By The Gold Report

Source: The Critical Investor for Streetwise Reports 09/04/2018

The Critical Investor profiles a developer with a copper-zinc project in British Columbia that has been attracting financing despite the current base metals slump.

Despite the summer doldrums, a strong dollar, a developing trade war between the U.S. and predominantly China, and the resulting poor sentiment in commodities and mining stocks, Kutcho Copper Corp. (KC:TSX.V) managed to raise decent money, necessary to fund its ongoing drill program at its flagship project, the Kutcho high-grade copper-zinc project in British Columbia, Canada.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in U.S. Dollars, unless stated otherwise.

On August 15, 2018, Kutcho completed its previously announced short form prospectus offering consisting of 9.2 million flow-through shares at a price of C$0.45 for gross proceeds of C$4.14 million. This offering will close in two tranches; the first of C$3.6M is already closed. Kutcho Copper has arranged a second tranche, on a delayed settlement basis, with one additional subscriber for total gross proceeds of C$540,000 to close on or before September 30, 2018.

The offering was conducted by a syndicate of well-known agents led by Haywood Securities, including GMP Securities, Canaccord Genuity, Cormark Securities and Macquarie Capital Markets Canada. These agents received a cash commission of 6% and warrants entitling them to acquire 480,000 common shares of the company at C$0.45 per share for a period of 24 months. A 6% finder’s fee plus warrant is decent, as it is becoming increasingly difficult at the moment to raise cash, due to negative sentiment and cannabis taking up most available investment dollars it seems, especially at a premium (18% at the time of the offering) and with no warrant like this round.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The filling up of the treasury didn’t stop there for Kutcho. The company received its second advance payment as planned on August 21, 2018, from Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE) in the amount of C$4.6 million under the agreement previously announced on August 10, 2017, entitling Kutcho Copper to a total of US$7 million. This amount is now fully received, and is meant to fund the ongoing expenditures related to completing its Feasibility Study (FS), like engineering, permitting, environmental work, geotechnical work, etc.

This work is progressing well, as Vince Sorace, president & CEO, stated:

“We have been making good progress in the field the past few months advancing the project towards Feasibility. Geotechnical and metallurgical drilling is almost complete, resource expansion drilling has commenced and environmental baseline studies have been progressing smoothly. The recent financing coupled with Wheaton’s payment gives the Company the capital towards continuing its goal of completing the planned Feasibility Study in Q2 2019.”

As a reminder, resource expansion drilling has commenced two weeks ago, and will be completed at the end of September/mid-October of this year. The FS data collection is on schedule and is also expected to be completed mid-October. The company is looking to complete its field season before the winter break (starting at the end of October), which would make everything more expensive, and according to management the company is on schedule. In the mean time, management acknowledged the issues that several companies had when applying for permits in BC (Taseko, KGHM), and has chosen to take a different road. This resulted in very good working relationships with supportive First Nations, and the company is working together now with the same bands with whom VP Community & Environment Sue Craig already reached agreements with at another, much larger project.

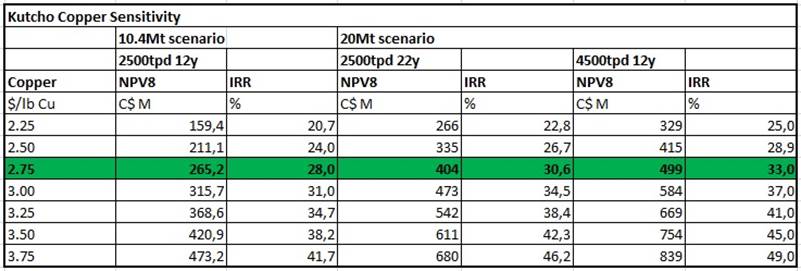

Although everything seems to be running smoothly and is managed very professionally, with a profitable (post-tax IRR of 28% @$2.75/lb copper, @$1.10/lb zinc) project that has a post-tax 2017 PFS NPV8 that is 15 times bigger than its current market cap, investors apparently don’t all seem to appreciate the quality and progress being made, and might still need to be made more aware of Kutcho Copper, as the share price drop was much more than justified based on negative mining stock sentiment and metal prices alone, as more well-known peers like Trilogy, NGEX and Nevada Copper lost (a lot) less during the summer:

