By Orbex

In its latest World Economic Outlook released this week, the International Monetary Fund gave a rather downbeat assessment of global financial conditions.

The IMF warned that global growth is projected to fall to just 3% this year. This marks its lowest levels since the 2008 financial crisis, dropping down from 3.8% in 2017.

This latest forecast is a -0.2% revision from the last one issued in July.

Recessionary Risks

The group cautioned that should the rate of global growth slip below 2.5%, this would signify a recession.

Gita Gopinath, the IMF’s chief economist, warned over the handling of such conditions, saying:

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

“At 3% growth, there is no room for policy mistakes and [there is] an urgent need for policymakers to cooperatively de-escalate trade and geopolitical tensions.”

The IMF has noted that world trade volume growth was just 1% over the first half of 2019. This its lowest level since 2012.

The report cited the ongoing trade war between the US and China as the chief driver for the downward trajectory in world growth.

Looking ahead, the IMF warned that if all planned US and Chinese tariffs are activated, world growth will fall by a further 0.8% into 2020.

Key takeaways from the IMF’s latest outlook

- Growth in advanced economies is forecast to slow from 2.3% in 2018 to 1.7% this year.

- US growth to slow from 2.9% last year to 2.4% in 2019.

- UK growth forecast to fall to 1.2% for 2019, down from 1.4% last year, as a result of Brexit uncertainty.

- German growth forecast to hit 0.5% by year-end, down from 1.5% in 2018, as a result of the collapse in automobile production.

- China’s economic growth forecast to slide from 6.6% to 6.1% as a result fo the negative impact of US trade tariffs.

- Saudi Arabia’s growth forecasts cut by 1.7% this year.

- Output growth in India lowered by 0.9%.

- In China, output forecasts down by 0.3% this year and 0.2% next year, marking just an 8% growth rate.

Looking ahead, the IMF report noted:

“With uncertainty about prospects for several of these countries, a projected slowdown in China and the US and prominent downside risks, a much more subdued pace of global activity could well materialize.”

Services Sectors Under Threat

Manufacturing readings globally have been falling heavily this year. However, services sector indicators have managed to stabilize.

That being said, the IMF warned that this might not last. They stated:

“The divergence between manufacturing and services has persisted for an atypically long duration, which raises concerns of whether and when weakness in manufacturing may spill over into the services sector,”

In all, the report makes for dire reading. It clearly highlights the damage inflicted by the US/China trade war.

This latest update puts even more focus on the need for a resolution to the trade war. In fact, it hones in on the importance of the ongoing trade talks and the potential for an initial deal between the two countries.

Technical Perspective

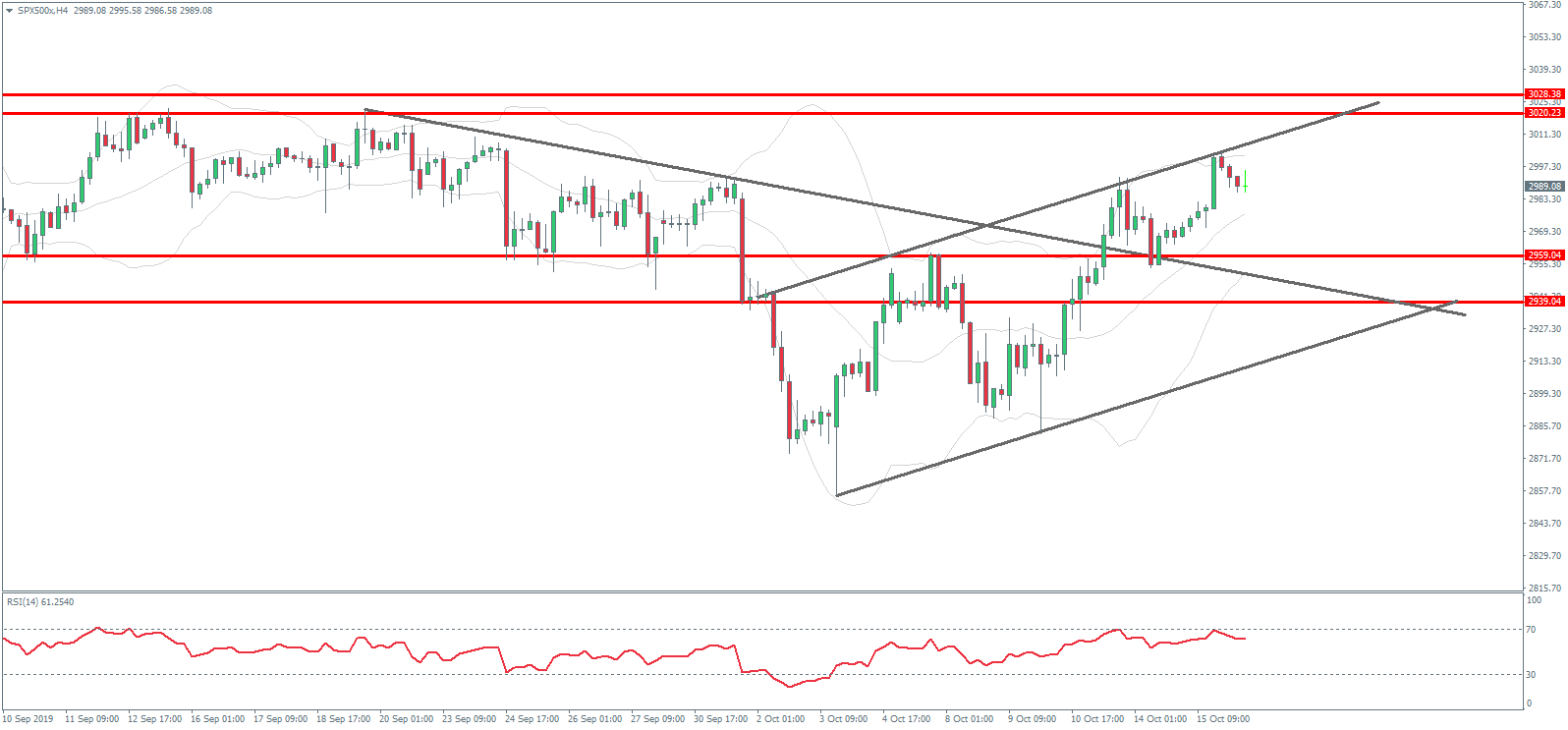

The SPX500 continues to move higher within the local bullish channel. Price recently broke out above the bearish trend line from year to date highs and has subsequently retested the trend line, which held as support.

For now, focus is on a further push higher with the band of resistance between 3020.23 and 3028.38 (all-time highs) the next area to watch. To the downside, any retest of the 2959.04 level should find support.

By Orbex