By IFCMarkets

Dollar strengthened over the past week

On Friday, quotations of US stocks slightly dropped . Index S&P 500 fell for the 3rd time in a row amid difficult US-China trade negotiations. Ther was not significant macroeconomic data in the United States.At the end of last week, US President Donald Trump’s statement that he is not going to meet China’s President Xi Jinping before the deadline for signing the trade agreement – March 1, 2019 brought a negative wave. In turn, market participants consider as a positive factor the United States Trade Representative Robert Lighthayzer’s and US Treasury Secretary Stephen Mnuchin’s visit to China held on February 14-15 . In the longer term, US stock quotations may be negatively affected by very weak forecasts of S & P 500’s total profit for the first quarter of this year. For the first time since 2016, quarterly earnings are expected to decline by 0.1% year by year. Regarding the forecasts of the profits of the S & P 500 companies for the whole 2019, it is expected to increase only by 4.3%. At the same time, since the beginning of the year, this index has already grown by 8%. Today it is not expected to publish significant macroeconomic indicators in the United States. The ICE US dollar index rose the 5th day in a row on Friday and updated the 6-week maximum. Investors consider dollar assets as “defensive” against the backdrop of trade wars. US stock index futures indicate a higher open today.

European indexes fell on Friday for the third day in a row

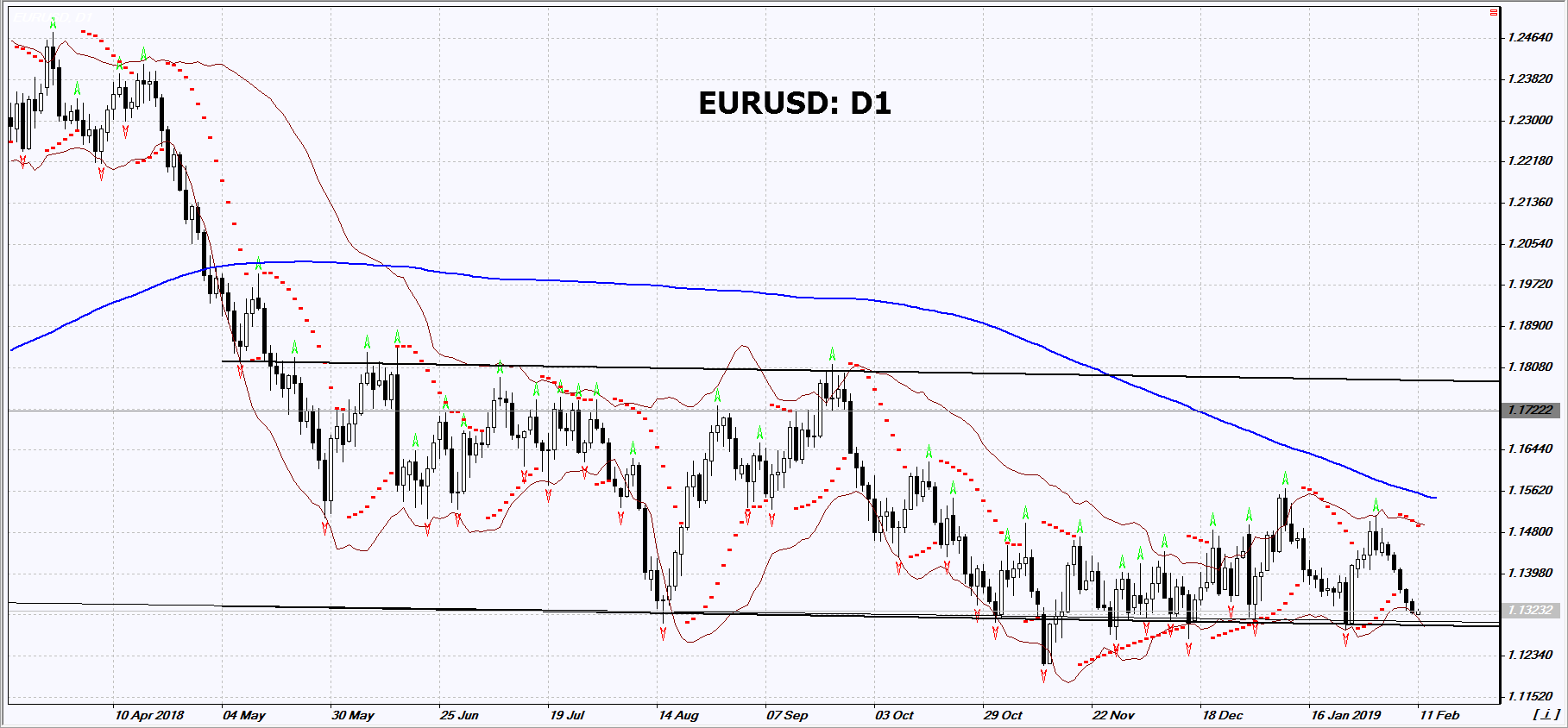

Following the ECB, the European Commission also lowered its growth forecasts for the Eurozone economy. In December, Germany’s trade balance and current account balance were worse than expected. This contributed to the decline in stock prices of European companies on Friday. However, in January, their cumulative P / E ratio was minimal since July 2013 and amounted to 12.1. This may indicate the preservation of potential growth of quotations. At the end of Friday’s trading, European stock markets won back some of the losses and the final decline was not too large. This was facilitated by the positive reporting and forecasts of the Swedish electronics manufacturer Dometic , as well as manufacturers of cosmetics and luxury goods by L’Oreal and Hermes. Currently only slightly more than half of European companies have reported for the 4th quarter. EURUSD Once again, it approached the key support level of 1.13, but has not yet been able to break it down. Today at 10-30 CET a large block of macroeconomic data will be released in the UK.

The changes JPY, Australian and New Zealand dollars was minimal on Friday

The cost of iron ore peaked at 4 and a half years, which contributed to the strengthening of the Australian dollar. Metallurgical and mining products occupy about a third of Australian exports. the New Zealand dollar also strengthened in anticipation of the next meeting of the Reserve Bank of New Zealand (RBNZ), which will be held on February 13. Today, the Japanese stock index Nikkei won back part of the losses due to the weakening of the yen. On Friday, it updated the monthly minimum due to the weak quarterly reporting by Nikon Corp. and global risks due to trade wars

Brent falls

Brent crude futures prices dropped slightly. This was facilitated by the message of the oilfield service company Baker Hughes about the increase in the number of operating drilling rigs in the US to 854 pieces per week. Oil production in the United States reached another record of 11.9 million barrels per day. At the same time, the Brent cost has been trading for 4 weeks in a narrow range of $ 59-63 per barrel. This may indicate a good balance in the oil market.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.