The Energy Report

Source: Peter Epstein for Streetwise Reports 08/14/2019

Peter Epstein profiles recent developments with this company that has a large vanadium deposit in Nevada, with a PEA on the way.

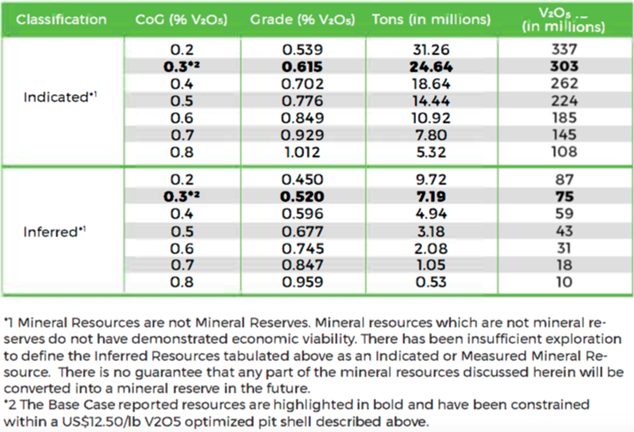

First Vanadium Corp. (FVAN:TSX.V; FVANF:OTCQB) has a large, near-surface vanadium resource (303 million pounds, Indicated category only), with a very good grade (0.615% V2O5) in the great mining jurisdiction of Nevada. The company has 42.4 million shares outstanding & $1.7 million in cash. Its enterprise value (EV) [market cap + debt cash] = $12.5 million = US$9.4 million. First Vanadium is fully funded through delivery of a preliminary economic assessment (PEA), expected by Q1 2020.

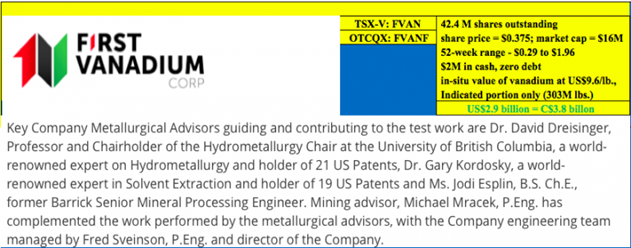

The technical team is nothing short of world class. I can’t imagine a better team to optimize a greenfield project than this one. The company’s board, management and technical team’s core competence is in the exploration, permitting, development, construction and operation of mining projects around the globe, with over 400 years combined experience. Not only are these highly experienced professionals good at what they do, they’re passionate about it. {see August corporate presentation}

The Carlin vanadium project, one of the best in North America

The Carlin Vanadium project is situated on 3,608 acres in mining-friendly Elko County, in north-central Nevada, and surrounded by exceptional infrastructure. It’s road accessible from the towns of Carlin and Elko. Carlin, 7 miles away, is a major rail hub to both coasts. A power line runs within five miles of the property. There are nearby mining communities, a skilled workforce, mining services, suppliers and venders, and an airport.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

It would be hard to overstate the importance of potentially developing a vanadium project in the U.S., with the president having named V2O5 a “strategic mineral,” and the very significant and growing need for vanadium in steel, the backbone of global growth. Not to mention the emerging Vanadium Redox Flow Battery (VRB) market.

The U.S. Department of Energy (DOE) has pledged to streamline and cut red tape from permitting and approval processes. And don’t forget, last year the federal tax rate was slashed from 35% to 21%.

The Carlin Vanadium project is one that I think could be up and running within five years. Especially if permitting and environmental protocols are reset for critical minerals in light of the escalating trade war between the U.S. and China.

A large, near-surface, high-grade resource

The high-grade, primary vanadium resource at Carlin consists of 303 million pounds V2O5 in the NI 43-101 compliant Indicated category. At a cut-off grade of 0.30%, the Indicated resource (80% of total resource) is 0.615% V2O5. There is also 75 million pounds in the Inferred category. Management believes there’s room to grow the resource if or when needed.

On August 7, First Vanadium announced that ongoing metallurgical test work on samples from the Carlin project resulted in a preliminary process flow sheet delineating extraction and recovery of vanadium as high-quality vanadium pentoxide (V2O5).

In my view, a very important and necessary milestone has been achieved, at reasonable cost, paving the way for a (fully funded) PEA by Q1 2020. The fact that management has announced a flow sheet signals confidence that they are well on the way to a viable PEA.

Paul Cowley, president & CEO, commented in the press release,

“The Company is very pleased at achieving this major metallurgical milestone for the project. With a preliminary flow sheet defined, the Company will now initiate Requests for Proposals from qualified engineering firms for a Preliminary Economic Assessment (PEA).”

And, here’s a great summary of the process flow sheet,

“The flow sheet follows four steps, 1) crushing & grinding, 2) pre-concentration to reduce the volume of feed to the pressure oxidation circuit, 3) acid leach & pressure oxidation to extract vanadium into solution, and 4) solvent extraction to generate a high-value, pure vanadium pentoxide (V2O5) flake product.”

The press release emphasized that the flow sheet uses conventional, off-the-shelf technology,

“The extraction process uses conventional unit operations (crushing, grinding, flotation, leaching, solid-liquid separation, solvent extraction & ion exchange, precipitation & calcination) and common chemicals (oxygen, sulfuric acid, ammonium carbonate & ammonium sulfate).“

A lot of the work to date has been aimed at driving capital and operating costs lower through optimization of the flow sheet. An example is the pre-concentration step that captures the bulk of the vanadium in a smaller volume of feed to the autoclave. This means a smaller autoclave could be constructed, which would be cheaper to build and operate. Importantly, additional test work to refine and optimize the process is expected to lower costs even further, in time for the PEA.

There are some very smart and talented metallurgists and engineers working on First Vanadium’s flow sheet! (see image below).

Regarding vanadium pricing, I’m not one to predict or forecast. I thought the price would remain close to $15/lb. Still, at the current vanadium pentoxide (China) price of US$9.5/lb, the in-situ value of the Indicated-only portion of the resource (303 million pounds) is ~US$2.9 billion = ~C$3.8 billion. Compare that to First Vanadium’s EV of US$9.4 million. This is the largest, high-grade primary vanadium resource in North America.

VRBs are coming on strong, VRB technology advances will help a lot

Vincent Sprenkle, a lead researcher at the U.S. DOE’s Pacific Northwest National Laboratory, recently said, “Vanadium Redox Flow Battery costs could be lowered by another 50%.” I think that sentiment speaks to the inevitability of additional technological advancements, which will be bullish for the vanadium market, as it will allow for more widespread adoption of utility scale VRBs outside of China, where VRB projects already have a strong foothold.

There are hundreds of battery metals juniors out there: vanadium, cobalt, lithium, nickel, graphite, but very few are moving the ball forward as rapidly and prudently as First Vanadium. Moving towards a PEA with the quoted (V2O5)Chinaprice at US$9.5/lb signals a strong belief in both the flow sheet and the project. The vanadium price dipped to US$8.1/lb in mid-July, but it’s up 17.3% since then.

First Vanadium Corp., (TSXV: FVAN) / (OTCQX: FVANF) with a PEA in hand early next year, a tremendous management, board, technical team and retained consultants, and a strong (high-grade primary vanadium)/sizable (303 million pounds Indicated) project, in a top mining jurisdiction, is worth a closer look.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University’s Stern School of Business.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about First Vanadium Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of First Vanadium Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned no shares of First Vanadium Corp. and the Company was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein’s disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.

( Companies Mentioned: FVAN:TSX.V; FVANF:OTCQB,

)