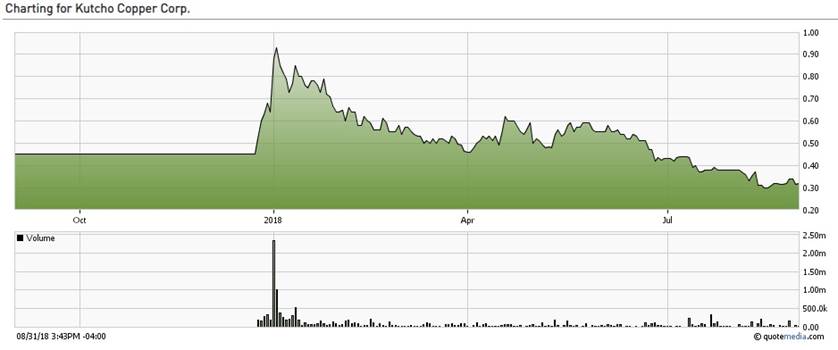

Share price over 1 year period

As it seems the Kutcho share price has found support now, and the market cap has come down to less than half the amount of cash in the treasury after the closing of the most recent offering, the buying opportunity for new investors is pretty good at the moment, and I am considering averaging down as well. I believe a second opportunity could present itself during tax-loss selling season, which usually puts pressure on stocks that have come down a lot during the year, and basically transpires between mid-November and mid-December until the holidays. However, it is also very well possible that Trump reaches an agreement with China on trade tariffs before mid-December, and commodity/mining sentiment could turn fairly quickly by then, and a rising tide lifts all boats.

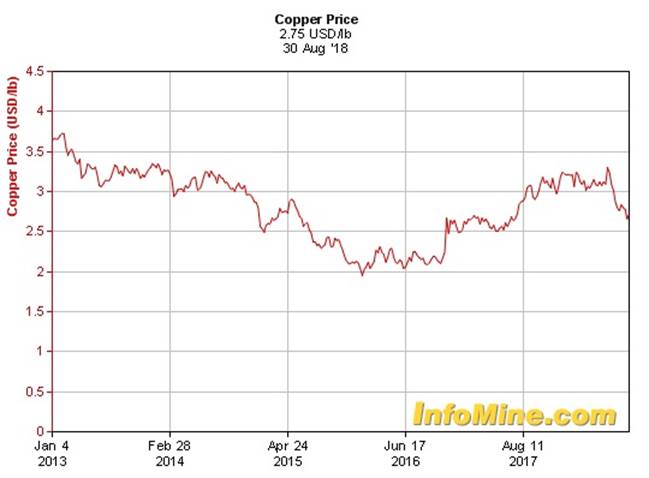

A quick update on metal prices: the copper price finally seems to consolidate at the $2.702.75/lb Cu levels, as potential copper mine strike issues (Escondida) and ongoing salary negotiations with other large LatAm mines seem to be dwarfed by China trade war concerns, which might be more or less contained by now for the time being:

The fundamentals for copper are still very strong for the next three years, with a 510 Mt deficit expected by 2021. But we are not out of the woods yet, depending on Trump’s goals and agenda. My belief is he will keep looking at the almighty U.S. stock markets, and more or less like the Federal Reserve, will determine his policies by probing and testing his ideas, and watch very closely what the effects will be on the stock markets.

