By The Gold Report

Source: Thibaut Lepouttre for Streetwise Reports 12/04/2018

Thibaut Lepouttre of Caesars Report profiles a company active in Portugal that uses the prospect generator model.

Explaining the prospect generator model

Avrupa Minerals Ltd.’s (AVU:TSX.V; AVPMF:OTC: 8AM:FSE) business model is quite simple: after adding projects to its portfolio, it tries to get them to a drill-ready stage where after it starts looking for a joint venture partner to do the heavy lifting.

This usually results in a very cost-effective way of exploring multiple projects without incurring the associated expenses: The partners usually cover the exploration expenses in return for a majority stake in the properties they are working on. Avrupa usually retains a minority stake in a project, which subsequently gets converted into a Net Smelter Royalty.

An excellent example of how the business model works is the joint venture deal on the Slivovo gold project in Kosovo. Avrupa discovered an interesting gold target in the country and allowed Byrnecut to earn an initial stake of 75% after spending a few million dollars on advancing the project. Byrnecut has subsequently increased its stake to 85% after delivering an economic study on the project, and as soon as it reaches a 90% stake, Avrupa’s position will be reduced to a 2% Net Smelter Royalty.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Doing business in Portugal

In the past, we have discussed Blackheath Resources (BHR.V), which was trying to advance a portfolio of tungsten assets in Portugal, so we are quite familiar with Portugal as a mining destination. And so is Avrupa. In fact, one of the assets Blackheath Resources was working on (the Covas tungsten project in Northern Portugal) was optioned from Avrupa Minerals, which has assembled a diversified portfolio of assets in the country over the past few years.

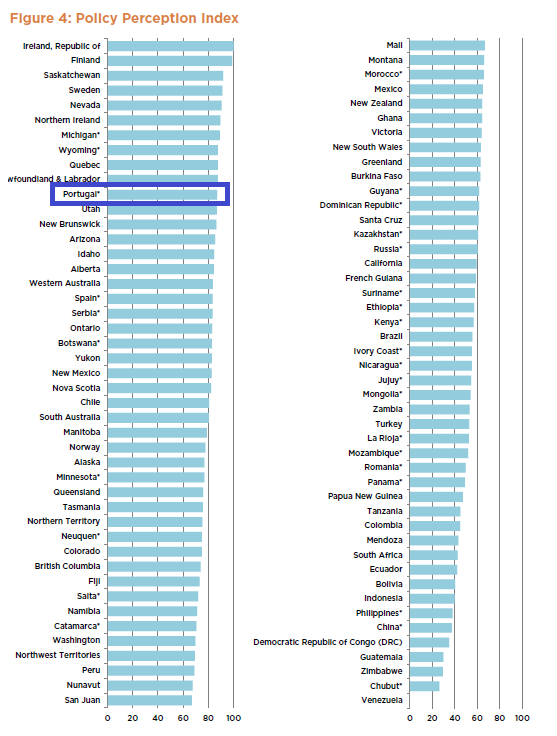

The the annual report of the Fraser Institute does a good job in ranking the jurisdictions from the perspective of a mining company. The Fraser Institute looks at countries based on how prospective they are to discover mineralization, but also how good the legal framework is (in some countries you own a mine, and the next day the president’s cousin is the new owner).

Whereas Portugal isn’t performing too well on the mineral potential index due to the relatively high percentage of the answer “not a deterrent to investment,” which only counts for half the value of a vote for “encourages investment.” But Portugal’s really strong point is the “Policy Perception Index,” where the country scores a stunning 87%, ranking it the 11th best nation to explore in the world, based on the perceived legal framework to conduct exploration and development activities.

And that’s what ultimately matters. Avrupa believes it owns some key claims in Portugal that are very prospective (which takes care of the mineral potential side of the index), and knowing the government policy is to be supportive of exploration and mining activities only strengthens Avrupa’s case.

