By The Gold Report

https://www.streetwisereports.com/pub/na/madness-in-the-crimex-trading-pits

Precious metals expert Michael Ballanger discusses effects of the Bank of Japan’s actions on the U.S. dollar, silver and gold.

The “big story” circulating around the blogosphere yesterday and last evening was a paper authored by Pimco’ s “strategist” Harley Bassman that essentially opined that “the Fed should unleash a massive Fed gold purchase program that could echo a Depression-era effort that effectively boosted the U.S. economy.” Well, isn’t that original? Back in 2013 I reviewed Michael Lewis’ follow-up to “The Big Short,” a brilliant piece of work entitled “BoomerangTravels in the New Third World” where Lewis interviews a Deputy Finance Minister at the German Bundesbank who told Lewis that because Germany had 3,390.6 tonnes of gold, its entire government debt was “covered.” At the time, I was listening to the audiobook while on a treadmill and I actually had a Eureka moment and immediately texted myself a reminder to make that the central theme of the weekend note to clients, which I did.

What everyone seems to agree upon is that it would be a bloody masterful way of turning DE-flationary expectations (which is what we have now) into IN-flationary expectations and put an end to all of the cash hoarding that has money velocity at a standstill. The desired result would be a booming economy and immediate sovereign solvency and peace and love breaking out all across the globe, right? WRONG! What this idiotic idea is really all about is bank loans and COLLATERAL. You see, as long as mortgages have an appreciating asset like a house attached to it, the bank that originated the mortgage is protected. However, in a deflationary spiral and even in a period of heightened deflationary expectations (otherwise known as “subdued inflationary expectations”), the collateral underpinning the loans weakens and the banks as originators have to post more capital to properly collateralize the loan.

So, when you look at these “brilliant” ideas involving the repricing of gold (and silver), it is NOT in any way designed as a panacea for the average working stiff; it is designed as way of repairing the severely impaired balance sheets of the treasuries of the entire Western financial system. Who are the largest investors in sovereign debt in Europe and in North America? It is the banks! And, of course, large bond funds like Pimco!

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Every single time you read about a wonderful new idea for solving all of the world’s ailments, all you have to do is plug in the word “bank” for the word “people,” or the words “average American” or “U.S. economy” in order to glean the truth. As an example, “Monetizing debt is good for the people” should be shown as “Monetizing debt is good for the banks.” Likewise, the statement “Quantitative Easing (QE) is of enormous benefit to the average American” should actually be “Quantitative Easing (“QE”) is of enormous benefit to the banks.” So, when I read that “the Fed should unleash a massive Fed gold purchase program that could echo a Depression-era effort that effectively boosted the U.S. economy,” what I automatically and subconsciously transcribe is “the Fed should unleash a massive Fed gold purchase program that could echo a Depression-era effort that effectively boosted the U.S. BANKS,” because the reparation of sovereign balance sheets is what such a move is and that does not imply easier credit conditions for the average citizen, nor does it mean lower borrowing costs for the “people.”

Today, in the Crimex trading dungeons, we have absolute bedlam as the dollar/yen has exploded northward after the Bank of Japan (BOJ) promised to buy every financial asset of every country in the world and assured the world it would pay for the purchases with yen printed on an Epsom printer after copious consumption of sake and beer. The Bank of Japan has been on an unsound money extravaganza for the better part of three years as it tries to jump-start the Japanese economy and revive inflation/deaden deflation, but for the first time in ages its negative-yen jawboning has worked with the USD gapping up over 2% versus the yen. The madness in the Crimex pits is a function of the insanity of central bank shenanigans, so it should come as no surprise that the day after I posted what I called “a truly frightening chart” of the GDXJ (Market Vectors Junior Gold Miners) at $35.02, the BoJ orchestrates a massive takedown and my decision to HOLD the GDXJ goes down into the drain.

What is concerning is that the HUI (NYSE Arca Gold BUGS Index) has done yet another of its negative-outside-day reversals today and given that next week is a “Fed-jawboning” week, the chances for a whoppingly big pullback in these massively overbought miners is high and rising. I can’t even count the number of times (since I took some profits in the HUI around 175) that I have thought “Here comes the correction in the gold and silver miners,” after which it just kept powering ahead. However, at 210, the HUI has stalled three times, so with today’s nearly 3% downstroke, it will be encouraging if it holds 200 for the week.

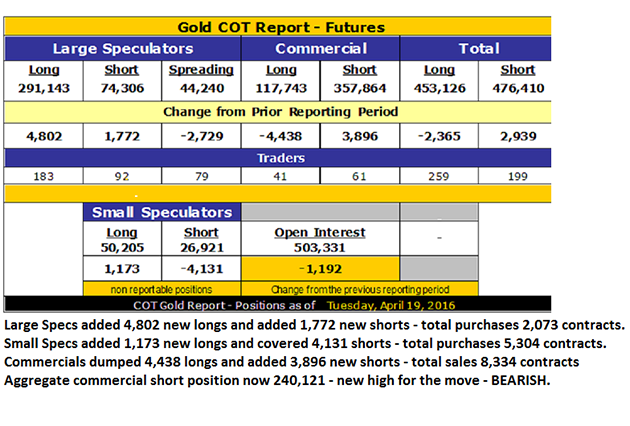

The COT report for the week ended April 19:

Commercials also added 11,668 new SILVER shorts and are pressing hard to crush this incredible move in silver. However, for now, the gold COT continues to test the mettle (and the buying power) of the Hedgies as this new net short position of the bullion bank behemoths coming in at over 240,000 is larger than at any time prior to 2015. Thus far, the sheer demand for physical metal and the inflows into the GLD (SPDR Gold Trust) and SLV (iShares Silver Trust) ETFs has served to keep the bullion banks from slamming everything lower, but as long as the Crimex allows these bastards to naked-short any and all amounts of synthetic, phony, paper gold and silver, the paper demand must keep up or the inevitable price smash is coming.

I close out the week feeling rather apprehensive about our fortunes for next week and for that reason, I took out another series of hedges against my sizable GDXJ and junior miner positions this afternoon, representing about 2.5% of the value of the portfolio. If everything continues to rally, I will have missed 2.5% of the appreciation and will be found babbling to myself in a corner, thumb firmly implanted in mouth and incapable of human or inhuman contact for a period of days, if not weeks, a condition many would deem preferable to the status quo.

So be it. . .

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation or editing so the author could speak independently about the sector. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts courtesy of Michael Ballanger

Streetwise – The Gold Report is Copyright © 2016 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 773-5020