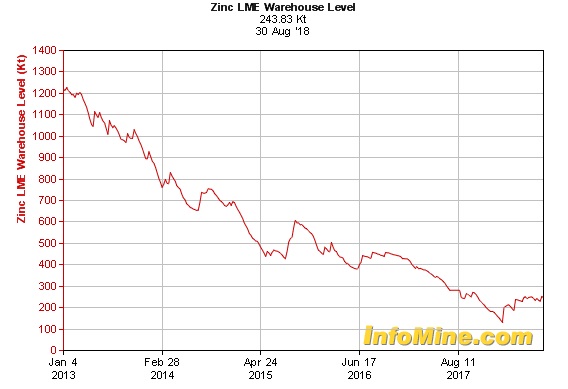

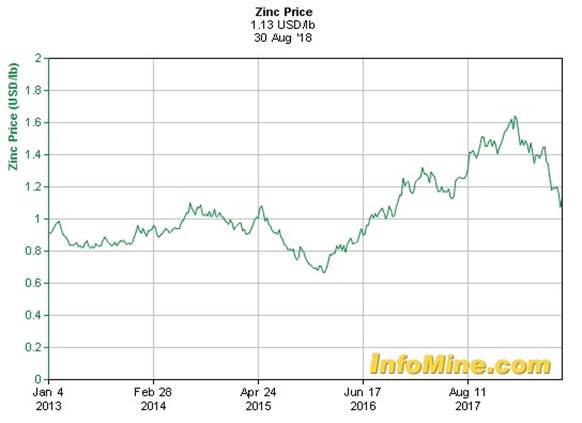

Zinc is developing/behaving differently, as it is less fragmented as a market, warehouse inventories have impact, smelters have even more impact on pricing and basically control the zinc market anyway. Since the LME inventories recovered from 150 kt to 250 kt in a matter of weeks, and the trade war eroded metal sentiment, the zinc bull market seemed to be over:

It can be seen that the low in LME levels coincided with the peak in the zinc price, although there is no direct correlation between LME levels and zinc price:

At a zinc price of $1.13/lb, it will be clear that only very robust zinc projects will be of interest for financiers/potential suitors. The Kutcho project is very robust with a conservative base case zinc price of $1.10/lb, and it can go much lower before the post-tax IRR drops below 1820%, which I consider a threshold for capex financing for this relatively small-sized base metal project. Many zinc projects are losing economic profitability now as their base case zinc prices are above current metal prices, and will have a hard time arranging capex or finding a suitor in the near future, as these are probably looking at a long-term zinc price of $1.001.10/lb now, as they usually discount current metal prices by 1020% to have a safety margin.

The Kutcho project isn’t losing any profitability at the moment as the base case metal prices were set at today’s prices. It is very rare to see this happening for a base metal project these days, and shows the strength of its economics. And this is just the first stage as investors familiar with the story know. Management is looking to double the tonnage through the ongoing exploration drill program, which could, combined with other measures, generate total tonnage in the realm of 20 Mt. Other opportunities are improving recoveries of copper and zinc, FX rates, higher metal prices and further optimization of, for example, mine plan and opex.

As a reminder, and I keep rehashing these figures as they show the current undervaluation at its very best, when I would use a 20 Mt scenario, an 80% Zn recovery rate, a 1.25 exchange rate, a US$2.75 base case copper price and a fixed US$1.10 Zn price, a 2,500 tpd throughput scenario for a LOM of 22 years, and a 4,500tpd throughput scenario for a LOM of 12 years, this would be the resulting, hypothetical sensitivity table:

I don’t expect the NPV8 to double instantly on doubling tonnage, but it will most likely increase significantly, and Kutcho Copper will turn into a deep value play even more, as C$265 million is 15 times current market cap, C$404 million is 22 times market cap, and C$499 million is 28 times market cap. There is, to my knowledge, no other project with such a big dislocation between market cap and (current and future potential) NAV, such a profitable base metal project, so cashed up and so backed by a very strong strategic partner that has a clear interest in bringing this project into production. And it also has its brand-new blockchain initiative MineHub, backed by a syndicate of large companies, which could add value further on. At some point in time, a re-rating seems almost inevitable, in my opinion, if the company keeps delivering as it does.

Kutcho project

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website http://www.criticalinvestor.eu to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The Critical Investor Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Kutcho Copper is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kutcho.ca and read the companys profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure:

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Wheaton Precious Metals. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Wheaton Precious Metals, a company mentioned in this article.

Charts and graphics provided by the author.

( Companies Mentioned: KC:TSX.V,

WPM:TSX; WPM:NYSE,

)