By Money Metals News Service

Since we’re approaching the sharing season and the gift of a book is a perennial winner, I’d like to suggest looking at a few concepts that have stood, and in more recent iterations, will hopefully stand, the test of time.

The meta-principles discussed – if understood, reflected and acted upon – can carry a life-long learner’s results to the next level. You become not only a better investor, but also a better human being! Here are a few books to consider:

- Reminiscences of a Stock Operator – Edwin Lefévre

- No Second Chance: Disarming the Armed Assailant – Bradley Steiner

- A Book of 5 Rings – Miyamoto Musashi

- Rich Dad Poor Dad – Robert T. Kiyosaki

- The Precious Present – Spencer Johnson, M.D.

- The New Case for Gold – Jim Rickards

- Second Chance: How to Make and Keep Big Money During the Coming Gold and Silver Shock-Wave – David H. Smith and David Morgan

- How I found Freedom in an Unfree World – Harry Browne

- Shadow Strategies of an American Ninja Master – Glenn J. Morris

- The Silver Manifesto – David Morgan and Chris Marchese

- You are the Placebo – Dr. Joe Dispenza

And now a Bonus…

Long ago, I realized the importance of finding one or two “big ideas” from each book I took the time to read. It’s especially helpful when you don’t have an inclination to read cover to cover.

Take a title to which I’ve long referred at conferences, Strauss and Howe’s seminal work, The Fourth Turning: An American Prophecy. What the Cycles of History Tell Us About America’s Next Rendezvous with Destiny. A history bug might revel in the details on every page, but most readers’ looking to understand and begin responding to the core of the authors’ argument can simply read the introduction and the first and last two chapters. (It also helps to take a few notes.)

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

For many years, I’ve followed the writings of Mark Ford (Michael Masterson), Founder of Early to Rise (earlytorise.com). Some elements of his style have refined how I approach this topic, they and may help you as well.

If you’re looking for the book’s main ideas, read the Preface, Introduction, and the first chapter carefully – which Ford notes often serves as “a sort of executive summary.”

Then read the first paragraph of each chapter, to seek out a pertinent concept the author wants to impart.

(In David Morgan’s and my just-released book Second Chance – we begin each chapter with an evocative quote that can stimulate a “call to action” on the part of the reader, who might then further delve into learning about that chapter’s main idea.)

Conclude by reading the last chapter/Epilogue – which summarizes the author’s thesis. Yes, there are books you may choose to read word for word… perhaps more than once. One such title for me was let my people go surfing – the education of a reluctant businessman, by Patagonia Clothing’s founder, Yvon Chouinard. But for the majority of works where you’re looking to discover the “core data,” this method can – and I believe will – place you on the fast track for acquiring and applying new knowledge in many areas of your life.

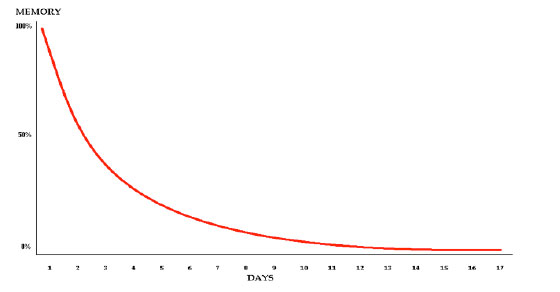

What’s critical is being able to hold onto your newlyfound wisdom. Research shows that if you’re not intentional about doing so, you will – in a surprisingly short time – forget just about all of it.

I experienced this concept long before I even knew it had a name. I would drive exactly 100 miles one way to study the art of American Combato with Shinan (founder) Professor Bradley Steiner. When new techniques were presented, I took notes, went home, and a week or so later got around to practicing. I improved but at a relatively slow pace.

Then one day, I tried something different. After taking notes as usual, I went to a tea shop, rewrote them, then to a nearby park to practice. At home each day thereafter, I performed an “Irreducible Minimum” – ten repetitions of each new technique as accurately as possible on both the left and right sides. My retention and rate of progress skyrocketed! I had discovered what came to be called the “3-21 Memory Law”. Thirty years later it’s still working for me – and it will for you.

The 3-21 Memory Law

Without some form of immediate study/practice/reflection, a new learning experience is quickly forgotten. After only a few days, 50% of what you thought you knew will have disappeared. This “forgetting” continues for 3 weeks, at which point the skill has degraded by over 90%! Unless that is, you “implant” it into long-term motor-muscle memory.

On November 14-15, The Morgan Report Team (David Morgan, Webmaster Bruce Ross, Senior Equities Analyst, Chris Marchese, and I) attended the Cambridge House/Katusa Research-hosted Silver and Gold Summit in San Francisco. We had tremendous interactions with like-minded attendees seeking information about precious metals and mining stocks and learned from some of the best presenters in the business. David Morgan was a keynote speaker, and Bruce Ross taped two dozen mining executive interviews for our subscribers at www.TheMorganReport.com.

I had the distinct pleasure of listening to, and later speaking with, the legendary analyst of The Dines Letter, Jim Dines. Jim spoke about much more than just where he believed gold and silver were headed over the next few years (up), and about the many correct market calls he has made since the 1980’s. He also talked about what really matters in cultivating a quality life on this plane.

About how to coordinate your behavior and treatment of others with what’s taking place while you accumulate wealth. About what he calls a “high state” of alignment. About making fewer assumptions, which he defines as “trying to tell the universe what to do.” I eagerly purchased a limited-edition copy of his book, Secrets of High States.

I intend to read and re-read Secrets, like I did Chouinard’s beautiful work…word for word – and definitely more than once! By utilizing the 3-21 Memory Law, the insights gained from Dines’ work can be meaningfully applied in my own life.

Holding an American Silver Eagle or a Gold Buffalo, I will not try to tell the market what it should do, in hopes of forcing the price to go where history says it must. I won’t assume to know the exact levels they will reach.

Rather, I will simply add to my holdings when I can – keeping them securely in a special place, away from my home – confident that the financial safety they engender for my family will serve to protect us during the coming years, exactly as they have done around the globe for people for over five millennia.

And I will take comfort in the knowledge shared by polymath Jacob Bronowski, Author of Ascent of Man, when he said, Gold (and silver) is the universal prize in all countries, all cultures and in all ages.

The Money Metals News Service provides market news and crisp commentary for investors following the precious metals markets.

The Money Metals News Service provides market news and crisp commentary for investors following the precious metals markets.