Source: ForexYard

President Barack Obama’s announcement that the budget deficit is set to hit $1.75 trillion or 12% of GDP is likely to lead to a bearish Dollar in the medium-long term. Meanwhile, forex traders are advised to follow constant daily developments coming out of the U.S. economy, such as the release of today’s quarterly U.S. GDP figures at 13:30 GMT. These figures are likely to determine the Dollar’s bullishness going into next week’s trading.

Economic News

USD – Dollar Floats on Faltering Economy

The Dollar gained against several of it major currency pairs, such as the EUR currency cross in early trading yesterday. However, those gains were quickly eroded as a glut of poor economic data from the U.S. helped to drive the pair back to its opening price level. The market absorbed less than stellar economic reports from the U.S. economy. Poor production data, lower housing numbers, and an increase in new unemployment claims took the energy from the EUR bulls and sapped the earlier gains from the EUR/USD. The pair began the day at 1.2716 and rose to a high of 1.2809. The USD closed up vs. the EUR by only 2 pips at 1.2732. The release of more poor performing data from the U.S. helped to sap the added risk taking in the forex market and the currency pair ended the day near its opening price.

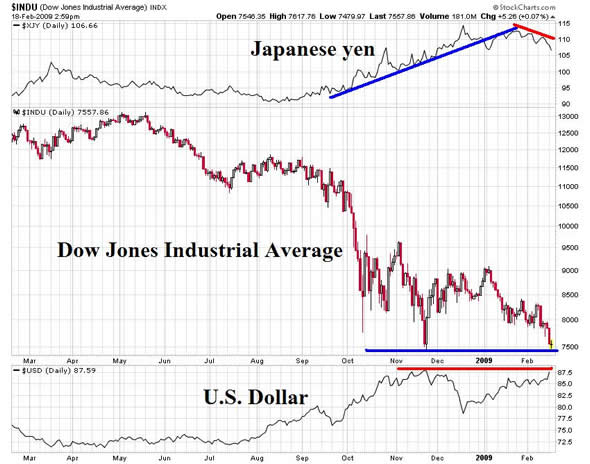

Against the Dollars other currency crosses, however, it lost some ground. The Dollar closed down 25 pips vs. the JPY at 97.58, reversing 3 days of gains. This may have been due to better-than-expected economic figures released from Japan. The GBP/USD made a slight correction in yesterday’s trading, as the Pound closed up 52 pips on the Dollar to 1.4297, making some amends for the previous days 300 pip decline against the greenback.

It should be taken into account that the market largely didn’t react overly negatively to President Barack Obama’s announcement that the U.S. government will run a $1.75 trillion budget deficit. This amounts to roughly 12% of U.S. GDP. The reason for this may be that traders still have confidence in the new president. However, if Obama fails to help kick-start the American economy after 6 months, then traders are likely to realize that Obama’s talk is substance, and not addition. This may on effect lead to a bearish Dollar in the medium-long term.

Later today, there are several important economic data releases coming out of the U.S. The most important of these publications is the Prelim quarterly GDP figures at 13:30 GMT. Analysts have forecasted that the U.S. economy is contracting by 5.4%. Combine this and further long term pressures of such a large budget deficit and we could see the Dollar depreciate against the EUR, perhaps to the 1.2800 level. However, if the results turn out to be better-than-expected, then the EUR/USD pair may reach 1.2650 by late trading.

EUR – GBP Moves on British Bank Bailout

The GBP appears to have offered some stability in Thursday’s trading. This comes about as Britain announces its most recent banking bailout. Yesterday, the British government unveiled a plan to protect banks from future losses related to bad debt. The plan was announced to backstop British banks that have lost billions of Pounds in the global financial crisis. This plan may ensure that British banks keep lending in spite of the large losses.

