By IFCMarkets

US stocks rebound as trade war fears ease

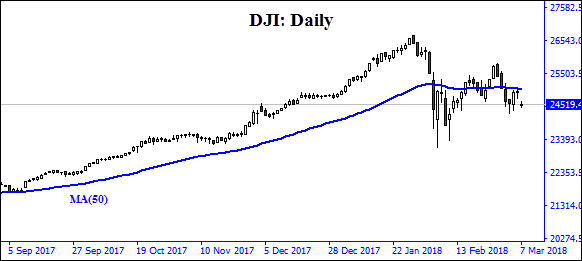

US stock indices extended gains Tuesday as initial concerns Trump’s tariff proposals could cause trade wars appeared to have calmed. The S&P 500 rose 0.3% to 2728.12. Dow Jones industrial average added 9.36 points to 24884.12. The Nasdaq composite index gained 0.6% to 7372.01. The dollar resumed weakening: the live dollar indexdata show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.6% to 89.456. Stock indices futures indicate lower openings today.

Political developments around President Trump’s plan to impose tariffs on steel and aluminum are the main drivers of markets in recent days. Concerns about possible trade war receded after President Trump tweeted that Canada and Mexico could avoid tariffs “if new & fair Nafta agreement is signed.” However they came to fore again after late Tuesday news that National Economic Council Director Gary Cohn is resigning from President Donald Trump’s administration as he failed to convince Trump not to impose the tariffs. In monetary policy front Fed Governor Lael Brainard suggested forces are lifting the economy and could push up the path of interest rates. And Dallas Fed President Rob Kaplan, not a voting member of Fed policy committee in 2018, said he still expects three interest rate increases this year, and that he wants to get started soon.

European stocks edge higher

European stocks advanced on Tuesday on rising optimism as concerns over Italian election results and fears of a global trade war abated. Both euro and British Pound extended gains against the dollar. The Stoxx Europe 600 rose 0.1%. The German DAX 30 closed 0.2% higher at 12113.87. France’s CAC 40 added 0.1% and UK’s FTSE 100 climbed 0.4% to 7146.75. Indices opened 0.4% – 0.5% lower today.

Fears about possible trade war subsided after reports top US lawmakers were worried about the consequences of a trade war and were calling the White House to reconsider the tariff plan. The European Union has threatened to impose a 25% tariff on some US goods if the tariffs come into effect.

Asian markets fall

Asian stock indices are falling after news Gary Cohn would resign as President Donald Trump’s top economic adviser after he lost a fight over tariffs. Nikkei lost 0.7% to 21261 as yen turned higher against the dollar. Chinese stocks are falling: the Shanghai Composite Index is down 0.6% and Hong Kong’s Hang Seng Index is 1% lower. Australia’s All Ordinaries Index is down 1% with Australian dollar stable against the greenback.

Brent slides on rising US inventories forecast

Brent futures prices are retreating today on rising US inventories expectations. Prices rose yesterday on the back of weaker dollar. The American Petroleum Institute late Tuesday report indicated US crude inventories rose by 5.66 million barrels to 426.88 million last week. Prices rose yesterday: May Brent added 0.4% to $65.79 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.