A deeper dive into Avrupa’s two main projects: Alvalade and Alvito

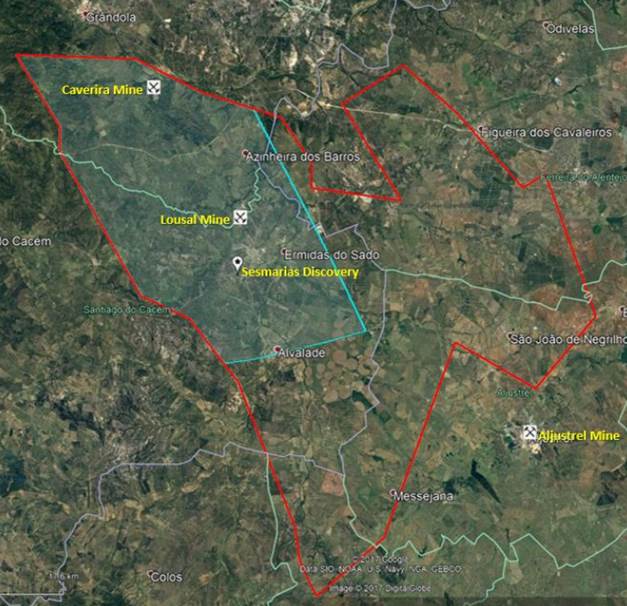

As Avrupa is a prospect generator, its portfolio obviously consists of several projects. We will focus on Avrupa’s two core projects: Alvalade and Alvito. While Alvalade is a large copper exploration target, Alvito appears to be a typical IOCG (Iron Oxide-Copper-Gold target). Although both properties are very close to each other, due to the different type of mineralization, they should be seen as two different projects.

Alvalade

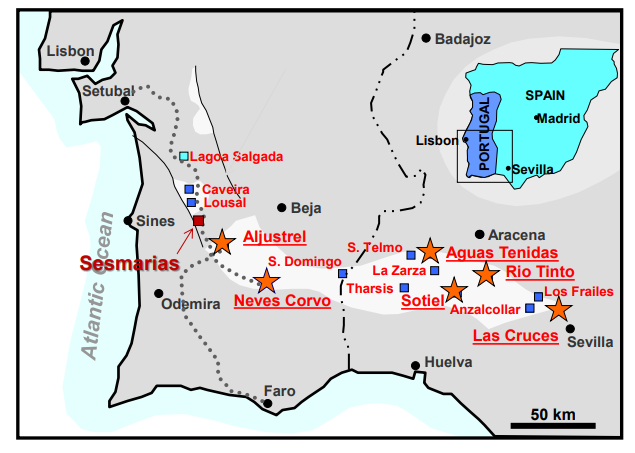

The Alvalade project is Avrupa’s flagship project, and is located on the western side of the Iberian Pyrite Belt (which has been explored and mined 3,000 years before the Romans occupied the Iberian Peninsula)). Alvalade has been the subject of two previous joint venture agreements, and the previous partners have spent approximately C$10M on exploring the tenements (of which the bulk, US$6.5 million, was spent by Antofagasta (ANTO.L). The two previous partners successfully identified several “pods” of massive sulphide mineralization over a strike length of almost 2 kilometers at Sesmarias. Some of the assay results showed high-grade polymetallic mineralization with 10.85 meters of 1.81% copper, 6.95% ZnPb as well as 75 g/t silver.

