By GCI Forex Research

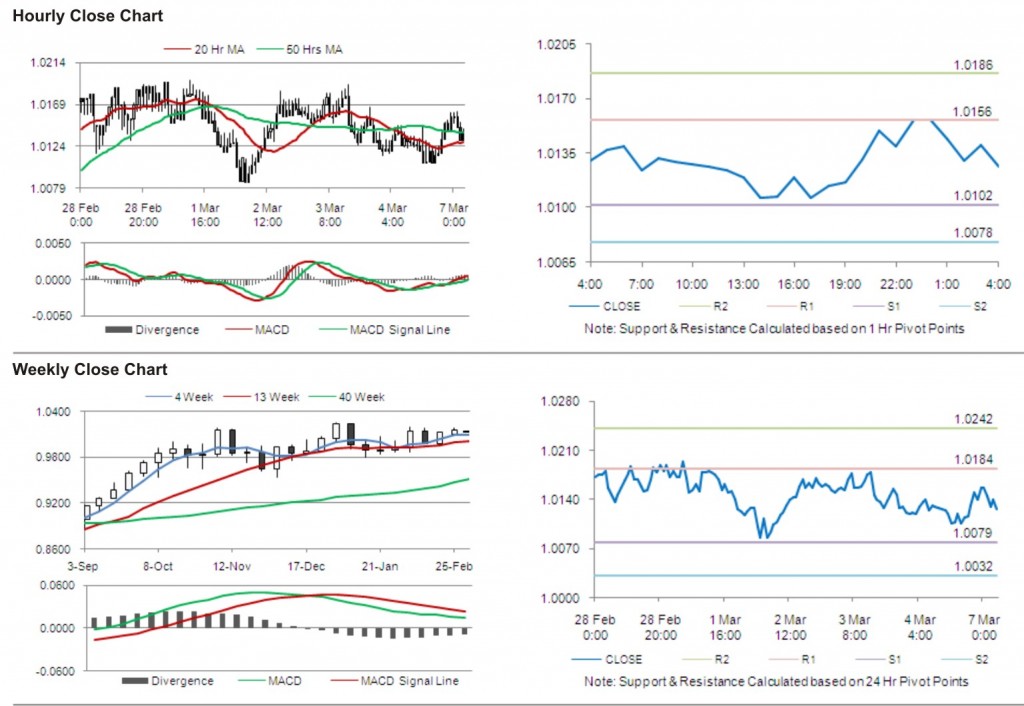

For the 24 hours to 23:00 GMT, AUD weakened 0.37% against the USD to close at 1.0118.

According to a monthly survey by The National Australia Bank, Australian business confidence rose to 14 points in February, from a reading of 4 in January. The NAB’s Business Conditions Index rose 2 points and reached -4 points in February 2011, even as confidence picked up sharply.

In the Asian session at 4:00GMT, the pair is trading at 1.0123, 0.05% higher from the New York session close.

LME Copper prices declined 1.3% or $130.0/MT to $9,840.3/ MT. Aluminium prices declined 0.8% or $21.8/ MT to $2,565.8/ MT.

The pair is expected to find first short term resistance at 1.0174, with the next resistance levels at 1.0224 and 1.0313, subsequently. The first support for the pair is seen at 1.0085, followed by next supports at 1.0046 and 0.9957 respectively.

Economic releases such as Westpac Consumer Confidence are expected to be the key indicators to determine future trading trends in the currency pair.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.

Forex Daily Market Commentary provided by GCI Financial Ltd.

GCI Financial Ltd (”GCI”) is a regulated securities and commodities trading firm, specializing in online Foreign Exchange (”Forex”) brokerage. GCI executes billions of dollars per month in foreign exchange transactions alone. In addition to Forex, GCI is a primary market maker in Contracts for Difference (”CFDs”) on shares, indices and futures, and offers one of the fastest growing online CFD trading services. GCI has over 10,000 clients worldwide, including individual traders, institutions, and money managers. GCI provides an advanced, secure, and comprehensive online trading system. Client funds are insured and held in a separate customer account. In addition, GCI Financial Ltd maintains Net Capital in excess of minimum regulatory requirements.

DISCLAIMER: GCI’s Daily Market Commentary is provided for informational purposes only. The information contained in these reports is gathered from reputable news sources and is not intended to be U.S.ed as investment advice. GCI assumes no responsibility or liability from gains or losses incurred by the information herein contained.