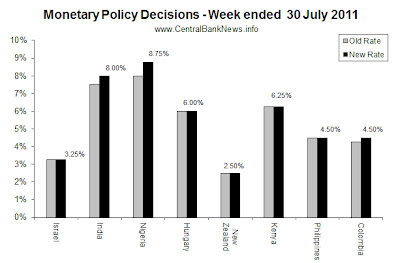

The week in monetary policy saw 8 central banks announcing interest rate decisions. Of those that changed rates were: India +50bps to 8.00%, Nigeria +75bps to 8.75%, and Colombia +25bps to 4.50%. Meanwhile those that held monetary policy interest rates unchanged were: Israel 3.25%, Hungary 6.00%, New Zealand 2.50%, Kenya 6.25%, and the Philippines 4.50%. Other than interest rates, the Philippines raised its required reserve ratio by 100 basis points to 21%, and Turkey dropped its required reserve ratios by 100-200bps to add extra liquidity to the market.

In terms of themes, the week was very much dominated by emerging market central bank activity. India surprised the market by raising rates more than expected in response to a persistent inflation threat against the backdrop of still relatively strong economic growth. Indeed the message was that emerging markets are still facing elevated price levels and inflationary impulse, and many of them are still recording relatively high rates of growth, particularly as compared to developed markets.

A selection of key quotes from the monetary policy statements and media releases are listed below:

- Bank of Israel (held rate at 3.25%): “Forecasters’ inflation expectations for the next twelve months remained steady at slightly below the upper limit of the target range. Forecasters’ inflation expectations and those derived from the capital market go together with the assessment that the Bank of Israel will continue to increase the interest rate, but at a slower pace than in the first half of the year.”

- Reserve Bank of India (increased 50bps to 8.00%): “Considering the overall growth and inflation scenario, there is a need to persevere with the anti-inflationary stance,”.

- Central Bank of Nigeria (increased 75bps to 8.75%): “The inflation outlook appears uncertain owing to the expected implementation of the new national minimum wage policy and the imminent deregulation of petroleum products,” and that there is “the need for pursuing policies to foster macro- economic stability, economic diversification as well as encouraging foreign capital inflows”.

- Reserve Bank of New Zealand (held rate at 2.50%): “Provided current global financial risks recede and the economy continues to recover, the Bank sees little need for the March 2011 ‘insurance’ cut to remain in place much longer. The current very high value of the New Zealand dollar is acting as a drag on the New Zealand economy. If this persists, it is likely to reduce the need for further OCR increases in the short term.”

- Philippine Central Bank (held rate at 4.50%): “bank lending has been growing at double-digit rates since January 2011, supported by the strong momentum of domestic economic activity and stable financial conditions… The Monetary Board is of the view that sustained foreign exchange inflows, driven by upbeat market sentiment over the brighter prospects for the Philippine economy, could fuel a further acceleration of domestic liquidity growth which could pose risks to future inflation.”

- Central Bank of Colombia (raised rate 25bps to 4.50%): “Since March, the average measures of core inflation has been a slight upward trend in June and reached a level close to the midpoint of the target range (3% + / – 1 percentage point). Inflation expectations at various horizons are also within that range.”

Looking to the central bank calendar, next week is set to be dominated by developed market or advanced economy central bank activity (note, the US also meets early in the following week). So it will be an interesting week in terms of how these banks react to whatever happens with the US debt situation…

- AUD – Australia (Reserve Bank of Australia) – expected to hold at 4.75% on the 2nd of August

- GBP – UK (Bank of England) – expected to hold at 0.50% on the 4th of August

- CZK – Czech Republic (Czech National Bank) – expected to hold at 0.75% on the 4th of August

- EUR – Eurozone (European Central Bank) – expected to hold at 1.50% on the 4th of August

- JPY – Japan (Bank of Japan) – expected to hold at 0.10% on the 5th of August

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2011/07/monetary-policy-week-in-review-30-july.html