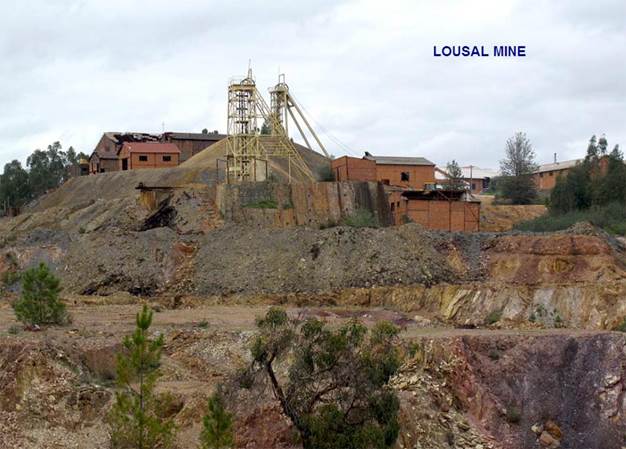

Sesmarias is located just seven kilometers from the past-producing Lousal mine where rock with an average grade of 1.4% zinc, 0.8% lead and 0.7% copper was estimated to be in place. This results in a total gross metal occurrence containing a total of 1.5 billion pounds of zinc, 860 million pounds of lead and approximately 750 million pounds of copper. It’s also interesting to note the pyrite of the mine was used as a source for the sulfur for the production of fertilizer (which was SAPEC’s main business), and perhaps this could provide Avrupa with an attractive revenue stream in the future as well (but the main focus will obviously be on the copper).

The Sesmarias target on the Avrupa land package shows similarities to the Lousal mine as the latter also consisted of several mineralized pods. We aren’t saying Alvalade is an exact copy of the Lousal mine, but the basic signatures of a multiple-lens occurrence have already been established.

And although two previous joint venture partners dropped the project, a third large conglomerate stepped up the plate and signed a non-binding LOI with Avrupa Minerals to spend a total of 13 million Euro on the Alvalade, Marateca and Mertola zones. The bulk of the money (10M EUR) would be spent on the Alvalade zone where the North American group was planning to drill up to 30,000 meters as part of an initial plan to earn a 51% stake in Alvalade. An additional 24% would be earned upon the completion of a feasibility study.

This joint venture agreement was announced in March but still hasn’t been executed yet. Although the exclusivity period has now expired, Avrupa indicated it is still actively pursuing the final execution of this joint venture deal, so let’s hope to see some white smoke soon.

But the clock is ticking, and Avrupa will spend a few hundred thousand euros on drilling the projects themselves (see later).

The downside at Alvalade seems to be limited. As only 40% of the 50 million tonne Lousal mine has effectively been mined, Avrupa estimates there’s approximately 30 million tonnes still in the ground. While mining 2.2% ZnPb and 0.7% copper wouldn’t have been very profitable in the 1980s and 1990s, the current gross rock value (before applying a recovery rate and smelter payability percentage) would be approximately $100/t (using $1.20 zinc, $1.00 lead and $2.75 copper). Note that neither the tonnage nor the grades have been estimated according to NI43-101 standards, so this is purely a theoretical and conceptual “idea.”

In a worst case scenario, Avrupa Minerals could always fall back on the existing 30 million tonnes at Lousal, perhaps complemented by the mineralized pods at Sesmarias should those be large enough to be mined.

