By CountingPips.com

Weekly CFTC Net Speculator Report

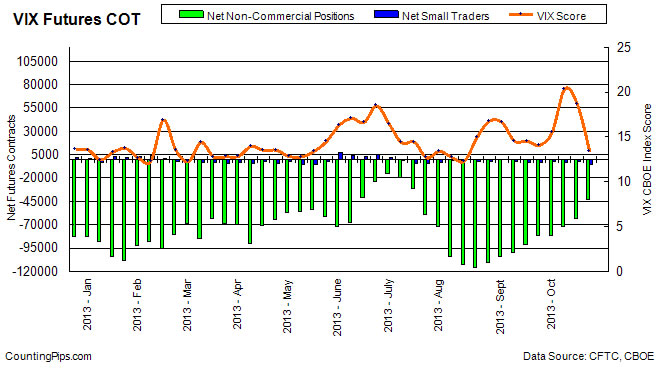

VIX: Large traders and speculators decreased their bearish positions for a third straight week on October 22nd in the futures trading market. The VIX non-commercial contracts totaled a net position of -43,297 contracts in the data reported for October 22nd, according to the Commodity Futures Trading Commission (CFTC). This was a change of +20,317 contracts from the previous week’s total of -63,614 net contracts that was registered on October 15th.

In the same time-frame, the VIX index score decreased from 18.66 on Tuesday October 15th to 13.33 on Tuesday October 22nd, according to the Chicago Board Options Exchange (CBOE) Volatility Index.

*The COT data was not published by the CFTC for close to a month due to the partial government shutdown and the latest data is up to October 22nd.

Last 6 Weeks of Large Trader Positions

| Date | Net Non-Commericals | Change |

| 09/17/2013 | -91017 | 8441 |

| 09/24/2013 | -81534 | 9483 |

| 10/01/2013 | -81942 | -408 |

| 10/08/2013 | -72250 | 9692 |

| 10/15/2013 | -63614 | 8636 |

| 10/22/2013 | -43297 | 20317 |

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators). Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

Article by CountingPips.com – Forex News