The Energy Report

Source: Michael Ballanger for Streetwise Reports 08/30/2018

Sector expert Michael Ballanger offers his investment thesis for this Colorado-based energy metals miner.

In June, I talked about a pending private placement being offered by Colorado-based Western Uranium Corp. (WUC:CSE; WSTRF:OTCQX) at $0.68 per unit (half-warrant at $1.15) and suggested that the deeply discounted market capitalization/pound of uranium/vanadium was being addressed by way of a joint venture with Australia-based Battery Metals Resources Ltd. (BMR).

I followed up with an e-mail two days later introducing BMR, which had just announced a $25 million initial public offering (IPO) with a concurrent $50 million secondary as a tagalong, with BMO Capital Markets as lead underwriter. These two e-mails were intended to provide a chance to either average down on the 2016 $1.70 funding or at the very least initiate new positions in the deal by way of the $0.68 unit, which was being raised as the share price cruised along in the $0.85-1.05 range during most of the marketing period.

Since then, the company has closed over $3.6 million and has completed a name change to Western Uranium and Vanadium Corp., and has released news regarding developments surrounding the 5 Mlb vanadium resource contained in the Sage Mine located in Colorado. WUC entered into a joint venture agreement with BMR pertaining to the exploitation of the Sage deposit, which was announced on June 6; it was this announcement that triggered my immediate interest in revisiting the opportunity after experiencing such dire disappointment in early 2017. The arrival of an Aussie group that knows mining and appears eager to advance and exploit the vanadium assets is a welcome development for WUC, and one that has resulted in my adding an additional chunk of stock to my portfolio. After participating in 2016 with a purchase of $1.70 unit deal, I have added triple the dollar amount in the most recent placement and now have an adjusted cost base of CA$0.80. With the stock at CA$1.55, a problematic situation has been rectified, with further developments on the very near horizon enhancing the near-term upside potential.

Technically, WUC has clawed its way back above the downtrend line from the $5.00 peak in 2015 and the $2.75 peak in 2017. RSI and MACD are in recovery mode and volumes are respectable.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

src=”https://www.streetwisereports.com/images/article_images/BallangerWUX8-30-18/image002.jpg”

Investing in uranium deals has been a nightmare since the late 2010 top, north of $75/lb, with all rallies being sold unmercifully and dips rarely advantaged. Rarely, if ever, treated as “green” energy, the U2O3 stocks have been treated like Japanese whaling ships at a Greenpeace convention. They are seen as “weaponry” by the masses, as opposed to the cleanest form of energy on the planet and one which has an extremely long shelf life. Vanadium stocks, by contrast, are beloved by the electric vehicle (EV) tribe, with many exploration issues having participated in the recent price advance.

Vanadium has been the superstar of the battery metals group, having outperformed lithium, cobalt and graphite since 2015. To understand the history of industrial applications for the metal, this link will take you to an excellent article from BBC World News.

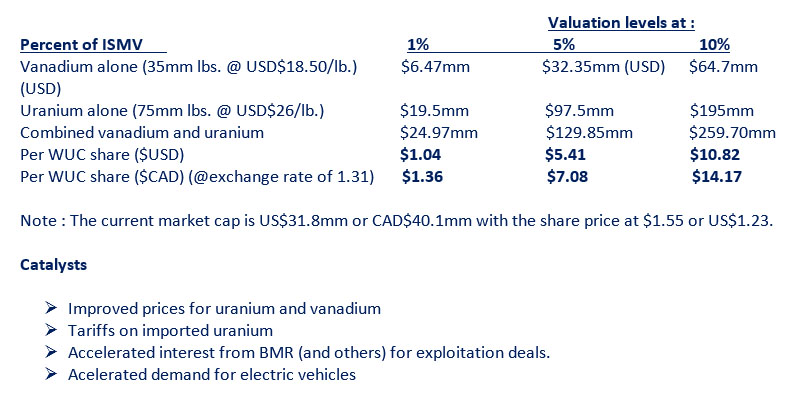

Valuation

The company has four main properties, which are estimated to contain a total estimated resource of 75 million pounds of uranium. In addition, three of the four properties contain 35 million aggregate pounds of vanadium, with an implied value of US$647 million. At the current price of $1.55 per WUC share, the company carries a market capitalization of US$31.6 million, which represents 4.88% of the in situ metal value (ISMV) of the vanadium alone. Combining the in situ metal value of the 75 million pounds of uranium (@ US$26/lb) worth US$1.95 billion, you arrive at a combined (uranium and vanadium) in situ metal value of US$2.475 billion, such that Western Uranium is trading at 1.27% of the value of all historic resources.

The Opportunity

Most developers in the mining space will carry market caps in the 5-15% range depending on location (geopolitical and geographic).

Conclusion

When you view Western Uranium and Vanadium Corp. and attempt to conduct the normal-course due diligence so greatly required in today’s world, you are taken aback by the numbers I have provided above. How can a company with assets this good be completely ignored by investors? How can an investment story so compelling be so completely dismissed, from 2015 at CA$5.00 all the way to CA$0.66 in 2018? The answer lies in management. George Glasier is a friend of mine and one of the senior statesmen of the North American uranium industry. He can tell you more about the uranium space than any person I have met in all of my years in the resource business. However, George operates his business from a technical perspective, and that includes language the vast majority of investors do not exactly comprehend. In my discussions with George, I committed to assist him in the marketing of the WUC story so as to ensure the maximization of shareholder value by way of the clarification of exactly how what George does will, in due course, result in a higher share price. And that is what I am trying to do today. Pretty simple math.

In my 41 years in the investment industry, I learned by way of pain and suffering that many great investment opportunities arise from the ashes of the “resistance to promote” by the managers of projects that are technically sound but either “early” or “late,” and WUC is just one of those opportunities.

If, by chance, the vanadium story is a “late-to-the-party” facet of the WUC attraction, then the majorasset, uranium, will be the fallback position because of its unenviable role as a major bear market disaster story. If the uranium space suddenly ignites, then the aggregate package is going to be revalued in short order, and it is important that both assets are strategic assets in terms of U.S. national security and are therefore integral to the story .

Any way you cut it, if WUC gets carved up as an “asset liquidation sale” (which it will not), shareholders will receive far greater rewards than what is being offered today by way of a US$31.8 million quote.

Recommendation: BUY at a US$1.50 limit (CA$2.00)

Target: US$3.40 (6-month); US$6.80 (12-month)

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Western Uranium & Vanadium Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: Bonaventure Explorations Limited is owned by me and my wife and has earned consulting fees from Western Uranium in the past. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Uranium & Vanadium Corp., a company mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: WUC:CSE; WSTRF:OTCQX,

)