As economy weakens, Fed keeps money spigot wide open

Stocks sink on economic worries; Dow off 138

Obama considers naming official to work on moving Guantanamo detainees

As economy weakens, Fed keeps money spigot wide open

Stocks sink on economic worries; Dow off 138

Obama considers naming official to work on moving Guantanamo detainees

Bryan and Ileana Russell received eviction notices from a law firm last year, even though they had never missed a mortgage payment. The Russells’ attorney discovered that a mistake had been made and that the bank pursuing the foreclosure. (May 2)

Thousands of demonstrators joined May Day rallies from San Francisco to Los Angeles Wednesday, demanding an overhaul of immigration laws Wednesday in an annual, nationwide event. (May 1)

By CountingPips.com

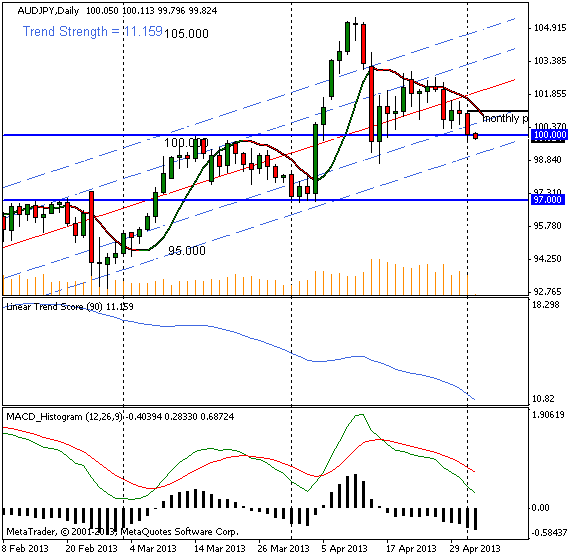

AUD/JPY off multi-year highs of mid-April

The Australian dollar declined today against the Japanese yen in forex trading for a second consecutive day and trades at a major level crossroads. The AUD/JPY currency pair closed the day right at the major level of 100 yen per aussie after opening the day just over the 101 yen per aussie level.

The Aussie had reached a multiyear high versus the yen in April after the Bank of Japan stated their monetary easing policy would be thoroughly implemented, bringing the yen crashing down against other currencies that soared to new highs. The AUD/JPY touched a high of 105.40 on April 11th but has steadily faltered from there to the current 100 exchange level.

Will falling under the 100 level end the uptrend for the AUDJPY?

The 100 level has previously been a major support and resistance level in trading the AUD/JPY pair as this threshold provided support in April and resistance in March. If prices can keep above this level, further bullish momentum would be possible into 101.50 with 102.50/65 lurking higher on the resistance ladder. Downside action would present the April 16th low near 98.70 as well as 98.50 and then another major previous support and resistance level at 97.00.

AUD/JPY Weekly Chart: MACD turning over

On the higher time frame, the MACD indicator (bottom window – green box highlighted) shows a crossover taking place on the weekly horizon that has held intact since the middle of October 2012. Of course, like with all indicators, this does not guarantee a downtrend is imminent as we could always reverse or trade sideways for a while but it does give some food for thought.

AUD/JPY Changes & Ranges: Past 6 Weeks

| week date | pct change | true range |

| 2013.03.24 | -1.27 | 1.849 |

| 2013.03.31 | +4.49 | 5.457 |

| 2013.04.07 | -0.34 | 3.747 |

| 2013.04.14 | +0.99 | 4.288 |

| 2013.04.21 | -2.17 | 2.542 |

| *2013.04.28 | -0.86 | 1.925 |

* so far this week at time of writing

Pivots and Trends Data:

Weekly Pivot Point: 101.24

Monthly Pivot Point: 101.03

Linear Regression Indicator Trend / Strength Data:

30-day current trend is BULLISH / Trend strength of 312.0 pips

60-day current trend is BULLISH / Trend strength of 756.1 pips

90-day current trend is BULLISH / Trend strength of 879.5 pips

180-day current trend is BULLISH / Trend strength of 2384.9 pips

365-day current trend is BULLISH / Trend strength of 1995.2 pips

Article by CountingPips Blog, News & Forex Analysis

By CountingPips.com

EUR/USD finishes April higher after decline in February and March

The European common currency has started the month of May off with gains to follow up on a positive April in the foreign exchange market trade. The euro rose higher today against the US dollar to touch its highest level since February 25th and has advanced each day so far this week.

The EUR/USD peaked in early trading at a high of 1.3241 before giving back most of those gains later on but managed to end the day with a modest increase. The high of 1.3241 marked the best level for the euro since February 25th when the euro was in the midst of a two month downswing that encompassed February and March after rallying in January. Amazingly, the EUR/USD is trading currently (approximately 1.3180 at time of writing) very close to the same level that it began 2013 at (1.3204).

Will the Euro be able to scale 1.3200 post ECB meeting?

While the euro has been on the uptick for the first half of the week, the test will be seen on Thursday when the European Central Bank concludes its monetary policy meeting and decides whether or not to cut its benchmark interest rate (currently at 0.75%). A rate cut may very well add pressure and weight to the euro but some market watchers feel that a rate cut has already been priced into the exchange rate. Either way, it will be worth watching to see if the EUR/USD can get back over 1.3200 level or if the pair quickly fades lower and has reached a top for the week.

Support & Resistance Levels: 1.3200, 1.3100/25, 1.3000

Looking for likely and major support and resistance levels brings out the obvious 1.3200 level which the pair failed to close above today. Further potential upside targets include 1.3260/85 and then 1.3300. On the downside, we run into 1.3125 which was a past resistance level then the major round numbers below at 1.3100 and 1.3000 are likely targets.

EUR/USD Changes & Ranges: Past 6 Weeks

| week date | pct change | true range |

| 2013.03.24 | -1.9 | 0.0297 |

| 2013.03.31 | +1.62 | 0.0295 |

| 2013.04.07 | +0.68 | 0.0170 |

| 2013.04.14 | -0.01 | 0.0200 |

| 2013.04.21 | -0.21 | 0.0140 |

| *2013.04.28 | +1 | 0.0200 |

* so far this week as of time of writing

Pivots and Trends Data:

Weekly Pivot Point: 1.3031

Monthly Pivot Point: 1.3036

Linear Regression Indicator Trend / Strength Data:

30-day current trend is BULLISH / Trend strength of 309.9 pips

60-day current trend is BEARISH / Trend strength of -20.7 pips

90-day current trend is BEARISH / Trend strength of -545.4 pips

180-day current trend is BULLISH / Trend strength of 165.3 pips

365-day current trend is BULLISH / Trend strength of 388.6 pips

Article by CountingPips Forex Blog & Analysis

President Obama named Rep. Melvin Watt (D-North Carolina), to head the Federal Housing Finance Agency, which oversees Fannie Mae and Freddie Mac. He also nominated ex-telecom lobbyist Tom Wheeler as the head of the FCC.

Greece agreed to sell a stake in gambling monopoly OPAP to investment fund Emma Delta on Wednesday. The country’s finance minister said it was their first big privatisation. Edward Baran reports.