The new plan helped to increase risk taking in early trading yesterday, resulting in the GBP rallying against the Dollar and the EUR. However these gains dissipated as the day wore on, as risk sentiment disappeared. The GBP/USD closed at 1.4297 from 1.4245 Wednesday. The Pound also gained some ground against the EUR, as the pair closed down 33 pips at 0.8904.

A week banking system that has suffered losses from toxic debt has characterized the may put downward pressure on the GBP in the coming weeks. This is likely to continue as more pressure may fall on British bank regulators to nationalize the ailing banking system amid the global financial crisis. Royal Bank of Scotland (RBS) has in effect already been nationalized by the most recent capital injection by the British government. Further involvement could put help to depreciate the GBP against its major crosses.

JPY – JPY Free Fall Continues

The JPY continues to fall against the major currencies, but the selling in mass of the Yen was briefly halted by better-than-expected production data. The USD/JPY fell early this morning as preliminary industrial production fell by 10%. While the number appears to be drastic, traders were prepared for a much larger drop. When this did not occur, the JPY was given a large boost. The pair closed at 97.58, down 25 pips from yesterday’s opening.

This production data is a stark reminder of the economic situation in Japan. Concerns regarding the fundamental weakness in the Japanese economy are having traders push the USD/JPY to its highest level in almost 4 months. The recent gains for the JPY may not hold as the market is very negative on its outlook for the Japanese economy. Further appreciation could take place in the USD/JPY and send the pair back to the 98.50 mark by the end of today.

Oil – Crude Oil Surges on Renewed Supply Cut Fears

Crude Oil experienced a sharp rise in prices yesterday as the Organization of Oil exporting Countries (OPEC) signaled it may be ready to make more supply cuts in the future. The price of Crude Oil jumped close to 5% yesterday to close at $44.48, up from $42.76. The United Arab Emirates (UAE) said it would reduce production supplies to Asia. This leads some Oil analysts to believe that more production cuts may be in store from the Oil cartel at their next meeting in March.

It appears OPEC may follow through on its promised supply cuts. In the past OPEC has announced future supply cuts, but member nations have sometimes been reluctant to comply as the drops in production lead to falling revenues for OPEC members. Recent data shows that the member countries have been steadily reducing their daily supply counts. This may lead to a further price appreciation for the commodity, perhaps to the level of $46 by the week’s end.

Technical News

EUR/USD

Narrow range trading continues as the pair did not make a significant move in either direction, and is currently traded around the 1.2745 level. However, the 4 hour chart’s RSI is floating near the bottom border, suggesting that the possible next move might be a bullish one. When the upwards breach occurs, going long with tight stops appears to be preferable strategy.

GBP/USD

The typical range trading on the hourly chart continues. Both the daily RSI and Slow Stochastic are floating in neutral territory. However, the pair currently sits near the bottom border of the 4 hour chart’s RSI, suggesting an upward correction may be imminent. When the upwards breach occurs, going long with tight stops appears to be preferable strategy.

USD/JPY

The price of this pair appears to be floating in the over-bought territory on the daily chart’s RSI indicating a downward correction may be imminent. The downward direction on the 4-hour chart’s Momentum oscillator also supports this notion. Going short with tight stops might be the right choice today.

USD/CHF

The pair has been range-trading for a while now, with no specific direction. The Daily chart’s RSI providing us with mixed signals. All oscillators on the 4 hour chart do not provide a clear direction as well. Waiting for a clearer sign on the hourlies might be a good strategy today.

The Wild Card – Crude Oil

Crude Oil prices rose significantly in the last week and peaked at $44.50 a barrel. However, 4 hour chart’s RSI is floating in an overbought territory suggesting that a recent upwards trend is loosing steam and a bearish correction is impending. This might be a good opportunity for forex traders to enter the trend at a very early stage.

Market Analysis provided by Forex Yard.

© 2006 by FxYard Ltd

Disclaimer: Trading Foreign Exchange carries a high level of risk and may not be suitable for all investors. There is a possibility that you could sustain a loss of all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with Foreign Exchange trading.