Drilling Alvalade

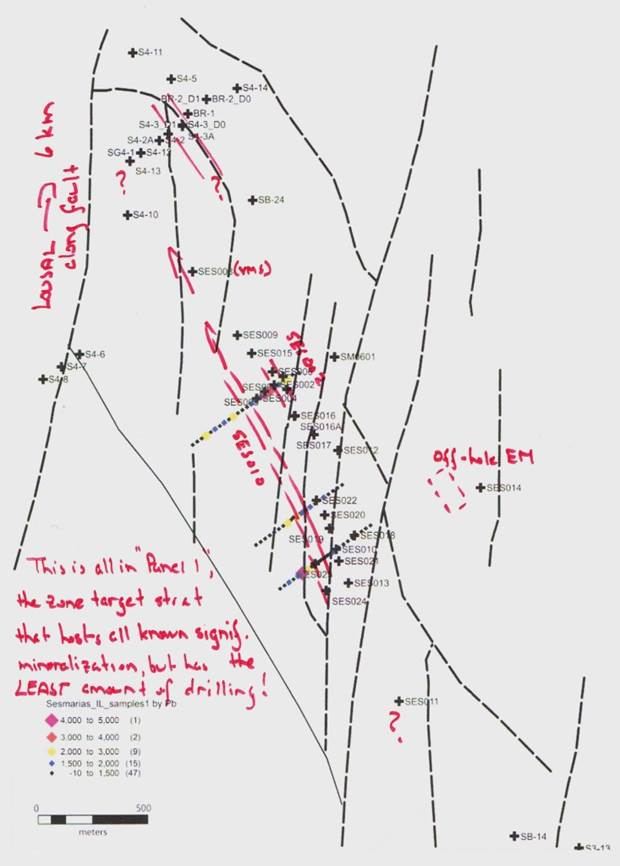

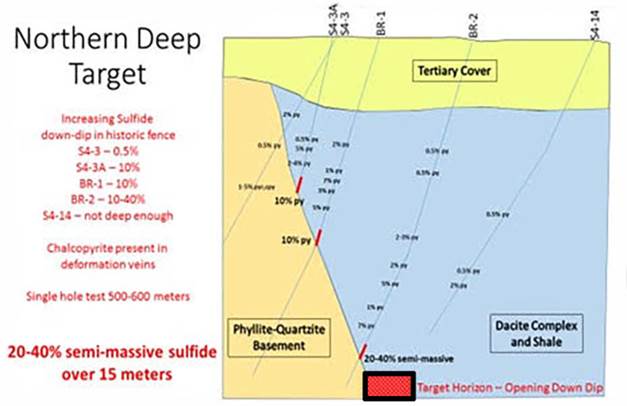

Avrupa is already mobilizing a drill crew to get the drill program at Alvalade started as soon as possible. The focus will be on the aforementioned Sesmarias zone, where Avrupa will start drilling at the SES010 lens where it’s targeting a 375 meter long “pod” that works out to be approximately 7.5 million tonnes with an average grade that’s quite typical for the Pyrite Belt (0.3-0.6% copper and 1.5-2.5% ZnPb). The grades aren’t extraordinary high, but it’s definitely doable.

After double-checking on the SES010 lens, Avrupa will move the drill rig to a position approximately 150 meters towards the northwest of SES022, where it will be following up on an anomaly. Should Avrupa indeed hit massive sulphide zones (preferably mineralized), an additional 2.5 million tonnes would be added to the overall size of the project. Should this first hole indeed hit the VMS, Avrupa will just “follow the trend” in a northwestern direction (see the map) in an attempt to continue to define a viable resource. It’s important to realize the 50 million tonne Lousal mine is just 6 kilometers northwest of Sesmarias, and along the same trend. This definitely doesn’t mean Avrupa is guaranteed to find something, but the exploration theory the company is trying to confirm makes sense.

A second drill rig will be directed towards the SES008 area where a previous drill program identified a massive sulphide zone and another mise a la masse anomaly. This will be a deep hole as CEO Kuhn thinks the previous holes just didn’t go deep enough.

Avrupa will be drilling approximately 3,000 meters at a total cost of just over half a million Euro (CA$800,000-850,000) and the first priority is to satisfy the spending requirements from the Portuguese government. Hopefully this drill program will have more spillover effects as a successful exploration result could either speed up the final execution of the joint venture deal announced in March, or could attract an entirely new joint venture partner.

Conclusion

It’s not always easy to put a value on prospect and project generators, as the very essence of the business model is to generate targets that are per definition conceptual. And while all theoretical concepts appear to be very intriguing, the proof will be in the pudding, and a lot more work will be required to upgrade the prospects to “real” projects.

Finding a partner with deep pockets will go a long way towards thoroughly exploring Alvalade (and the other projects in Avrupa’s portfolio), so let’s hope the results of the Alvalade drill program will be good enough to attract a new partner.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: a long position in Avrupa Minerals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with Avrupa Minerals. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Avrupa Minerals. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Avrupa Minerals, a company mentioned in this article.

( Companies Mentioned: AVU:TSX.V; AVPMF:OTC: 8AM:FSE,

)