By IFCMarkets

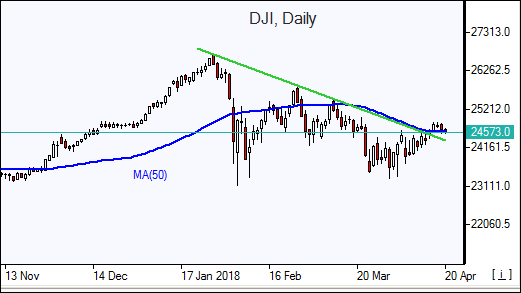

Dow dips back into negative territory

US stocks closed lower on Thursday on mixed corporate reports. Dow Jones industrial average lost 0.3% to 24664.89, falling back into negative territory for 2018. The S&P 500 fell 0.6% to 2693.13 with nine of the 11 main sectors ending lower. The Nasdaq composite dropped 0.8% to 7238.06. The dollar strengthened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 89.85. Stock indices futures indicate lower openings today.

The rise in yields of long dated Treasurys was also a drag on equities as inflation expectations rose to the highest level in about three years. In economic news Fed Governor Lael Brainard said she saw “some signs of financial imbalances in the economy.” Weekly jobless claims were slightly higher at 232,000 for the week while 230,000 claims were expected. And an April reading of business conditions from the Philadelphia Federal Reserve rose to 23.2 from 22.3.

DAX slides as European indices edge up

European stocks ended marginally higher on Thursday led by energy shares. The euro joined British Pound’s retreat against the dollar. The Stoxx Europe 600 index ended less than 0.1% higher. Germany’s DAX 30 underperformed falling 0.2% to 12567.42. France’s CAC 40 rose 0.2% and UK’s FTSE 100 gained 0.2% to 7328.92. Indices opened mixed today.

Pound’s weakening accelerated after report UK retail sales fell 1.2% month-on-month in March, missing forecasts, of 0.4% decline. And euro-zone’s current account surplus eased to 35.1 billion euros in February compared with January, still up compared with the year-earlier period.

Technology shares lead Asian markets lower

Asian stock indices are mostly lower today after Taiwan Semiconductor Manufacturing cut its revenue target citing softer demand for smartphones. Nikkei slipped 0.1% to 22162.24 despite continued yen weakening against the dollar. Earlier inflation report indicated Japan’s core consumer prices rose 0.9% from a year earlier in March, versus February’s reading of 1%. Chinese stocks are down: the Shanghai Composite Index is 1.5% lower and Hong Kong’s Hang Seng Index is down 1.2%. Australia’s All Ordinaries Index is down 0.2% despite Australian dollar fall against the greenback.

Brent slides

Brent futures prices are edging lower ahead of the joint Organization of the Petroleum Exporting Countries and non-OPEC ministerial monitoring committee (JMMC) meeting today. They ended higher yesterday: Brent for June settlement rose 0.4% to close at $73.78 a barrel on Thursday.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.