By Admiral Markets

The EURUSD is patiently waiting for major economic data coming in this week. We have some real high impact info this week and we could see risk-off sentiment possibly coming back. We need to watch out for upcoming releases:

- Wednesday – CNY manufacturing data, very important data for CNY + ADP

- Thursday – ECB press conference and OPEC

- Friday – NFP

Any bad US data during week including bad CNY data could cause a risk off. If OPEC fails to cut Oil and oil price drops subsequently, it won’t be good for USD. End of month positions may reverse too on profit taking.

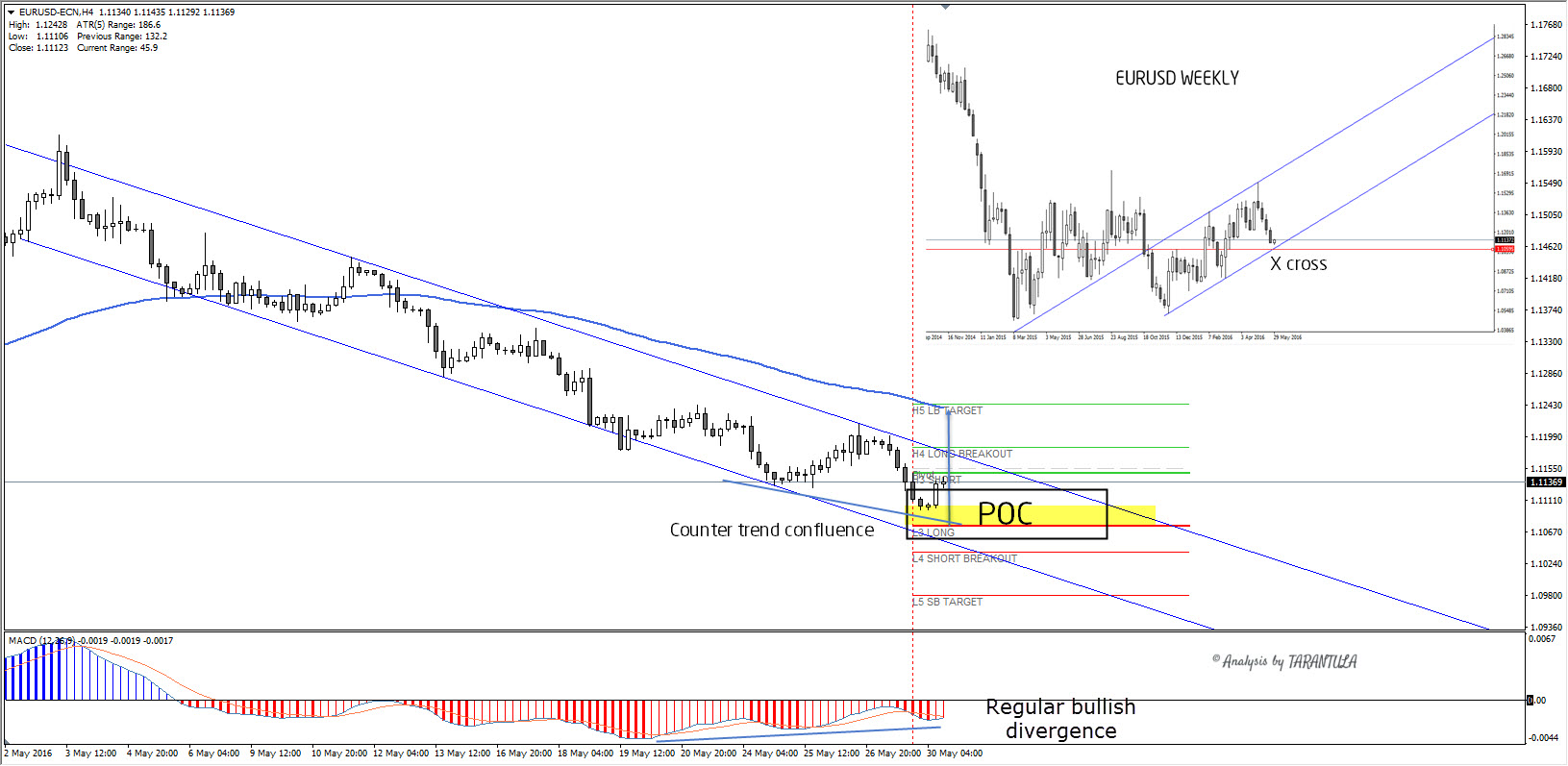

In addition to fundamentals, technical chart is also showing signs of a possible counter trend movement as we could see that weekly support is there – X cross on weekly chart formed by historical buyers and lower equidistant channel support line. On H4 time frame we can see the similar picture. L3 support is sitting at the bottom of equidistant support + we can see a regular bullish divergence. While above 1.1085-70 EURUSD might turn bullish targeting 1.1200 and 1.1240.

So it is very important that we pay attention to price flow as the EURUSD is close to a counter trend confluence POC.

Follow @TarantulaFX on twitter for latest market updates

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Article by Admiral Markets

Source: EUR/USD watch for counter trend confluence

Admiral Markets is a leading online provider, offering trading with Forex and CFDs on stocks, indices, precious metals and energy.