Technical analyst Clive Maund discusses the factors he sees weighing on precious metals in the near term.

By The Gold Report – Source: Clive Maund for Streetwise Reports 06/08/2020

The precious metals sector is now set up for a correction that could be quite severe, which is evident on the charts, but also made more likely by the fundamentals where we see a return to “risk on” as a result of ongoing massive money injection by the Fed coupled with this being a seasonally weak summer period for the metals ahead of their seasonally strongest time, which runs from late July through September. The return of “risk on” will be greatly encouraged by the stock market breaking out to new highs which will suck money out of the PM sector to be deployed in biotech, blockchain, the FAANGS and the better cannabis stocks, but it should return as the economy gets going again and all the newly created money starts to drive inflation sharply higher.

Starting with gold’s 6-month chart we see that it is weakening following a failed upside breakout from a Symmetrical Triangle, and is it now close to breaking the first line of support shown. Once that fails it is likely to head down to the next support level near to its 200-day moving average.

On gold’s 13-month chart we can see that while gold is firmly in a bull market there is plenty of room for it to react back significantly without breaking down from its uptrend channel.

The 6-month chart for GDX shows it completing what looks like a Head-and-Shoulders top at a quite a high level, and with this morning’s drop it could soon break down from the pattern leading to a potentially steep drop.

On the 13-month chart for GDX we can see that there is plenty of room for it to drop, and the minimum objective in the event of it breaking below nearby support is the support in the $26 zone, and given that once the psychology changes, declines in the sector tend to be self feeding, it could go quite a lot lower than that.

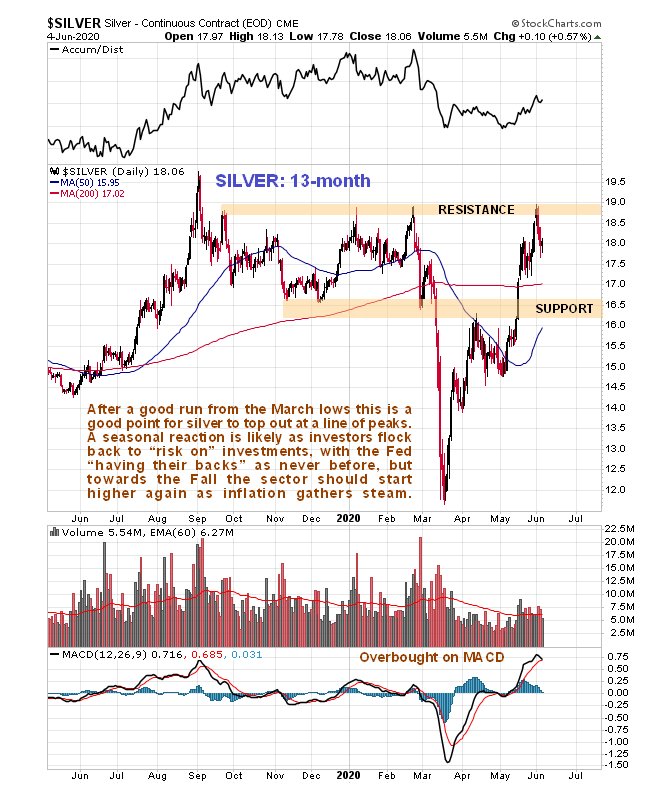

Silver just topped out at the resistance at a line of peaks and looks set to react back at least to the support shown on the 13-month chart, and could easily drop further if that fails.

One silver stock that actually has a strong chart overall that we bought a few weeks ago, Kootenay Silver Inc. (KTN:TSX.V), hit a trendline target as we can see on its 13-month chart and could get dragged down significantly with most other stocks in the sector. So it is thought better to take out now modest profits in this immediately and then wait for the chance to buy it back when the sector correction is thought to have run its course.

The conclusion is that the correct tactics with respect to the precious metals sector are to either step aside, or hedge with either leveraged inverse ETFs such as DUST, or better still Puts in say GLD and GDX, or a combination of the two. The corrective phase will probably be over by early August.

Originally posted on CliveMaund.com at 11.00 am EDT on 5th June 2020.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

( Companies Mentioned: KTN:TSX.V,

)