In the previous two segments of this research post PART I, PART II, we’ve hypothesized that the recent Chinese economic data and the resulting global shift to re-evaluate risk factors within China/Asia are prompting global traders/investors to seek protective alternative investment sources. Our primary concern is that a credit/debt economic contraction event may be on the cusp of unfolding over the next 12~24 months in China/Asia. It appears that all of the fundamental components are in place and, unless China is able to skillfully navigate through this credit contraction event, further economic fallout may begin to affect other global markets.

One key component of this credit crisis event is the Belt Road Initiative (BRI) and the amount of credit that has been extended to multiple foreign nations. We don’t believe China will run out money by the end of March and we don’t believe any crisis event will come out of nowhere to land in China within a week or two. Our concern is for an extended downturn to decrease economic opportunity by 5~12% each year for a period of 4~7+ years. It is this type of extended economic slowdown that can be the most costly in terms of political and economic opportunity. An extended downturn in the Chinese and Asian economies would create revenue, credit, debt, and ongoing social servicing issues.

As we explore this concept of an extended economic downturn, we need to consider the BRI projects and obligations. China has committed to invest $1 trillion into the BRI and it is estimated that the infrastructure projects throughout Asia will require $26 trillion over the next decade. Our opinion is that the total investment required to complete this transition and truly open economic opportunity within the BRI will require an expanding global economy without any fear of an economic downturn. We believe even a mild Chinese/Asian economic contraction event could dramatically alter the longer term objectives of the BRI and put many “at risk” projects in jeopardy.

The potential for an immediate downward price swing in the Chinese/Asian stock market related to these recent economic data points. The reality is that the Chinese economy is contracting much faster than nearly anyone expected. The longer the US/China trade issues continue, the more likely it is this contraction event will continue. At some point in the near future, consumers will move towards more of a protectionist stance where extended consumer spending will contract. At that point, the Chinese economy will have entered a type of “death spiral” where the race to the bottom persists.

We believe the immediate downward price move in the Chinese/Asian stock market may only last a month or so before finding some price support. Over time, the constraints of a slowing local and regional economy may prove to be much more than China is capable of handling long term. Much like the US 2008-09 credit crisis, the collapse of the credit market, when it reaches a disorderly contraction, becomes a very dangerous event. As long as this economic contraction continues in an orderly manner, we may continue to see extended price weakness. If this continues over a lengthy period, we may see price weakness throughout many other regional markets – such as India, Pakistan, Malaysia, Singapore, and others.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Custom Index– Custom Index chart by TradingView

We believe the Asian region will experience continued weakness over the next few months as further downside rotation drives prices lower while credit, debt and trade issues are resolved. It is our opinion that China/Asia will continue to struggle to attain real economic growth over this period and that further price weakness will become evident over the Spring months. Causing investors to seek shelter elsewhere. Our cycle analysis suggest mid April or early May as dates that align with such a move. This correlates with our projections for Gold and Silver in terms of some type of market crisis driving Gold and Silver prices much higher.

At this point, skilled traders and investors should be watching for signs that some type of external event may be unfolding that we are currently unaware of. Some type of event appears to be ready to unfold that will drive equity prices lower while pushing Gold and Silver prices higher. Our belief that it could be some type of China/Asia contagion leads us to believe that a downside price rotation could be nearing for the Asian markets.

Watch how this plays out over the next 30+ days. We only have about 30~40 days before we should have more clarity about this crisis event and we should be using this time to prepare for and protect our investments. We’ll keep you informed by providing more research and updates as we see need to alert you.

If you want to join a group of professional traders, researchers, and friends, take a look at our trading newsletter to learn how we can help you find and execute better trades each month. We believe 2019 and 2020 will be incredible years for skilled traders and we are executing at the highest level we can to assist our members. In fact, we are about to launch our newest technology solution to better assist our members in creating future success.

Our team has 53 years of experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

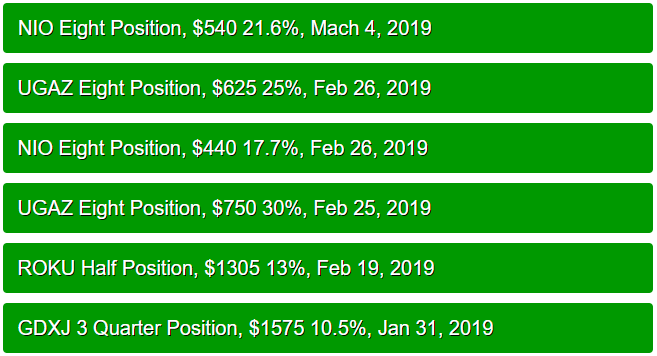

RECENT CLOSED TRADES

Chris Vermeulen

Technical Traders Ltd.