By Tomasz Wiśniewski, Chief analyst at Alpari Research & Analysis

One instrument which is currently in a very interesting place is gold. The precious metal has suffered a lot recently, mostly due to two factors. The first one is the stronger USD; we all know that gains on the greenback cause drops on commodities. The second factor is the Risk ON mode on stocks, which negatively affected the safe haven assets, particularly gold. Thanks to that, gold had made new yearly lows over the last week.

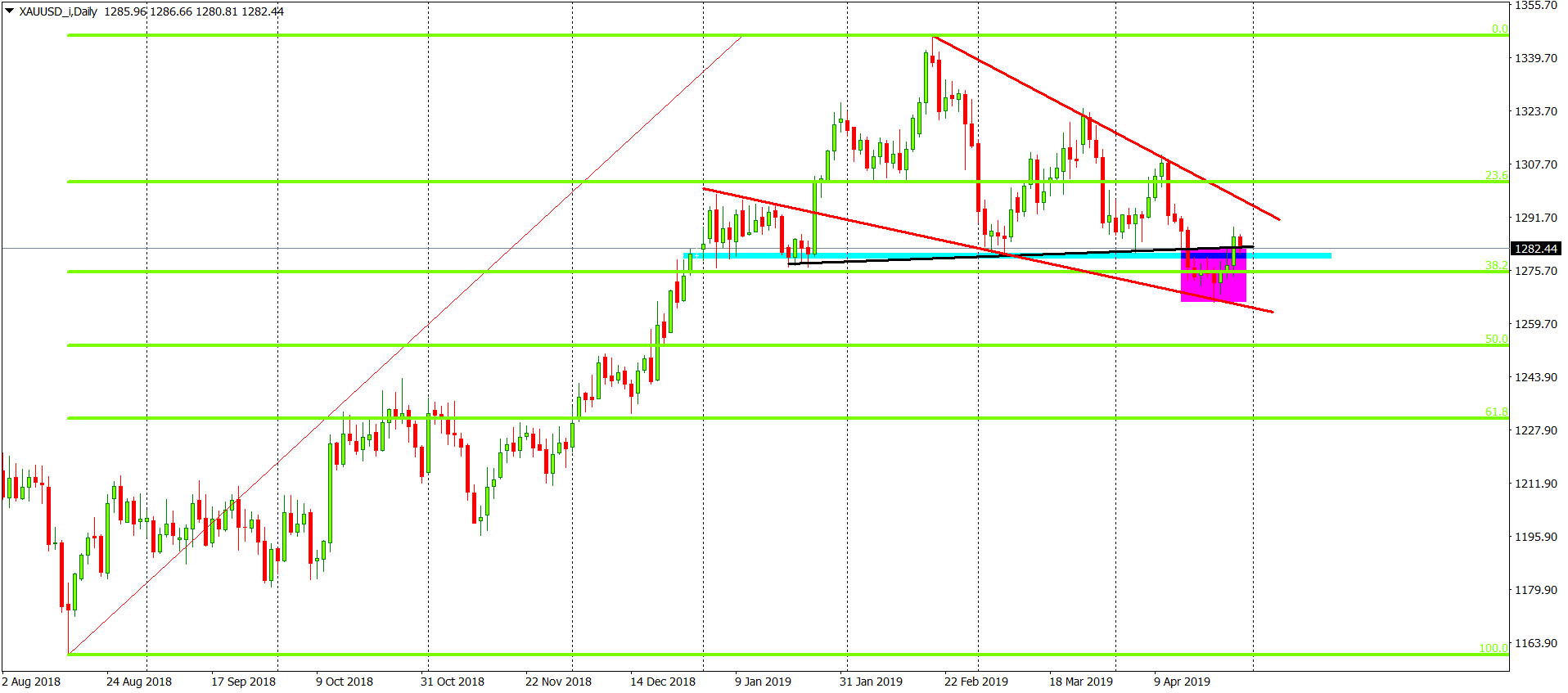

Now, let’s look on this from a distance. Last week’s drop was a bearish breakout of the symmetrical triangle pattern and the H&S. That gave us a strong sell signal but as we can see, this signal has been ignored by traders. Why ignored? Mainly because the price came back above the broken supports, i.e. above the lower line of the triangle (black) and the neckline (blue). In theory, that creates a false breakout pattern and brings us a more positive scenario.

Now, let’s look on this from a distance. Last week’s drop was a bearish breakout of the symmetrical triangle pattern and the H&S. That gave us a strong sell signal but as we can see, this signal has been ignored by traders. Why ignored? Mainly because the price came back above the broken supports, i.e. above the lower line of the triangle (black) and the neckline (blue). In theory, that creates a false breakout pattern and brings us a more positive scenario.

This scenario is additionally driven by the fact that the price bounced from the 38.2% Fibonacci and that we are inside of a wedge pattern (red). The wedge is a trend continuation pattern and the main trend seen on the chart is positive. I like to play it safe, so I would say that we are currently in no-man’s land. How do we trade this? In my opinion, we should wait for a breakout from the wedge. A breakout to the upside would be a buy signal and breakout to the downside would be a signal to go short. Somehow, I think that first option is slightly more probable.

Source: Alpari