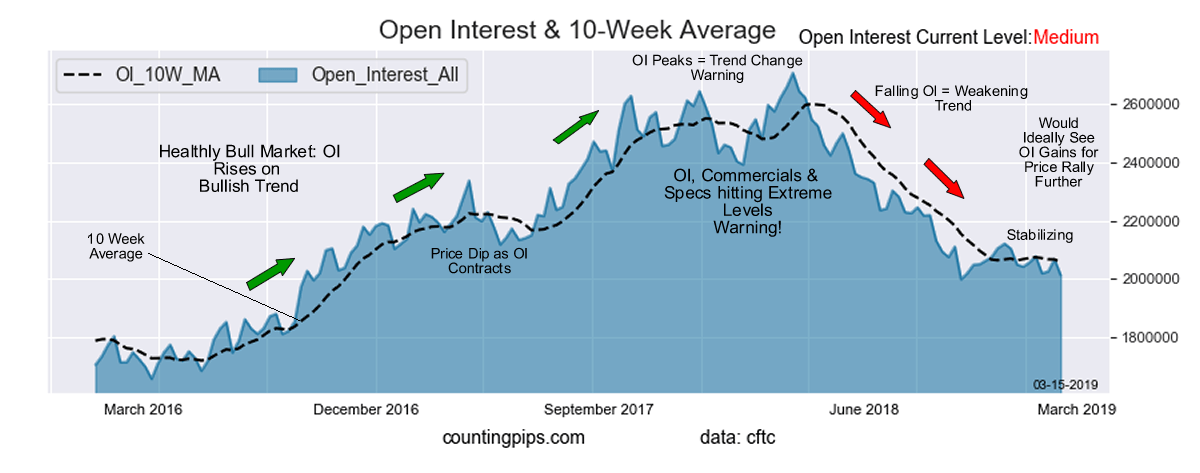

In the chart below, crude oil prices rose in tandem with open interest for over a year displaying a characteristic “healthy” bull market. Also, notice later in the chart that when open interest peaked and started to decline, price continued on its bullish path for some time but eventually ran out of steam and into a deep correction.

Prices rising with open interest down can be considered a weak uptrend or a short covering uptrend. This is a weak position because there are less traders buying into this market and less open orders available to fuel the rally further.

Short covering is when the players betting against a rising price give up and start to liquidate their positions. This gives price a boost in the short-term but is not considered a strong position because fuel is leaving the market. We can get confirmation of short covering (and actual trader changes) from the weekly COT trader statistics.

In the chart below, the Dow Jones mini contract shows a strengthening or “healthy” bull market that runs out of steam with falling open interest and a modest price correction. Instead of open interest regaining previous levels in tandem with price gains (top green arrows), OI keeps falling which foreshadows another correction ahead for this market (dramatic fall in late 2018). The far right of this market shows another example of strong price gains but low open interest (we will have to wait for the outcome).

This is a very common situation in the markets we cover, especially if following a recent run up in both price and open interest. If open interest liquidates sharply after a peak or high levels, we will typically see price follow along with it sooner or later. This means that bulls have left the building and have lost the will to fight for higher prices.

Ken Shaleen describes in his book that there are many markets the public (speculators, small traders) only like to play from the long side. This can include markets like gold, us dollar, stock markets, etc. This means that there are consistent patterns of high open interest when prices rise and vice versa. This fact can also illustrate that many bear markets are accompanied by declining and low open interest as traders that like to play a market from the long side are just not interested if price is falling.

Falling prices and low open interest can mean another thing when both have made moves that have been exhausted to the downside or pushed to extreme lows. This can be the start of the next uptrend if sellers take profits, buyer interest starts to pick up, a new fundamental factor reveals itself or if a few of these factors come into play. When a market is beat down in this situation, with both price and OI scraping the bottom of the chart, it may not take much to get the ball rolling the other way.

A healthy bear market is when price is falling and OI is gaining (more and more traders are adding fuel to price declines). A bounce in price will be accompanied by a dip in the OI (price gains but with lowering enthusiasm from traders).

Shaleen points out that this occurrence is more rare than when price and open interest are falling together. However, it does happen as we can see in the recent Coffee chart below. This market follows a characteristic “healthy” bear market where open interest rises continually throughout the slide in prices. The trend is temporarily broken after extreme positions are seen for both of the large traders as well as peaks in open interest. Price gains were relatively short lived as this market has been rocked by the large supply of coffee in coming out of Brazil and Vietnam.

Although there are no silver bullets or really anything in trading that is a surefire certainty, open interest analysis can help give us clear market signals by telling us which way the wind is blowing in the futures markets.

As we can and will see in these markets, some of the open interest setups can take time to develop. Price moves may take many weeks or many months to happen. The positive on these situations is that we can see some of these things ahead of time. We also can gain a deeper understanding of the market dynamics beyond just speculators, commercials and small traders.

Article by Zachary Storella, founder/editor of CountingPips.com, an investor, computer programmer and a COT enthusiast since 2007.

This website uses cookies.