By IFCMarkets

Market participants are hoping for the resumption of US cotton purchases by China

China’s Vice-Premier Liu He held telephone negotiations with US Treasury Secretary Steven Mnuchin and US Trade Representative Robert Lighthizer. Some market participants hope that China will begin to purchase a small portion of American agricultural goods before concluding a trade deal with the US. Will cotton prices rise?

Since mid-summer of 2018, China has imposed a 25% import duty on US cotton. The US is the world’s largest exporter of cotton, and China is its main global buyer. The meeting of US President Donald Trump and Chinese President Xi Jinping was scheduled for April of the current year, but now, a number of sources such as the South China Morning Post believe that it can be postponed to June. At this meeting, the US-China trade deal, which regulates the terms and volumes of the acquisition of American goods, should be approved. According to preliminary estimates, cotton production in China in 2018 amounted to 6.1 million tons, which is 7.8% more than in 2017. At the same time, cotton imports to China increased by 36.2% and amounted to 1.57 million tons. According to the U.S. Commodity Futures Trading Commission, the volume of net shorts on cotton futures has been declining for the 3rd week in a row in the Intercontinental Exchange (ICE). An additional factor for the increase in demand may be too rainy weather in Texas, which can damage cotton crops.

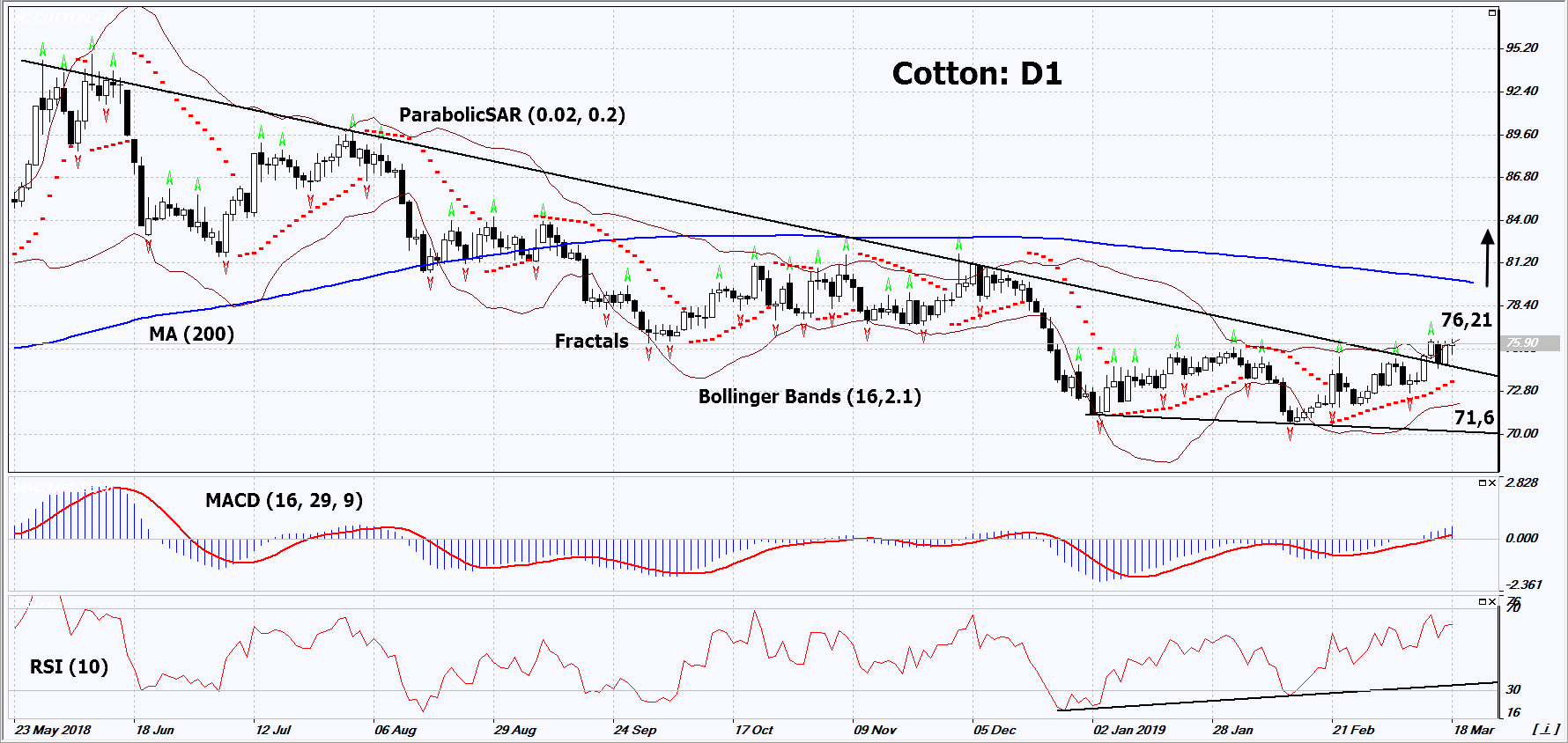

On the daily timeframe, Cotton: D1 has left the downtrend and moved upward. A number of technical analysis indicators formed buy signals. The further price growth is possible in case of an increase in global demand and deterioration of weather in the US.

- The Parabolic Indicator gives a bullish signal.

- The Bollinger bandsа have narrowed, which indicates low volatility. Both Bollinger bands are titled upward

- The RSI indicator is above 50. It has formed a positive divergence.

- The MACD indicator gives a bullish signal.

The bullish momentum may develop in case Cotton exceeds the upper Bollinger band and its last fractal high at 76.21. This level may serve as an entry point. The initial stop loss may be placed below the two last fractal lows, the Parabolic signal and the lower Bollinger band at 71.6. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level (71.6) without reaching the order (76.21), we recommend to close the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

| Position | Buy |

| Buy stop | Above 76.21 |

| Stop loss | Below 71.6 |

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.